Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Finextra

APRIL 22, 2024

The Bank for International Settlements together with seven central banks is embarking on a major project to explore tokenisation of cross-border payments.

The Fintech Times

APRIL 22, 2024

The Fintech Times recently attended Token2049, the premier crypto event held annually in Dubai and Singapore where founders and executives of leading Web3 companies and projects meet, network and share their views on the industry. There were several opportunities for us to catch up with industry leaders throughout the event, to understand the overlap between the traditional financial services sector and this fast-expanding world of crypto.

Finextra

APRIL 22, 2024

EC antitrust regulators are set to approve an offer from Apple to open up the NFC chip technology that enables iPhone users to make contactless payments to third-party providers, according to Reuters.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

TechCrunch Fintech

APRIL 22, 2024

After a tumultuous year, banking-as-a-service (BaaS) startup Synapse has filed for Chapter 11 bankruptcy and its assets will be acquired by TabaPay, according to the two companies. The deal is pending bankruptcy court approval. Founded in 2017, Mountain View-based TabaPay is an instant money movement platform that Softbank backed in a 2022 round of an […] © 2024 TechCrunch.

Finextra

APRIL 22, 2024

Coupa, the margin multiplier company, and Bottomline, a global leader in business payments, announced a strategic partnership to simplify and optimize payment processes for businesses. Coupa can now connect to Paymode-X, Bottomline’s business payments network that offers Premium ACH, to automate payments from buyers to suppliers.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech News

APRIL 22, 2024

Fintech Australia and the Thai Fintech Association have formalised their partnership through a memorandum of understanding (MOU) to boost the fintech capabilities of both nations. The MOU signing ceremony took place in at the Money20/20 Asia event in Bangkok and saw key figures like Chonladet Khemarattana, President of the Thai Fintech Association, and Brian Collins, Deputy Chair of Fintech Australia, come together to ink the deal.

The Payments Association

APRIL 22, 2024

Instant payments are rapidly transforming the transaction landscape, supported by a global increase in payment rails and advanced services, despite facing challenges from fraud and regulatory demands.

Fintech News

APRIL 22, 2024

Maybank Singapore has introduced a new online investment service called Goal-Based Investment (GBI), designed to make investing more accessible. This service allows customers to start investing from S$200, making it an accessible unit trust investment option. The GBI platform enables users to set financial targets, evaluate their risk tolerance, and tailor investment strategies through Maybank’s website and app.

Tearsheet

APRIL 22, 2024

Visa introduced the Visa+ service in April last year to bridge the gap among various apps in the peer-to-peer (P2P) payments space, allowing for real-time payouts to participating digital wallets. At the time, Visa+ outlined plans to make the service widely available to Venmo and PayPal users in the US by mid-2024. Expanding on last year’s announcement, the recent development marks the official [consumer] launch of the service with inaugural partners PayPal, Venmo, and DailyPay.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech News

APRIL 22, 2024

Global payments company Nium has announced a new partnership with Artajasa, a prominent Indonesian payment infrastructure provider. This collaboration, formalised through a Memorandum of Understanding (MOU) at the Money 20/20 Asia conference in Bangkok, aims to improve real-time, cross-border payment services between Indonesia and the international market.

Finextra

APRIL 22, 2024

Money moving platform TabaPay is to acquire the rival assets of bankrupt Banking-as-a-Service platform Synapse.

Fintech News

APRIL 22, 2024

Singapore-based fintech startup Bambu had shuttered its operations as of 31 December last year, following the decision made jointly by its management and investors, according to Tech in Asia. The B2B firm, which specialised in providing robo-advisory products to financial institutions, was unable to achieve profitability within the set timeframe, leading to its shutdown.

NACHA

APRIL 22, 2024

Same Day ACH and B2B Propel ACH Network Growth in the First Quarter mkahn@nacha.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech News

APRIL 22, 2024

Indonesia’s financial technology landscape is experiencing explosive growth, fueled by the rise of mobile payments and digital banking. While this digital transformation offers undeniable convenience, it also introduces new challenges to mobile security in Indonesia Malware and phishing attacks pose a significant threat to the integrity and security of financial platforms, jeopardising both user data and financial security.

Finextra

APRIL 22, 2024

Earth Day — Financial institutions are under increased pressure from regulatory bodies to understand their environmental footprint and that of the companies they finance or invest in, otherwise known as financed emissions.

Fintech News

APRIL 22, 2024

Thailand’s Securities and Exchange Commission (SEC), in conjunction with the Ministry of Digital Economy and Society and other relevant agencies, has initiated measures to block unauthorised access to digital asset service providers’ platforms. This move aims to enhance law enforcement efficiency and prevent the laundering of money obtained through illegal activities.

TechCrunch Fintech

APRIL 22, 2024

Pomelo, a startup that combines international money transfer with credit, has raised $35 million in a Series A round led by Dubai venture firm Vy Capital, TechCrunch has exclusively learned. Additionally, the company is announcing a $75 million expansion of its warehouse facility. Founders Fund and A* Capital also participated in the financing, along with […] © 2024 TechCrunch.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Fintech News

APRIL 22, 2024

Singapore-based fintech startup Qashier has received in-principle approval from the Monetary Authority of Singapore (MAS) for a Major Payment Institution (MPI) license. This approval positions Qashier to provide merchant acquisition services along with domestic and cross-border money transfer capabilities. Under the Payment Services Act, implemented in 2019 to regulate payment systems and providers, companies operating prior to the act like Qashier were allowed to operate under an exempted frame

Payments Dive

APRIL 22, 2024

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

Bank Automation

APRIL 22, 2024

Truist Bank expects to continue investing in technology to save money as it restructures. “We continue to see improvements in productivity due to investments in technology,” Chief Executive William Rogers said today during Truist’s first-quarter earnings call.

Finextra

APRIL 22, 2024

UK Finance has teamed up with law firm Addleshaw Goddard to put together a set of model clauses that bank account providers and PSPs can use in variable recurring payments (VRPs).

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Fintech News

APRIL 22, 2024

Homegrown financial services company Singlife has partnered with Doctor Anywhere, a local tech-driven healthcare firm, to launch a new health subscription plan aimed at self-employed individuals, including gig workers. The plan, named DA Healthwise Plus , is designed to provide affordable healthcare options and accident coverage which has been notably absent for many freelancers and contract workers such as ride-hailing and food delivery drivers.

Finextra

APRIL 22, 2024

Enter design thinking—an approach that goes beyond mere products to delve deeply into customer exper.

The Fintech Times

APRIL 22, 2024

Codebase Technologies , a UAE-based fintech platform provider, has launched its ‘Digibanc SME Financing’ platform to address the needs of underserved Micro, small, and medium-sized enterprises (MSMEs) across MENA and APAC. Through the new launch, Codebase Technologies, with offices across MENA , Africa and APAC, will provide financial institutions with a tailored platform to launch a variety of SME financing products and services such as digital supply chain financing products, BNPL

Finextra

APRIL 22, 2024

Banks are becoming outdated today, especially with the rapid rise of the fintech sector that aims to.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Payments Dive

APRIL 22, 2024

JPMorgan Chase is an early user of Codat’s Supplier Enablement product, which launched this week.

Finextra

APRIL 22, 2024

Tokenised money is on the horizon in numerous countries. This week, the Bank of England’s Sarah Breeden announced that a discussion paper will be released in summer 2024 to draw on input from the private sector to complement the work being conducted on stablecoin regulation and retail central bank digital currency (CBDC).

The Paypers

APRIL 22, 2024

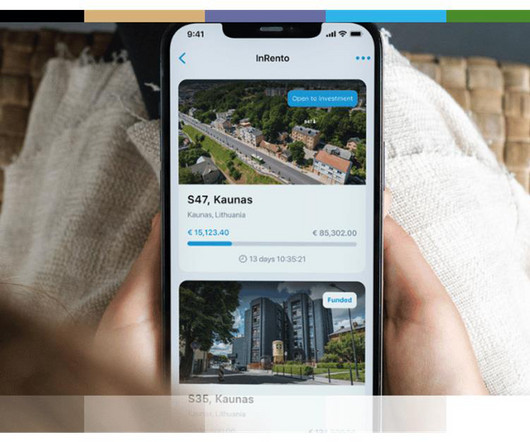

Lithuania-based fintech Paysera has incorporated in its app the ability to directly invest in crowdfunded real estate rental projects on the InRento platform.

Finextra

APRIL 22, 2024

The UK's Financial Conduct Authority intends to step up its investigations into the competitive implications of Big Tech companies in financial services.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content