New York Governor signs gun code law

Payments Dive

OCTOBER 10, 2024

Gov. Kathy Hochul signed a new law Wednesday requiring merchants to use a gun code, saying it could help prevent mass shootings.

Payments Dive

OCTOBER 10, 2024

Gov. Kathy Hochul signed a new law Wednesday requiring merchants to use a gun code, saying it could help prevent mass shootings.

Fintech News

OCTOBER 10, 2024

Fintech Alliance.PH announced that it will be joining the Singapore Fintech Festival 2024 to showcase its digital finance innovations. The event, one of the largest fintech gatherings globally, will be held from 6 to 8 November 2024, at the Singapore EXPO. Last year, Singapore Fintech Festival gathered 66,000 participants from 150 countries, and an even larger audience is expected this year.

Fintech Finance

OCTOBER 10, 2024

SMEB , a banking and financial technology company dedicated to supporting small business, today announces the appointment of Amanda Harrison to Chief Revenue Officer. Based in London and bringing more than 15 years of payments industry experience, specialising in B2B technology sales, Amanda will be responsible for developing and overseeing SMEB’s commercial strategy and ensuring long term business growth across its key business lines.

Fintech News

OCTOBER 10, 2024

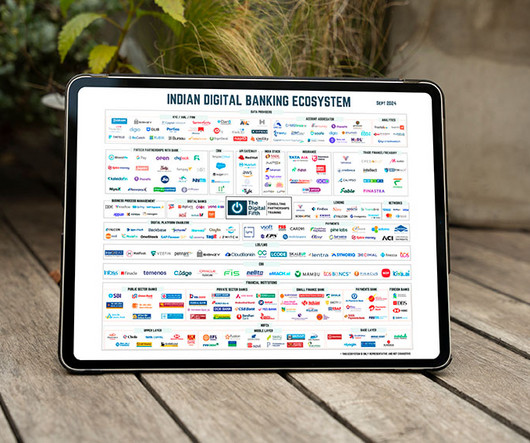

The banking landscape in India has undergone a major transformation, driven by significant investments in digital infrastructure and innovations by both incumbents banks and new fintech entrants, a new analysis by the Digital Fifth, a fintech consulting and advisory firm in India, says. This dynamic ecosystem is supported by regulatory advancements and collaborative partnerships, which are expected to continue fostering innovation and growth in the sector.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finextra

OCTOBER 10, 2024

TD Bank has agreed to pay $3 billion in penalties after pleading guilty to violating US anti-money laundering federal laws.

Fintech News

OCTOBER 10, 2024

Vietnam’s digital economy is rapidly expanding, reaching a value of US$30 billion in 2023 and projected to increase by 20% to hit US$43 billion by 2025. T his growth is fueled by technology adoption across businesses, the rise of key sectors including fintech, as well as rising middle-class incomes, a new report by Acclime Vietnam, a professional services provider from Ho Chi Minh City, says.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Clearly Payments

OCTOBER 10, 2024

Loyalty programs have become an integral part of shopping, offering businesses a way to build stronger customer relationships, increase retention, and drive sales. Loyalty programs can boost overall revenue for merchants by 5 to 10%. In payment processing, loyalty programs also play an important role, enhancing the transaction experience for both merchants and consumers.

The Fintech Times

OCTOBER 10, 2024

Payments giant Mastercard has revealed that South Africa is becoming the first market to benefit from the security and speed of real-time card payments. Mastercard plans to enable acquiring banks in South Africa to process real-time card payments , through a variety of strategic partnerships and enhancements to its network. Instant and secure payments can act as a multiplier to help businesses and economies thrive and grow.

Fintech Finance

OCTOBER 10, 2024

Alipay+ , Ant International’s cross-border mobile payment and digitalization solution, revealed three trends shaping the future of tourism to the benefit of global merchants and the industry. “Tourism’s importance to economic growth makes it essential for the industry to pursue innovation and new partnerships so that more people can benefit,” said Douglas Feagin, President of Ant International.

Basis Theory

OCTOBER 10, 2024

Chargebacks damage budgets and reputations. Merchants need to have a plan to reduce chargebacks.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

OCTOBER 10, 2024

Former UBS chief executive Ralph Hamers has become an external senior advisor for Arta Finance, an AI-based digital wealth management startup founded by former Google executives.

Fintech Finance

OCTOBER 10, 2024

tbi bank is taking a key step in its technological development by opening its own technology hub, tbi tech, in Türkiye. With this strategic move, the bank aims to not only accelerate the development and integration of innovative services into its products, but also expand its access to international talent. The hub’s HQ is in Istanbul, while most innovations come from its Research and Development (R&D) office at Zafer Technopark in Usak.

Finextra

OCTOBER 10, 2024

Monzo is offering employees the opportunity to sell part of their stakes in the digital bank through a secondary sale that sees its valuation hit £4.5 billion, according to Sky New.

The Paypers

OCTOBER 10, 2024

Stripe has announced its partnership with NVIDIA in order to optimise its AI-powered capabilities and expand worldwide access to the latter’s AI platform.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

OCTOBER 10, 2024

Revolut is to provide business merchants in the UK with the ability to accept American Express cards, unlocking access to higher spending, premium customers and supporting further growth of the card scheme's network in the UK.

Electronic Payments Coalition

OCTOBER 10, 2024

Today, the Electronic Payments Coalition (EPC) released its 2024 Q3 Data Dashboard, highlighting the emerging trends within the credit and debit markets. The post EPC Q3 2024 Data Dashboard appeared first on Electronic Payments Coalition.

Finextra

OCTOBER 10, 2024

London-based account-to-account payments provider Banked has gained a foothold in the Australian market through the acquisition of local player Waave. Financial terms were not disclosed.

The Paypers

OCTOBER 10, 2024

Aeropay has announced its partnership with Worldpay in order to optimise gaming payments for operators and players in the region of the US.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

OCTOBER 10, 2024

Alipay+, Ant International’s cross-border mobile payment and digitalization solution, revealed three trends shaping the future of tourism to the benefit of global merchants and the industry.

Bank Automation

OCTOBER 10, 2024

Toronto-Dominion Bank will plead guilty to money-laundering charges, a US Department of Justice prosecutor said in a Newark, New Jersey, courtroom on Thursday. Two of the bank’s US subsidiary units intend to enter guilty pleas, the prosecutor said during a hearing before a US District judge. The charges include failing to maintain an adequate anti-money […] The post TD will plead guilty to money-laundering charges in NJ court appeared first on Bank Automation News.

Finextra

OCTOBER 10, 2024

Citi is working with Mastercard to enable clients to make real-time cross-border payments to debit cards.

Finovate

OCTOBER 10, 2024

Digital bank Pockit has acquired multi-currency account provider Monese. Pockit plans to continue operating both brands separately while combining efforts to process $6.52 billion (£5 billion) in annual transactions. Monese’s B2B arm, XYB, will be spun off as a standalone business, and Monese’s 100 employees will join Pockit. U.K.-based digital bank Pockit announced that it has acquired multi-currency account provider Monese.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Finextra

OCTOBER 10, 2024

Farther, the leading technology-centric financial advisory firm, closed a $72 million Series C funding round to expand its advisor network and enhance its wealth management platform.

Finovate

OCTOBER 10, 2024

ANNA, a small business banking and tax app for SMEs, has implemented biometric re-authentication strategies to fight fraud. The new re-authentication procedures are designed to help combat the threat of Authorized Push Payment (APP) fraud. U.K.-based ANNA made its Finovate debut at FinovateEurope 2020 in Berlin. All-in-one business and tax app for SMEs, ANNA , has become one of the first financial institutions in the U.K. to deploy biometric re-authentication strategies to fight financial crime.

Finextra

OCTOBER 10, 2024

Today, Ripple, the leading provider of digital asset infrastructure, announced the launch of new features and functionality to Ripple Custody, bringing the benefits of its market-leading bank-grade custody technology to fintechs and crypto natives.

The Paypers

OCTOBER 10, 2024

Digital payments provider Network International has announced the launch of a series of in-person payment services in Kenya, aiming to boost commerce in the region.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Finextra

OCTOBER 10, 2024

Green fintech, Cogo, is today announcing its partnership with the UK’s greener digital bank, Tandem, has evolved to now offer customers a carbon management solution which is integrated into the bank’s app.

The Paypers

OCTOBER 10, 2024

Telecom provider Ooredoo has entered into a strategic partnership with Qatar Islamic Bank (QIB) to introduce an AutoPay service via the QIB Mobile App.

Finextra

OCTOBER 10, 2024

Kyriba, a global leader in liquidity performance, announced today an AI-driven platform designed to enhance financial connectivity and operational agility for CFOs and their teams.

The Fintech Times

OCTOBER 10, 2024

In a significant development for the United Arab Emirates’ burgeoning virtual asset market, OKX , a global on-chain technology company, has launched a licensed cryptocurrency exchange for both retail and institutional investors in the UAE. This move comes shortly after the Virtual Assets Regulatory Authority ( VARA ) intensified its efforts to safeguard Dubai’s virtual asset ecosystem by targeting unlicensed firms operating within its jurisdiction.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content