Gen Z clings to new payment tools

Payments Dive

APRIL 12, 2024

Gen Zers will abandon a transaction in one out of two cases if their preferred payment method isn’t available, says an EY payments specialist, citing the firm’s survey results.

Payments Dive

APRIL 12, 2024

Gen Zers will abandon a transaction in one out of two cases if their preferred payment method isn’t available, says an EY payments specialist, citing the firm’s survey results.

VISTA InfoSec

APRIL 12, 2024

Cybersecurity is vital in today’s fast-paced digital world, where keeping your private information safe is as crucial as the technology itself. Proxies are key players in this arena, not just for the tech-savvy but for everyone online. They work quietly behind the scenes, rerouting your internet traffic to keep your activities private, speed up your browsing, and even unlock content that’s out of reach due to geographic restrictions.

Payments Dive

APRIL 12, 2024

“Digital wallets, once primarily associated with consumer transactions, have now firmly established their presence in the B2B realm,” writes a Mastercard manager.

Bank Automation

APRIL 12, 2024

Citigroup is focused on simplifying its infrastructure and overall technology through automation and cloud migration as it upped tech spend 6% year over year to $2.2 billion in the first quarter.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finextra

APRIL 12, 2024

The Competition and Markets Authority (CMA) has identified key risks to fair competition in AI Foundation Models (FMs), growing concerns as AI rapidly develops in the financial industry.

Bank Automation

APRIL 12, 2024

JPMorgan Chase is investing in innovation and technology within its wholesale payments operations amid rising demand for global payments capabilities. The $3.7 trillion bank is leaning into payment systems, Chief Financial Officer Jeremy Barnum said today during the bank’s first-quarter earnings call.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Basis Theory

APRIL 12, 2024

Expanded Apple Pay JS Support In March, we added support for merchant tokens and Buy Now, Pay Later to Apple Pay JS. This enables merchants to decrypt the Apple Pay Payment Token to obtain the DPAN / MPAN and cryptogram for custom payment processing.

The Fintech Times

APRIL 12, 2024

Employee benefits provider, Zest , is partnering with Newcastle Building Society , one of the UK’s largest building societies, to meet employee demand for more flexible and personalised benefits. Having joined the Zest benefits platform, Newcastle Building Society can provide visibility to its employees of all their benefits and encourage them to review these on a regular basis.

Finextra

APRIL 12, 2024

Jack Henry™ (Nasdaq: JKHY) announced today that United Bank selects Jack Henry to support its growth, modernize operations, and gain a competitive edge.

Payments Dive

APRIL 12, 2024

BNPL users, who are having problems with overspending and missed payments, are tapping buy now, pay later services to spread out their cash flow.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Bank Automation

APRIL 12, 2024

Wells Fargo pulled back on its branch footprint as digital and mobile banking adoption climbed in the first quarter. “Our branches are becoming more advice-focused … [and] we are modernizing and optimizing our branch network,” Chief Executive Charlie Scharf said today during the bank’s Q1 earnings call.

Fintech Finance

APRIL 12, 2024

Finzly , the pioneering provider of modern money movement systems to financial institutions, has announced its achievement as one of the first Third-PartyService Providers (TPSP) to be certified for compliance to ISO 20022 messaging standards for Fedwire. This landmark accreditation positions Finzly at the forefront of innovation, enabling financial institutions to transition to the next generation of payment processing.

Bank Automation

APRIL 12, 2024

Springfield, Ill.-based bank INB relies on third-party vendors to build most of its technology, then customizes it to meet the needs of INB its clients. “For our size, we need a good partner,” Chief Operating Officer Mark Donovan told Bank Automation News.

The Fintech Times

APRIL 12, 2024

Payments giant Mastercard is joining forces with Nairobi-based Equity Bank , to enable customers based in Kenya to send money safely and securely to 30 countries. Through Mastercard Cross-Border Services, Equity Bank customers can now send funds through any Equity branch location in Kenya. This platform offers a suite of benefits including faster transaction times, enhanced security measures, and competitive pricing, making cross-border transactions accessible to consumers across Equity BankR

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

APRIL 12, 2024

Mastercard and Equity Bank have announced a strategic collaboration that will enable Equity Bank customers to send money safely and securely to 30 countries. This collaboration marks a significant milestone for cross-border financial transactions in Kenya.

The Fintech Times

APRIL 12, 2024

While current research payment options available to UK asset managers are adequate, the Financial Conduct Authority (FCA) has put forward plans for a new way to pay to, in turn, create a more competitive market. This change has been done to create a fairer market for smaller asset managers who can sometimes struggle with operational complexities. Additionally, the current rules also restrict UK asset managers’ ability to buy investment research produced outside the UK.

The Paypers

APRIL 12, 2024

France-based Deblock has announced its decision to choose the banking aggregation and payment automation platform Numeral to manage its SEPA payments.

The Fintech Times

APRIL 12, 2024

Restricting incoming international talent into the UK will exacerbate the tech industry’s skills gap; according to the employee relocation platform, Jobbatical , in its latest report. Within the report, ‘ A case for rethinking skilled immigration in the UK ’, Jobbatical reveals the extent of problems caused by staff shortages. In fact, around 58 per cent of businesses rely on international workers to fill open positions.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

APRIL 12, 2024

Nubank Ultravioleta, the exclusive experience for high-income Nubank customers, announces its entry into the travel segment with the pre-launch of its Global Account, in partnership with Wise Platform, Wise’s market-leading global infrastructure solution for banks and large companies.

The Fintech Times

APRIL 12, 2024

As much as 75 per cent of financial institutions (FIs) are struggling to utilise new payment offerings and stronger cybersecurity due to continuing reliance on legacy core systems; Endava , a technology services company, has revealed. Endava delves into FI strategies for meeting customer demand in its new Retail Banking Report , finding that 75 per cent of organisations believe they offer a good user experience, have strong data management practices and better technology than competitors.

Finextra

APRIL 12, 2024

Russia’s MTS Bank has announced it will hold an initial public offering (IPO), despite current Western sanctions on Russian banks.

FloQast

APRIL 12, 2024

The journey to a successful Initial Public Offering (IPO) requires preparation, strategic planning, and a deep understanding of regulatory requirements. Among the many steps in this journey is filing SEC Form S-1. In this article, we’ll cover everything you need to know about filing the S-1 so you can ensure your company is well-prepared for this momentous step.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

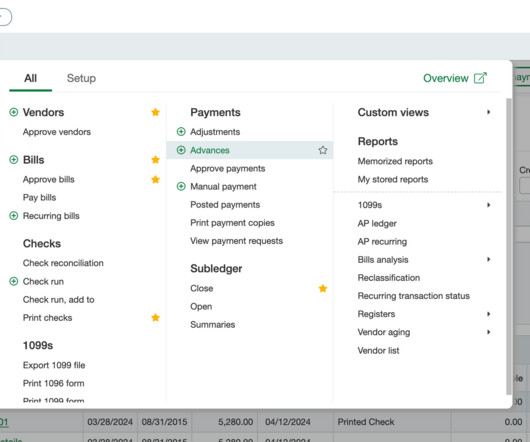

Nanonets

APRIL 12, 2024

Invoices are a time-consuming hassle but a part of every business. Sage Intacct makes the entire process simple. It creates professional invoices for your accounts receivables and helps process invoices as part of your accounts payables. Sage Intacct has additional features to simplify both ends of invoices. With tracking and reporting, supporting recurring invoices, and recording payments, these extra features make Sage Intacct's capabilities one of the best.

Finextra

APRIL 12, 2024

BNY Mellon (NYSE:BK), the global financial services company, is collaborating with Accenture (NYSE:ACN), a leading professional services company, to modernize financial services offerings with an initial focus on data management and analytics product development and delivery.

Finovate

APRIL 12, 2024

Need some Friday insight to carry you into the weekend? We’ve got you covered. Today, we’re unveiling four videos featuring interviews with fintech experts. These videos provide valuable perspectives on the escalation in geopolitical risk, key tech trends revealed at FinovateEurope, and a comprehensive overview of what’s hot and what’s not in the fintech space.

Nanonets

APRIL 12, 2024

The Importance of Accounts Reconciliation Companies handle a variety of finance-related documents, ranging from bank statements to invoices and payroll records. Amidst this deluge of numbers and figures lies a crucial task: account reconciliation. Without accurate reconciliation, discrepancies can slip through unnoticed, leading to financial inaccuracies, compliance issues, and potential for fraud.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Finextra

APRIL 12, 2024

Akin’s award-winning legal data productivity platform OverRuled has acquired the TURBOFAC Comprehensive U.S. Sanctions Research System, creating an essential one-stop-shop for sanctions professionals globally.

Nanonets

APRIL 12, 2024

Bank Reconciliation Vs. Book Reconciliation In accounting and financial management, we encounter the terms "Book Reconciliation" and " Bank Reconciliation " These terms are often used interchangeably, leading to ambiguity regarding their meanings. Book Reconciliation serves as the umbrella term, encompassing a broader spectrum of financial data matching that involves comparing the ledger entries with figures from other financial documents.

Finextra

APRIL 12, 2024

Citi emerged as the top underwriter for equity capital markets (ECM) in Asia ex-Japan for the first quarter (Q1) of 2024, continuing the strong momentum built in 2023. At the end of Q1, Citi commanded a total issuance volume that was double that of the next closest competitor.

Fintech Finance

APRIL 12, 2024

Mastercard and Equity Bank have announced a strategic collaboration that will enable Equity Bank customers to send money safely and securely to 30 countries. This collaboration marks a significant milestone for cross-border financial transactions in Kenya. Remittances are a key economic driver in Sub-Saharan Africa with a reported $53 billion flowing into the region in 2022.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Let's personalize your content