CEOs Sound Off: Payments forecasts for 2023

Payments Dive

NOVEMBER 16, 2022

The CEOs of Brex, Splitit and Paystand weigh in on what’s to come in the year ahead, commenting on the trends, challenges, regulation and M&A.

Payments Dive

NOVEMBER 16, 2022

The CEOs of Brex, Splitit and Paystand weigh in on what’s to come in the year ahead, commenting on the trends, challenges, regulation and M&A.

Synapse Payment Systems

NOVEMBER 9, 2022

Profit margins are tight right now, and as operating costs increase, many businesses wonder if they should surcharge credit cards. While there are pros and cons to surcharging, most businesses are better off avoiding it. Here’s why credit card surcharges hurt your business—and what you should do instead to raise revenue and keep customer loyalty. What is a Credit Card Surcharge?

Agile Payments

NOVEMBER 29, 2022

LinkedIn Marketing Tips for SaaS Startups in 2023. Learn to promote your startup marketing by reaching your customers and SaaS executives through lead gen forms, creating effective landing page funnels and useful content. The vital issue for any startup, especially a “Software as a Service” company, is good marketing. These are the steps you want to take to fully utilize this process: Introduce your product to the right audience, Position this product by lead generation, Build awareness of your

Axway

NOVEMBER 22, 2022

Regardless of a business’s products and services, B2B transactions are central to operations — whether communications with suppliers, customers, distributors, or even end consumers.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payment Savvy

NOVEMBER 9, 2022

EFT payments are becoming increasingly popular as more and more people conduct their financial affairs online. But what exactly is an EFT payment? In this article, we will answer the question of what an EFT payment is, and we’ll also discuss the different types of ETF payments, the benefits of using EFT payments, and the risks associated with this type of payment.

The Finance Weekly

NOVEMBER 6, 2022

CFOs are well experienced finance professionals who know how to lead their team and the finance company through many different scenarios. Supposing a CFO has a couple years of experience, they have been through many ups and downs, uncertainties, and market changes that would have left them prepared for future challenges. One of the most difficult time periods that a CFO can go through is when the company decides to go public.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Synapse Payment Systems

NOVEMBER 9, 2022

For many businesses, the holidays are the busiest time of the year. While more customers and revenue are certainly a plus, this can also be a season of increased chargebacks and payment disputes. Fortunately, there are things every business owner can do to minimize chargeback risk and avoid costly hassle. Keep reading to learn how to avoid chargebacks and payment disputes during the holiday season.

CB Insights

NOVEMBER 17, 2022

Sam Bankman-Fried’s crypto exchange FTX filed for bankruptcy protection on November 11 — the culmination of a steady stream of bad news for the company and a “bank run” that saw roughly $6B in customer withdrawals. A total of 134 affiliated companies were part of the filing, and there could be more than a million creditors involved. download The State of Blockchain q3’22 report.

Axway

NOVEMBER 17, 2022

I’m proud to announce that Axway is named a Leader in the 2022 Gartner® Magic Quadrant for Full Life Cycle API Management.¹ This marks the seventh time that Axway has been recognized.

Payment Savvy

NOVEMBER 8, 2022

Barely a couple of decades ago, there were just a few options available for transferring money from one account to another, but the rise of internet banking has given way to a bunch of different services with different names, processes, fees, and waiting times. The banking world has, thankfully, moved on quite a bit from the days of telegram wires, and most transfers these days are quick, free of major hassle, and relatively secure.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Finance Weekly

NOVEMBER 8, 2022

What is a financial tech stack? A tech stack, or a solutions stack, is the combination of technologies and software tools that an organization uses in order to conduct day to day business operations. As the number and quality of software tools increases, companies are constantly looking to find better ways to cut down on manual work and increase efficiency.

Payments Dive

NOVEMBER 21, 2022

Ryan McInerney, who will become CEO of the card network juggernaut next year, recently detailed the areas where he sees opportunities for the company.

The Paypers

NOVEMBER 28, 2022

The Government of the UK and the Monetary Authority of Singapore (MAS) have signed a cross-country memorandum of understanding (MoU), deepening collaboration in fintech, and strengthening their financial cooperation.

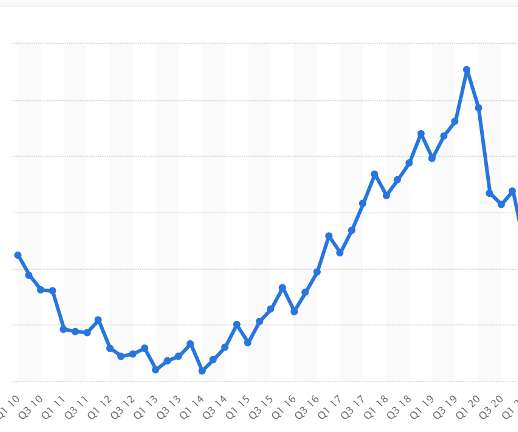

CB Insights

NOVEMBER 3, 2022

While insurtech funding has remained relatively flat quarter-over-quarter in 2022, insurers are still actively engaging with startups to improve their businesses — including addressing climate-related risks. . download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Axway

NOVEMBER 22, 2022

The director of the?Consumer Financial Protection Bureau (CFPB) has just announced the coming of a new U.S. open banking rule , accelerating the move toward open banking in North America.

Agile Payments

NOVEMBER 23, 2022

How to Manage Your Investment Portfolio as a SaaS Business.

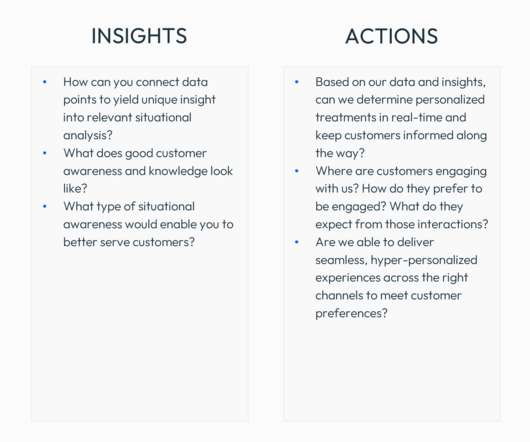

FICO

NOVEMBER 30, 2022

Home. Blog. FICO. Four Key Components of Real-Time Insurance Success. Insurers need to make real-time decisions using advanced analytics, with interactive communications, based on a complete view of the customer. FICO Admin. Thu, 08/22/2019 - 12:37. by Rodrigo Camargo. Director, Partner Solutions. expand_less Back To Top. Wed, 11/30/2022 - 12:10. Throughout these years of working with insurance companies to leverage technologies such as like data streaming and orchestration , rules authoring and

Payments Dive

NOVEMBER 22, 2022

The news report on workforce reductions at the payments processor follows its announcement earlier this month that it would embark on a $500 million cost-cutting program.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

The Paypers

NOVEMBER 4, 2022

Lithuania-based fintech Paysera has partnered with Airwallex to enable its clients to send money to 149 countries and 9 countries’ open IBAN accounts.

CB Insights

NOVEMBER 7, 2022

What is accounts payable automation software? Accounts payable (AP) automation software companies automate the entire accounts payable process, from invoice to pay to reconciliation, with the aim of reducing manual processes and avoiding human errors. Accounting and finance departments use this technology to manage massive amounts of invoices from their suppliers or payment leaders.

Axway

NOVEMBER 20, 2022

On December 12-15th, Axway and EasiRun are sponsoring the digital IT Days in Germany to highlight API security as the key to business success for organizations in Europe’s German-speaking countries (DACH region).

Agile Payments

NOVEMBER 19, 2022

How To Improve Employee Productivity with AI.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

FICO

NOVEMBER 30, 2022

Home. Blog. FICO. Profitability and Customer Financial Health in Retail Banking. Here’s how to strike a balance that delivers long-term benefits for customers' financial health. FICO Admin. Tue, 02/18/2020 - 14:57. by Bill Waid. expand_less Back To Top. Wed, 11/30/2022 - 19:00. In my recent Forbes article , I explored a vision for the future of retail banking where the customer’s complete financial wellness is at the center of decision making.

Payments Dive

NOVEMBER 2, 2022

The money transfer company said it’s adding a new crypto feature to its mobile app, expanding on an attempt to appeal to a younger client set.

The Paypers

NOVEMBER 1, 2022

Rapyd has conducted a fintech developer survey that reveals their challenges, opportunities, and a wish to collaborate within the developer community.

CB Insights

NOVEMBER 4, 2022

Founded in 1869 , Goldman Sachs has established itself as one of the world’s largest investment banks and is a major force in the global financial markets. But the firm is now looking to expand far beyond its traditional business lines, such as investment banking and asset management. For example, it recently launched a digital consumer bank called Marcus and partnered with Apple to launch a credit card.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Axway

NOVEMBER 10, 2022

Our Griffins at Work series introduces you to some of our incredible Griffins, sharing their stories about all the things that make Axway an incredible place to work, grow, and succeed.

The Finance Weekly

NOVEMBER 27, 2022

Extended Planning and Analysis (xP&A) is a form of financial planning that takes the best financial planning and analysis capabilities and extends them into other fields across the organization. Implementing xP&A allows planning, forecasting, analytics, and all of the other benefits of FP&A to reach all of the operational departments in the company.

FICO

NOVEMBER 30, 2022

Home. Blog. FICO. Top 3 Actions for Delinquency Management Alleviating Inflation Concerns. What prudent and responsible actions can we diligently deploy to face the potential fallout of inflation? FICO Admin. Thu, 08/22/2019 - 12:37. by Cyril Cherian. expand_less Back To Top. Wed, 11/30/2022 - 16:00. The financial institutions who were resilient during the pandemic learned from their experiences in 2008 and were better prepared for inflation.

Payments Dive

NOVEMBER 3, 2022

With the latest acquisition, Fiserv is further strengthening its restaurant chops, adding cloud-based reservation and table management to its BentoBox operation.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content