Apple unveils new iPhone touch and pay feature

Payments Dive

JUNE 12, 2024

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

Payments Dive

JUNE 12, 2024

The P2P ‘Tap to Cash’, which enables iPhone users to transfer money by holding their phones together, was unveiled along with a slate of other features Monday.

The Payments Association

JUNE 25, 2024

Banks are de-banking payment providers, causing major disruptions in cross-border transactions and impacting financial inclusion

VISTA InfoSec

JUNE 19, 2024

With the surge in remote work and virtual meetings, video communication is crucial for businesses and individuals. However, this convenience comes with significant cyber risks that can compromise sensitive information and privacy. Therefore, this article explores the common cyber threats in video communication and provides strategies to mitigate them.

PCI Security Standards

JUNE 11, 2024

To address stakeholder feedback and questions received since PCI DSS v4.0 was published in March 2022, the PCI Security Standards Council (PCI SSC) has published a limited revision to the standard, PCI DSS v4.0.1. It includes corrections to formatting and typographical errors and clarifies the focus and intent of some of the requirements and guidance.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Next

JUNE 27, 2024

By Kate Knudsen, Senior Program Director at BHMIAs the payments space changes rapidly, banks, merchants, and processors are updating front-end platforms to The post Unlocking profit potential in the payments back-office first appeared on Payments NEXT.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Payments Dive

JUNE 7, 2024

The state may become the first in the nation to outlaw the imposition of credit and debit card interchange fees on state excise tax and tips.

Finextra

JUNE 28, 2024

Thousands of Barclays, HSBC, Nationwide and Virgin Money customers have been hit by a payments problem that has seen some people not receiving their salaries.

VISTA InfoSec

JUNE 19, 2024

On June 17, 2024, the Los Angeles County Department of Public Health (DPH) disclosed a data breach impacting more than 200,000 clients, employees, and other individuals. The stolen data includes personal, medical and financial information. The DPH said the incident took place between February 19-20, 2024, was caused by a gang of cyber criminals who gained access to the log-in credentials of email accounts of 53 employees through a phishing email.

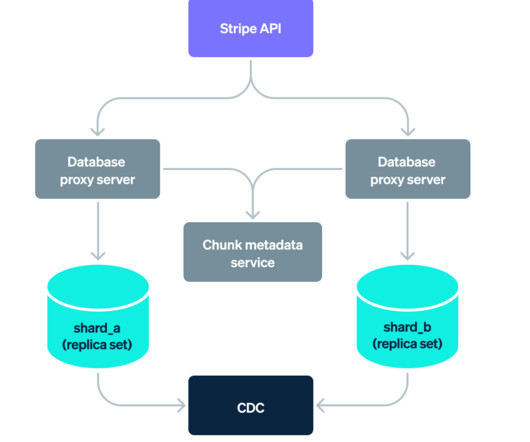

Stripe

JUNE 5, 2024

In this blog post we’ll share an overview of Stripe’s database infrastructure and discuss the design and application of the Data Movement Platform.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Fintech Times

JUNE 29, 2024

The first stage of the European Union ‘s Markets in Crypto Assets Regulation (MiCA) will come into play on 30 June. However, a new report by Acuiti , the management intelligence platform, and conducted by Eventus , the trade surveillance software provider, has found that a move to establish market surveillance systems is underway as firms find themselves underprepared.

Fintech News

JUNE 17, 2024

The global wealth management industry is undergoing a profound transformation, including in Asia, driven by the convergence of technological advancements like artificial intelligence (AI), shifting investor preferences, and evolving economic conditions. Capgemini’s World Wealth Report 2024, now in its 28th edition, reveals that high-net-worth individuals (HNWI) are reaching unprecedented numbers and wealth levels, with the Asia Pacific region emerging as a hotbed of growth and innovation.

Payments Dive

JUNE 13, 2024

The tech giant will allow installment plans from Affirm, as well from certain debit and credit cards, onto Apple Pay alongside its own BNPL service.

Finextra

JUNE 5, 2024

The Bank for International Settlements says it multi-central bank CBDC platform, Project mBrige, is ready to accept value added products and new use cases as it reaches minimum viable product stage (MVP).

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

VISTA InfoSec

JUNE 26, 2024

The frequency and sophistication of cyber threats make cybersecurity a critical factor in any company. Therefore, investors should be more vigilant, recognizing that a company’s cybersecurity posture can significantly impact its financial health and stability. This article highlights the need for robust cybersecurity strategies and how these can determine investment decisions.

Open Banking Excellence

JUNE 26, 2024

11th July 2024 Live Event Linkedin Twitter Europe FinTech Awards Welcome to the Europe FinTech Awards Europe is home to many of the world’s premier financial services centres and a burgeoning financial technology market. These awards were developed to celebrate this incredible community, and the achievements and successes of Europe’s best and brightest.

Bank Automation

JUNE 20, 2024

Morgan Stanley’s Jeff McMillan, head of firmwide artificial intelligence, is focused on developing and deploying AI throughout the operations of the $212 billion financial institution. The New York-based FI appointed McMillan to the newly created position March 14, he told Bank Automation News.

Fintech News

JUNE 10, 2024

Forbes has released its annual 30 Under 30 Asia list, recognizing the entrepreneurs, artists, athletes, and changemakers who are leading transformative initiatives across key industries in the Asia-Pacific (APAC) region. The Forbes 30 Under 30 Asia Class of 2024 features 300 notable nominees selected across ten categories: The Arts (Art and Style, Food and Drink); Entertainment and Sports; Finance and Venture Capital; Media, Marketing and Advertising; Retail and E-Commerce; Enterprise Technolog

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payments Dive

JUNE 25, 2024

On Tuesday, Judge Margo Brodie denied a preliminary settlement proposal made by the card networks Visa and Mastercard, and merchants who sued them in federal court nearly two decades ago.

Finextra

JUNE 10, 2024

Apple has unveiled a Tap to Cash feature that lets people send each other money simply by tapping their iPhones.

VISTA InfoSec

JUNE 18, 2024

Data is the driving force behind businesses in this digital age. From customer information and financial records to trade secrets and proprietary research, these digital assets are invaluable. As cyber threats evolve, safeguarding your organization’s data has become an utmost priority. Whether you’re a small business owner, a corporate leader, or an Information and Communication Technology (ICT) specialist, the consequences of a data breach are severe and far-reaching.

Open Banking Excellence

JUNE 19, 2024

Almost 60 percent of pension pots are taken in one go as a cash lump sum, according to new research. In sectors where many people work part-time and therefore have lower savings, this can even be around 90 percent, according to the latest retirement data from the Financial Conduct Authority (FCA) But those taking the money all at once may be losing out on various benefits and even be pushed into higher tax brackets.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

The Fintech Times

JUNE 2, 2024

Fraud prevention decision-makers across Europe are well aware of the growth and danger of AI-driven identity and financial fraud, but are unprepared to combat it, Signicat , the European digital identity and fraud prevention solution provider, has revealed in a new report. ‘ The Battle against AI-driven Identity Fraud ‘ study by Signicat delves into how organisations across Europe are battling the growing threat of AI-driven identity fraud.

Fintech News

JUNE 25, 2024

DANA stands at the forefront of the rapidly evolving digital landscape of Indonesia, revolutionising the way people conduct financial transactions. Founded in 2018, DANA has swiftly become one of the nation’s leading e-wallet and payment services, boasting an impressive user base approaching 200 million in 2024. With a vision to create a cashless society in Southeast Asia’s largest economy and to empower millions with innovative financial services, as the ubiquitous digital payments service in I

Payments Dive

JUNE 14, 2024

The judge's likely rejection would scuttle a $29.79 billion deal that was two decades in the making.

Finextra

JUNE 11, 2024

Mastercard has set itself a target of hitting 100% e-commerce tokenisation in Europe by 2030, phasing out manual card entry and making online shopping safer and more accessible.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

VISTA InfoSec

JUNE 7, 2024

As flexible working arrangements become increasingly common across every industry, companies need secure, dependable ways to grant remote employees online access to company data, services, and applications. Productivity in today’s highly digital business environment depends upon employees being able to access the systems and information they need for work when needed, from any location.

Bank Automation

JUNE 25, 2024

Point-of-sale financing as an alternative payment method is a growing opportunity for lenders, technology company Pagaya’s President Sanjiv Das says on this episode of “The Buzz” podcast. According to auto lender and Pagaya partner Ally Financial, POS financing is expected to reach a value of more than $81 billion by 2030.

Fintech Finance

JUNE 19, 2024

New research released today by emerchantpay , a leading global payment service provider and acquirer, has found that there is strong market potential for merchants who prioritise the adoption of Open Banking payments early in their payment strategies. The survey of UK consumers found that one in two people are unknowingly using this payment method during checkout, with more than half (51%) of the UK population being unfamiliar with the term Open Banking.

Let's personalize your content