PayPal changes up its pricing

Payments Dive

JUNE 24, 2022

In a move that could increase or decrease charges for merchants, the company said it aims to better distinguish between personal and commercial payments on its system.

Payments Dive

JUNE 24, 2022

In a move that could increase or decrease charges for merchants, the company said it aims to better distinguish between personal and commercial payments on its system.

The Finance Weekly

JUNE 22, 2022

With a recession looming, many Fractional CFOs (FCFOs) are worried that they will lose their customers due to budget cuts. However, by implementing FP&A automation, their customers will be provided a more in-depth analysis that will set them up for any scenario that can occur in the coming months. In addition, it will create a far more efficient process that will allow FCFOs to take on more customers and add value.

Axway

JUNE 15, 2022

We are back with our Meet the Griffins series where we present an outstanding employee who we feel embodies Axway ’s culture and is an excellent example of commitment, achievement, motivation, and work ethic.

The Paypers

JUNE 1, 2022

The Central Bank of Ghana (BoG) has announced it granted Vodafone Cash and CalBank customers the opportunity to test its online version of its digital currency (CBDC), the eCedi.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Agile Payments

JUNE 27, 2022

8 Best Practices for Managing SaaS Contracts & Agreements.

CB Insights

JUNE 8, 2022

Slice , a virtual credit card provider, has raised $50M in a Series C. The round drew participation from GMO VenturePartners, Insight Partners, Moore Strategic Ventures, and Tiger Global Management. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop"><div cla

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

National Merchants Association

JUNE 30, 2022

Digital solutions such as automation and payment integration have become a necessary part of managing business transactions seamlessly. Digitizing your business means automating most tasks required to run a business’ payment systems and integrating them with modern digital technology, saving valuable time, effort, and cost. Automated payments are critical aspects of running a competitive business, providing customers with frictionless, efficient, and secure transactions.

Axway

JUNE 9, 2022

Literally everything that we do on the Web today, and the vast majority of what happens in the API space, is based on the Hypertext Transfer Protocol (HTTP). It has been around since the Web was created in 1989.

The Paypers

JUNE 22, 2022

Kernolab , a Lithuania-based fintech startup focused on helping businesses drive value through embedded finance solutions, has partnered with Ondato for all KYC compliance capabilities.

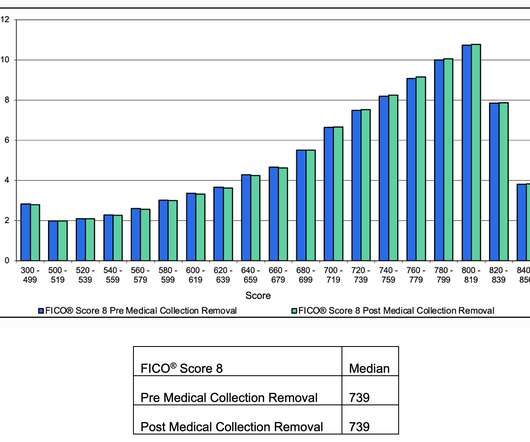

FICO

JUNE 30, 2022

Home. Blog. FICO. Medical Collection Removals Have Little Impact on FICO Scores. Based on FICO’s analysis, only 3% of FICO scorable consumers would be impacted by medical collection removals. Saxon Shirley. Thu, 05/12/2022 - 07:46. by Tommy Lee. expand_less Back To Top. Thu, 06/30/2022 - 15:00. More than 100 million people in America have health care debt , according to Kaiser Health News, which lead to the decision of medical collection removals.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

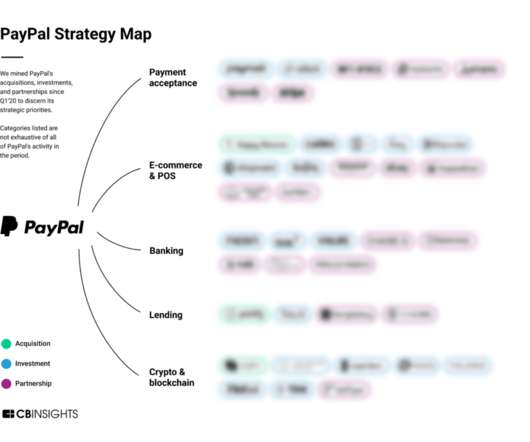

CB Insights

JUNE 6, 2022

Payments giant PayPal has forged hundreds of strategic business partnerships, invested in more than 30 different companies, and even made a handful of acquisitions over the last 2 years. FREE DOWNLOAD: STATE OF FINTECH Q1 2022. q1 2022 brought a -18% decline in quarterly fintech funding. Download the report to learn more. hbspt.forms.create({. onFormReady: function ($form) {. window.ClearbitForHubspot.addForm($form); }, region: “na1”, portalId: “763793”, formId: “f5

Payments Dive

JUNE 17, 2022

"The Visa-Mastercard duopoly controls about 80% of the market share, allowing them to raise fees indiscriminately and with no formidable opposition," contends Doug Kantor, general counsel for the National Association of Convenience Stores.

National Merchants Association

JUNE 30, 2022

Digital solutions such as automation and payment integration have become a necessary part of managing business transactions seamlessly. Digitizing your business means automating most tasks required to run a business’ payment systems and integrating them with modern digital technology, saving valuable time, effort, and cost. Automated payments are critical aspects of running a competitive business, providing customers with frictionless, efficient, and secure transactions.

Axway

JUNE 23, 2022

Establishing a personal relationship with your customers is all about building a strong foundation of trust, understanding and mutual respect. In other words, people want to feel like the brands they support are also supporting them. .

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Paypers

JUNE 8, 2022

Popular online payments provider PayU has announced it expanded to Ghana and has introduced several strategic offerings to its portfolio, including PayFlex in South Africa and Scan to Pay and Pay by USSD capabilities in Nigeria.

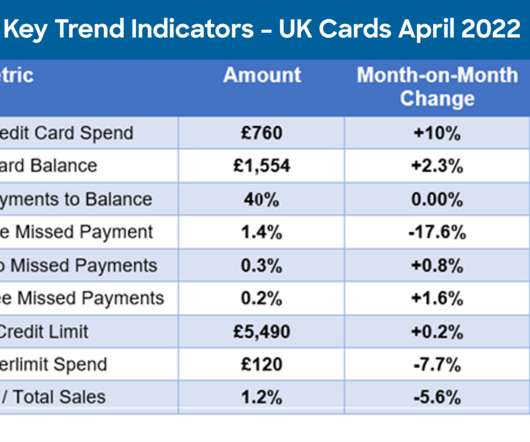

FICO

JUNE 28, 2022

Home. Blog. FICO. UK Credit Card Trends: Cost-of-Living Stress Starts to Show in Data. The signs of the cost-of-living crisis are still limited, with the biggest area of concern being a 3 percent increase in missed payments for new accounts. Darcy Sullivan. Tue, 11/10/2020 - 12:17. by Liz Ruddick. expand_less Back To Top. Tue, 06/28/2022 - 14:10. FICO’s report of April 2022 UK card trends shows some early signs of the impact of the widely reported cost-of-living pressures.

CB Insights

JUNE 10, 2022

Finch , an API builder connecting corporate HR systems, has raised $15M in a Series A. The round drew participation from Bedrock Capital Management, General Catalyst, Y Combinator, and Menlo Ventures, among others. the state of venture report. Download our free report to get the TL;DR on what you need to know about venture funding and trends in Q1 2022.

Payments Dive

JUNE 1, 2022

Buy now-pay later providers have made their financing services more available for everyday purchases, offering consumers a tool to deal with inflation.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

National Merchants Association

JUNE 30, 2022

Digital solutions such as automation and payment integration have become a necessary part of managing business transactions seamlessly. Digitizing your business means automating most tasks required to run a business’ payment systems and integrating them with modern digital technology, saving valuable time, effort, and cost. Automated payments are critical aspects of running a competitive business, providing customers with frictionless, efficient, and secure transactions.

Axway

JUNE 22, 2022

Cyber attacks and security concerns continue to hamper the IT industry, as new development practices, extra languages, and structural frameworks appear. In fact, a wide number of data breaches and cyber attacks in 2022 have already interrupted normal business conditions.

The Paypers

JUNE 15, 2022

Advanced Fraud Solutions (AFS) , a provider of payments fraud detection, has announced an agreement with Fiserv , a provider of payments and financial services technology.

FICO

JUNE 27, 2022

Home. Blog. FICO. Build Winning Customer Experiences Without Tanking Efficiency. Consumers spent hundreds of thousands, even millions, on banking and insurance products over the course of their lifetimes. How can you get them to spent it with you? FICO. Tue, 07/02/2019 - 02:45. by Bill Waid. expand_less Back To Top. Mon, 06/27/2022 - 16:00. Banking and insurance companies have a customer experience problem: despite spending hundreds of millions of dollars trying to optimize their clients’ custom

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

CB Insights

JUNE 10, 2022

Juni , a neobank for e-commerce companies, has raised $206M in a mix of debt and equity. The $100M Series B equity round drew participation from Mubadala Capital, while the $106M in debt financing was provided by TriplePoint Capital. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="ct

Payments Dive

JUNE 6, 2022

Bank of America and Wells Fargo have both been sued recently by consumers who allege they were defrauded by scam artists using Zelle payments.

National Merchants Association

JUNE 28, 2022

In simple terms, embedded finance is financial/banking services by a non-financial/banking services provider. Some key examples include digital wallets , payments, and lending services. For many banks, the rise of these offerings represents a threat and perhaps brings an urge to re-evaluate their products, modernize their services, and invest more in customer loyalty.

Axway

JUNE 21, 2022

2022 Axway Excellence Awards. The acclaim belongs to our customers. The honor is all ours. We’re grateful and honored that our customers have chosen Axway to help make the great things they do possible.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

JUNE 20, 2022

Russia’s Rostec Group , a government organization, has developed a blockchain platform to launch a digital system for international payments capable of replacing the global SWIFT system.

FICO

JUNE 27, 2022

Home. Blog. FICO. FICO® Resilience Index Can Improve Card Account Management. Pandemic Period Results Demonstrate Value of Borrower FICO ® Resilience Index Insights. by Brendan LaCounte. expand_less Back To Top. Mon, 06/27/2022 - 15:00. In the early months of the COVID-19 pandemic, FICO found that the FICO® Resilience Index was a strong predictor of the likelihood that a consumer would receive a loan accommodation (payment deferral, forbearance, etc.) following implementation of the CARES Act.

CB Insights

JUNE 1, 2022

TransferMate , an international payments and money transfer company, has raised $70M in funding from the Railway Pension Trustee Co. Ltd. (Railpen). <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop"><div class="cta-desktop center-copy "><h4&

Payments Dive

JUNE 8, 2022

As Toast adds services, the Boston startup is taking business from larger rivals and fintech peers, analysts say.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content