Cross-border payment plays rev up

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Payments Dive

OCTOBER 10, 2022

The Clearing House, Swift and rivals are jostling to speed up cross-border payments, with collaboration and competition likely to emerge at an international conference this week.

Axway

OCTOBER 20, 2022

Congress enacted the Drug Supply Chain Security Act (DSCSA) in late November 2013, with the aim of providing additional oversight of the drug chain of custody throughout distribution.

The Finance Weekly

OCTOBER 9, 2022

In the past, there was little opportunity for close collaboration between the functions of finance and IT. Now, however, they routinely work together to create high-value, strategic projects for the organization. As organizations implement new technologies and launch digital initiatives meant to modernize or wholly transform their operations, effective finance and IT collaboration can help to assure that the organization realizes positive outcomes from those investments.

FICO

OCTOBER 12, 2022

Home. Blog. FICO. Risk-Aware Marketing to Personalize Telco Customer Engagement. Here's how technology from the banking space can help telcos compete with aggressively competitive sales and retention tactics. FICO Admin. Tue, 07/02/2019 - 02:45. by Tim Young. expand_less Back To Top. Wed, 10/12/2022 - 15:35. Telcos are entering a brave new world of aggressively competitive sales and retention tactics.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

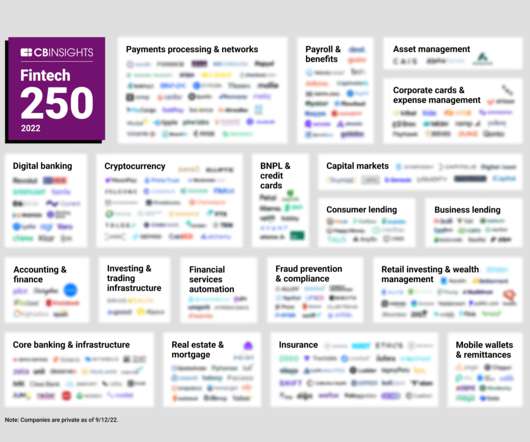

CB Insights

OCTOBER 4, 2022

CB Insights has unveiled the winners of the fifth annual Fintech 250 — a list of the 250 most promising private fintech companies worldwide. . Some of this year’s winners are building safer and more efficient ways to send and receive payments. Others are striving to make banking, loans, mobile wallets, and investing products available to historically underserved populations all over the world. .

The Paypers

OCTOBER 18, 2022

US-based Open Banking operator Plaid has published The Fintech Effect report that shows 84% of UK consumers use fintech for money management in 2022.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Axway

OCTOBER 4, 2022

E-invoicing is becoming a mandate throughout Europe for all companies doing business with the public sector. The requirement is that companies need to be able to generate and send electronic invoices.

Cardfellow

OCTOBER 31, 2022

They may have even suggested a specific gateway, such as Authorize.Net or NMI. Or perhaps you’re currently using one of those gateways but are considering a switch. In this article, we’ll compare and contrast Authorize.Net and NMI, two of the most popular gateways available, to help you make the right decision. Key Terms About Authorize.Net About NMI Key Differences Between Authorize.Net and NMI Features and Services Authorize.Net Features NMI Features Pricing Key Terms In order to effectively c

FICO

OCTOBER 24, 2022

Home. Blog. FICO. Fannie Mae and Freddie Mac Will Require the Use of FICO Score 10 T. FICO?Score 10 T gives mortgage lenders the flexibility and predictive power to make more precise lending decisions. FICO Admin. Tue, 11/12/2019 - 19:52. by James Wehmann. expand_less Back To Top. Mon, 10/24/2022 - 21:05. The Federal Housing Finance Agency (FHFA) has announced that FICO® Score 10 T has been validated and approved for use by Fannie Mae and Freddie Mac (the Enterprises).

CB Insights

OCTOBER 24, 2022

Fintech funding has taken a beating this year after a record-shattering 2021, but big tech companies are still keen on the space. The tech giants — such as Meta, Apple, Google, and Amazon — are well-positioned to do well in fintech, one key reason being that they all have far-reaching platforms with gigantic user bases. This creates opportunities to seamlessly integrate financial services into existing products through partnerships or in-house efforts, scale them up with ease to reach users alre

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Paypers

OCTOBER 13, 2022

Online food delivery company Deliveroo has partnered with Sweden-based Buy Now, Pay Later platform Klarna to offer customers the possibility to buy groceries and takeout food on credit.

Payments Dive

OCTOBER 4, 2022

In a 6-1 vote, the Federal Reserve finalized a debit card processing rule that underscores a requirement that multiple card networks be available for routing transactions, including online.

Axway

OCTOBER 31, 2022

“API Products” are mentioned relatively often, and there are different ways to look at the topic. None of them is inherently “right” or “wrong”, and we’ll discuss the two most important flavors of API products in this blog post.

The Finance Weekly

OCTOBER 27, 2022

The horrors are real when it comes to financial reporting. Your ability to effectively operate your organization can be severely hampered by nightmare realities such as disparate data systems and a lack of security (and let's not even get started on manual data entry and re-entry). The worst part is that without the proper technology to help streamline and integrate financial reporting processes, your business will continue to have cascading errors, which will eventually result in the worst of a

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

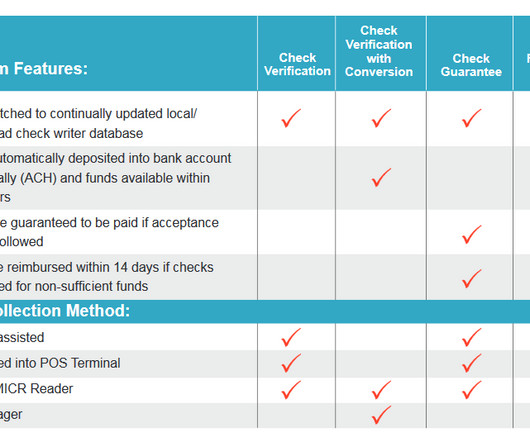

Cardfellow

OCTOBER 26, 2022

How do you know if it’s right for your business? In this review, we’ll go over the company’s services, pricing, and reviews from Payment Alliance International customers to help you get a full picture of what it’s like to work with PAI. About Payment Alliance International Credit and Debit Card Processing Check Processing Payment Alliance International Gun Sales Pricing for Gun Dealers Additional Services ATM Placement Gift and Loyalty Cards Business Funding Data Security Packages PAI Rates and

CB Insights

OCTOBER 18, 2022

Global fintech funding fell 38% quarter-over-quarter (QoQ) to hit $12.9B — matching Q4’20’s level. Deals fell slightly, dropping 9% QoQ to reach 1,160. Mega-rounds also accounted for a smaller percentage of total funding (34%) compared to the average of 66% in 2021. Below, check out a handful of highlights from our 150-page, data-driven State of Fintech Q3’22 Report.

The Paypers

OCTOBER 20, 2022

Chinese social media platfom TikTok has reportedly announced several job openings in the US indicating plans to expand ecommerce services in the country, according to South China Morning Post.

Payments Dive

OCTOBER 21, 2022

The bank said it invested in the regulated gaming company Sightline Payments this week, following an agreement earlier this year to be the firm’s primary merchant acquirer.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Axway

OCTOBER 11, 2022

Many of the discussions around open banking use cases have centered on the benefits for individual consumers – from greater data portability and privacy to easier account management and more personal finance options, or even social goods like green lending …

FICO

OCTOBER 26, 2022

Home. Blog. FICO. America’s AI Bill of Rights is the Right Idea – and It’s About Time. The AI Bill of Rights is the first step toward similar regulation of AI and machine learning algorithms. FICO Admin. Thu, 08/22/2019 - 12:37. by Scott Zoldi. expand_less Back To Top. Wed, 10/26/2022 - 15:00. It’s been a couple of weeks since the White House released its Blueprint for an AI Bill of Rights , a 73-page handbook that was promptly, and probably predictably, pilloried with headlines like, “ Biden’s

Cardfellow

OCTOBER 26, 2022

SQ Merchant Services Credit Card Processing Breach Insurance Cash Advances Can I get equipment from SQ Merchant Services? Customer Service What does it cost? What about contracts and termination fees? Reviews What CardFellow Thinks SQ Merchant Services SQ Merchant Services offers a basic range of processing and business services. You can take credit and debit cards (in person, online, with mobile devices, or using internet-connected computers), as well as EBT and fleet cards.

CB Insights

OCTOBER 31, 2022

The investment landscape has changed dramatically in the last decade with the rise of retail investment platforms allowing individuals to control their own portfolios. These apps offer consumers a cheaper, faster, and more hands-on experience — and completely bypass institutional investors. download the State of Fintech Q3 ’22 Report. Get the free report for analysis on dealmaking, funding, and exits by private market fintech companies.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

The Paypers

OCTOBER 12, 2022

US-based blockchain and crypto solutions provider Ripple has announced its first On-Demand Liquidity (ODL) customer in France, partnering with Lemonway , and in Sweden with Xbaht.

Payments Dive

OCTOBER 18, 2022

“In addition to cross-border payments, the benefits of FedNow must be widely available to Americans through competitive, diverse providers — including nonbanks,” writes a U.S.-based Wise executive.

Axway

OCTOBER 10, 2022

In a world where short attention spans are drawn by the latest thing that glitters, we rarely pause to consider the workhorses that make our digital world go round. Well, we want to change that.

Tribe Payments

OCTOBER 25, 2022

The anything and everything as a service (XaaS) model has revolutionised society. Hugely attractive to businesses across sectors, it has been especially embraced by the fintech sector.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Cardfellow

OCTOBER 26, 2022

History What can YapStone help me with? Taking payments Processing international payments Equipment Tell me about security What about costs? YapStone Reviews YapStone on Yelp YapStone and RentPayment.com at the Better Business Bureau History YapStone got into payment processing in 1999 by launching RentPayment, the credit card processing payment option for apartment rentals.

CB Insights

OCTOBER 4, 2022

We mined Yardstiq ’s interviews with software buyers to understand the decision criteria they use when evaluating spend management & corporate cards solutions. . Download the buyer’s guide to see our overview of this software category and the questions you should be asking to evaluate solutions, from pricing to integration. Buyers interviewed for this report include: .

The Paypers

OCTOBER 27, 2022

US-based financial infrastructure company for businesses, Stripe , has announced its official launch in Thailand, aiming to make it easier and faster for businesses to access the global economy.

Payments Dive

OCTOBER 6, 2022

The card behemoth said it’s observing an increase in in-person fraud now that U.S. consumers are returning to their pre-pandemic shopping habits.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content