FedNow attracts real-time payments early adopters

Payments Dive

MARCH 23, 2023

Companies partnering with the Federal Reserve to test the real-time payments system see it as a way to draw customers and get an edge on rivals.

Payments Dive

MARCH 23, 2023

Companies partnering with the Federal Reserve to test the real-time payments system see it as a way to draw customers and get an edge on rivals.

PCI Security Standards

MARCH 27, 2023

From 27 March to 27 April 2023, eligible stakeholders are invited to review and provide feedback on the PCI Token Service Provider (TSP) Security Requirements v1.0 during a 30-day request for comments (RFC) period.

The Finance Weekly

MARCH 16, 2023

The quick and unexpected collapse of the second and third largest bank collapses in US history sent shock waves throughout the markets. Silicon Valley Bank (SVB) collapsed last Friday and it sent both private and public companies scrambling to address what exposures they had with SVB and other banks that might be at risk. To top it off, this occurred on a Friday, meaning many executives and CFOs had to wait all weekend until Monday to take real action.

Nanonets

MARCH 28, 2023

Digital transformation is not just a buzzword. It is a strategic process that enables businesses to embrace the latest technologies and evolve to remain competitive in today's fast-paced digital world. It is all about transforming business models and operations using advanced digital technologies to deliver value to customers, improve employee productivity, streamline operations and increase revenue.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

FICO

MARCH 14, 2023

Home Blog FICO Claims Automation for Health Plans: Transformation with a Small “t” By focusing on transformation with a small “t” that addresses measurable performance gaps, health plans and administrators can use claims automation to control costs and risk FICO Admin Tue, 07/02/2019 - 02:45 by Paul Crowder expand_less Back To Top Tue, 03/14/2023 - 14:15 Some time ago, I witnessed a plea for help in a global healthcare summit from a Director of Claims Management for assistance in automating thei

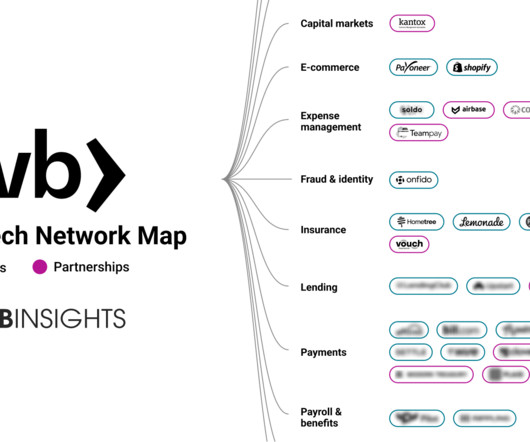

CB Insights

MARCH 14, 2023

For its 2,690+ fintech clients, Silicon Valley Bank (SVB) is more than just a bank. In addition to the venture debt financing and startup banking that it’s known for, SVB is a gateway for commercial payments and online payments acceptance. In fact, it markets itself not as a bank, but as a financial technology partner. According to SVB, its clients account for 71% of all fintech IPOs since 2020.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Agile Payments

MARCH 8, 2023

How Businesses Can Prevent Identity Fraud with ID Verification

The Paypers

MARCH 24, 2023

J.P. Morgan has announced a pilot of biometric-based payments with select US-based retailers, looking to enable speed and efficiency for merchants and consumers alike.

Axway

MARCH 10, 2023

Celebrated annually on March 8 th , International Women’s Day (IWD) — which falls during Women’s History Month as observed in the United States, United Kingdom, and Australia — highlights the social, economic, cultural, and political achievements of women around …

Nanonets

MARCH 30, 2023

Did you know that it takes small-to-midsized companies up to 25 days to complete the processing of a single invoice? In a world where time is money, businesses and customers alike seek hassle-free payment methods that save time and increase efficiency. Enter payment automation - a solution that has gained popularity in recent times due to the pandemic and the new competitive landscape.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

CB Insights

MARCH 2, 2023

What is a fiat-backed stablecoin? Fiat-backed stablecoin companies in this market issue stablecoins collateralized by fiat currency. Fiat-backed stablecoins are backed at a 1:1 ratio, meaning 1 stablecoin is equal to 1 unit of currency. For each stablecoin that exists, real fiat currency is held in a bank account. download the state of blockchain 2022 report Get the latest data on blockchain funding trends, unicorns, exits, and more.

Payments Dive

MARCH 13, 2023

As the banking crisis spread, payments players, such as FIS, and venture-backed firms, including Payoneer, were caught in the contagion.

FICO

MARCH 30, 2023

Home Blog FICO Defending Your Fully Digital Wallet Against Fraud Moving to a primarily digital wallet doesn’t mean sacrificing fraud protection – in fact, it means stepping up protection against scams FICO Admin Fri, 07/10/2020 - 18:12 by TJ Horan Vice President, Product Management expand_less Back To Top Thu, 03/30/2023 - 13:15 Ever since I cast off my physical wallet in favor of a digital one , I’m walking a little lighter.

The Paypers

MARCH 21, 2023

The Australian Prudential Regulation Authority has reportedly asked banks to report on transactions involving crypto assets and to provide updates.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

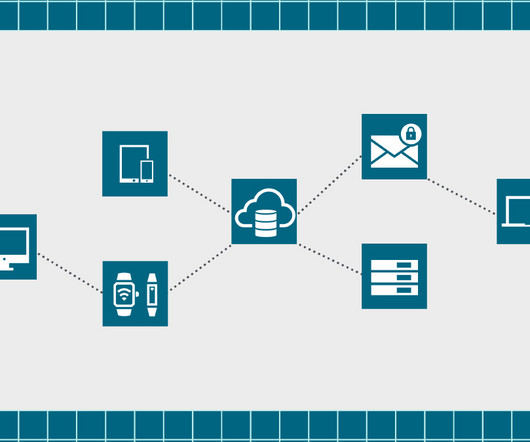

Axway

MARCH 30, 2023

The digital future belongs to companies taking an ecosystem approach that connects them with customers and partners in an interdependent way. According to Dr.

Nanonets

MARCH 30, 2023

Intelligent Document Processing (IDP) refers to the automation of data extraction from unstructured documents. It eliminates the need for manual data entry, reduces errors, and increases efficiency in document management. As we enter the sixth decade of the information age, data has become a currency of the business world. However, it is estimated that a vast majority of a company's data remains unstructured, taking the form of written text found in various forms such as reports, contracts,

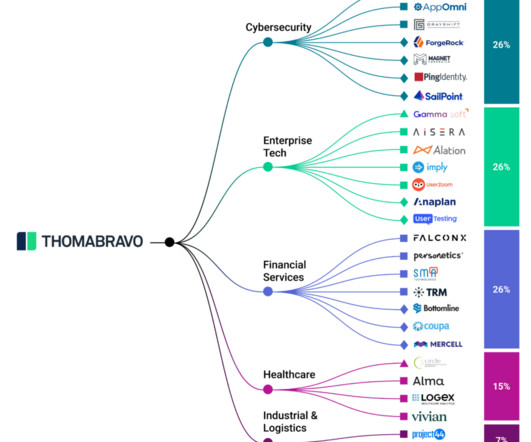

CB Insights

MARCH 8, 2023

Thoma Bravo is one of the world’s leading private equity firms, with a successful track record of investments across the technology, healthcare, financial services, and software industries. how investors use cb insights to improve deal flow Download the deck to see how investors are leveraging the CB Insights platform. First name Last name Email Company Name Job Title Phone number The company’s portfolio includes some of the most iconic and successful companies in the world, like SolarWind

Payments Dive

MARCH 27, 2023

The private label digital credit card company is stacking up online retail customers, with plans to add debit options and in-store clients this year.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payment Savvy

MARCH 28, 2023

Investors and financial analysts are constantly searching for metrics that can help them better understand a company’s financial performance. One such metric is the Trailing Twelve Months (TTM) calculation. TTM is a powerful tool that takes into account a company’s financial data from the previous four quarters and is regularly updated to reflect the latest performance of the company.

The Paypers

MARCH 30, 2023

French authorities have conducted multiple raids on five major banks in the country as part of an investigation into possible fiscal fraud and money laundering, according to Finbold.

Axway

MARCH 28, 2023

If it seems like all you hear about is ChatGPT these days, you would be right — and for good reason: OpenAI announced a new milestone this month in the race to monetize artificial intelligence.

Nanonets

MARCH 30, 2023

Introduction Healthcare and medical establishments are known for their abundance of data entry and record keeping. Many of these processes are manual, which can lead to errors, delays, and inefficiencies. Manual data entry involves the use of human operators to input data into a computer system or database, and this process can be time-consuming and error-prone.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

CB Insights

MARCH 29, 2023

What is banking-as-a-service? Banking-as-a-service companies enable collaboration between banks and third parties. They help third parties build, launch, and scale banking products and services through banks’ application programming interfaces (APIs). These companies typically partner with legacy banks to provide their non-banking fintech clients with a full range of banking capabilities, which they embed into their clients’ existing platforms.

Payments Dive

MARCH 7, 2023

The gunman in a 2019 attack at an El Paso Walmart store likely used a credit card to buy his gun online. This story is one in a series of pieces tracking payment methods for guns used in mass shootings.

FICO

MARCH 28, 2023

Home Blog FICO How to Unlock the Power of Hyper-Personalization To achieve hyper-personalization, banks must understand their customers’ activity, behaviors and preferences across the entire banking ecosystem FICO Admin Thu, 12/19/2019 - 16:29 by Bill Waid Chief Product and Technology Officer expand_less Back To Top Tue, 03/28/2023 - 15:00 The American Bankers Association (ABA) recently surveyed its members about marketing’s use of data and analytics.

The Paypers

MARCH 30, 2023

Two of the largest payment companies in the world, Mastercard and Visa , have reportedly planned to acquire Pismo , a Sao Paulo-based fintech company, according to Bloomberg.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Axway

MARCH 28, 2023

APIs have a clearly defined role in business operations, so they should be treated as such: they are business capabilities, not just technical integrations. That’s where API marketplaces enter the picture.

Nanonets

MARCH 29, 2023

What is Accounts Payable? Accounts payable (AP) refers to the amount of money a company owes to its vendors, suppliers, and creditors for goods and services received but not yet paid for. It is a liability on the company's balance sheet, representing the company's obligation to make payments to its creditors. The accounts payable process typically begins when a company receives an invoice from a vendor or supplier for goods or services that have been delivered.

CB Insights

MARCH 3, 2023

What are payment APIs & infrastructure? Payment application programming interface (API) and infrastructure companies enable small and medium-sized businesses (SMBs) to manage payments by providing APIs and infrastructure tech that act like credit card processors. This technology can handle a wide array of payment tasks — from one-time payments to subscription payments to crypto payments — to create a smooth checkout experience for merchants and shoppers.

Payments Dive

MARCH 6, 2023

While the digital payments pioneer has kept its PayPal and Venmo operations separate, the parent company expects them to converge in about a year.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content