Feds crack down on improper payments

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

CB Insights

JULY 19, 2022

Global fintech funding fell 33% quarter-over-quarter (QoQ) to hit $20.4B — its lowest level since Q4’20. Deals also hit a 6-quarter low, dropping 17% QoQ to reach 1,225. In line with this trend, $100M+ mega-rounds also accounted for a smaller percentage of total deals (4%) and funding (47%) than they did at any quarterly point last year. Below, check out a handful of highlights from our 197-page, data-driven State of Fintech Q2’22 Report.

FICO

JULY 21, 2022

Home. Blog. FICO. Continuous Financial Education for Women Small Business Owners. FICO-hosted panel at NAWBO’s 2022 Advocacy Days discusses how financial education impacts access to capital and business growth for small businesses. FICO. Tue, 02/18/2020 - 14:57. by Joanne Gaskin. expand_less Back To Top. Thu, 07/21/2022 - 15:30. In June, I had the pleasure of participating in a panel discussing credit access and financial education for women small business owners at the National Association of W

The Paypers

JULY 29, 2022

The Paypers has launched the 7th edition of the Payment Methods Report 2022 , which offers a detailed look at the latest developments in the payment methods space and the new technologies that these methods rely on.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

The Finance Weekly

JULY 19, 2022

FP&A software assists CFOs, finance leaders, and FP&A experts in ensuring the financial health of their organization by tracking and analyzing current outcomes and forecasting future performance. These cutting-edge tools aid teams in streamlining, automating, and improving the accuracy and efficacy of tactical and strategic initiatives. With providers of all shapes and sizes offering FP&A software, selecting the right platform for your specific needs can be difficult.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Payments Dive

JULY 14, 2022

The Federal Reserve plans to unleash a U.S. real-time payments system next year in the form of FedNow, but it’s an open question as to whether, or how, consumers and businesses will adopt instant payments.

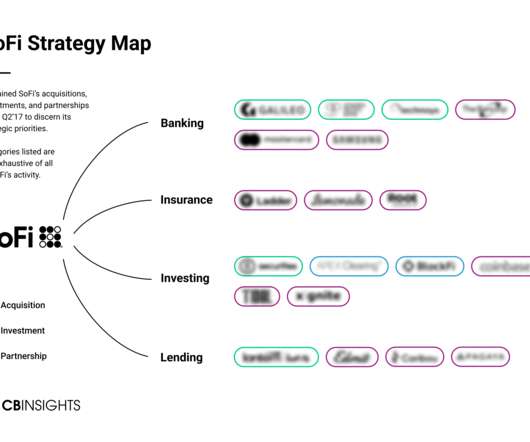

CB Insights

JULY 12, 2022

Consumer-facing finance company SoFi has traditionally been known for its lending services. The company went public in 2021, and now has a market cap of over $5B, even amid 2022’s widespread slump in tech stocks. <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop&#

Axway

JULY 12, 2022

The French economist Charles Gave is very clear : “Most economic activity is nothing but energy transformed.

The Paypers

JULY 25, 2022

UK-based money remittance platform Airwallex has launched an online payments app on Shopify , allowing merchants to integrate a gateway plugin on their online store and accept payments from customers around the globe.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Finance Weekly

JULY 28, 2022

FP&A software company , Vena Solutions made headlines recently with their controversial Systems and Organization Controls (SOC) reports grabbing the spotlight. One of Vena’s customers, , Verra Mobility , claimed that Vena misled them into believing that the Soc 1 Type II report that Verra was given had been audited by an independent auditor. Verra, a Nasdaq listed mobility software firm (Nasdaq: VRRM), cited in a , securities filing from April that the report was audited in house by Vena, wh

Agile Payments

JULY 5, 2022

Instant Payout Providers Help You Build Your Business.

Payments Dive

JULY 5, 2022

The earned wage access provider said that it was eliminating some fees just as the federal agency decided to remove a prior order giving the company leeway under certain laws.

CB Insights

JULY 26, 2022

Venture capital investors scaled back crypto investments in Q2’22 due to macroeconomic pressures and concerns about crypto valuations and stablecoins. Global funding fell by 29% quarter-over-quarter. Below, take a look at a few highlights from our 192-page, data-driven State of Blockchain Q2’22 Report. For all the record figures, private market data, and deeper insights, download the full report.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Axway

JULY 11, 2022

For most of our clients, their finance department is under construction: the order of the day is digital transformation of the finance function. . (Version française ci-dessous).

The Paypers

JULY 8, 2022

Russia-based Sberbank has started removing chips from un-activated cards to combat shortage after European suppliers halted deliveries based on EU sanctions imposed on the country amid the ongoing Ukraine invasion.

FICO

JULY 19, 2022

Home. Blog. FICO. Wolf, Goat and Cabbage: The Digital Customer Experience Riddle. Disjointed digital customer experiences are causing banking and insurance customers to flee in record numbers. FICO. Tue, 07/02/2019 - 02:45. by Jim Neumann. expand_less Back To Top. Tue, 07/19/2022 - 14:55. Building compelling, digital customer experiences that are validated by analytics is the key to successful digital transformation strategies… and a vexing challenge for banks and insurance companies facing ever

National Merchants Association

JULY 14, 2022

Companies that qualify for low-risk merchant accounts often pay lower service fees and benefit from other perks that help them succeed. Can your business take advantage of low-risk merchant account processing? Learn more about what constitutes a low-risk merchant account, so you can focus on the best processing options that match your business’s features.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payments Dive

JULY 12, 2022

The Australian company will pay $11 million to Sezzle after it dropped a plan to purchase the Minneapolis-based company in the face of “macroeconomic and market conditions.

CB Insights

JULY 15, 2022

The post The TL;DR Live: The State of Fintech Q2’22 appeared first on CB Insights Research.

Axway

JULY 12, 2022

The French economist Charles Gave is very clear : “Most economic activity is nothing but energy transformed.

The Paypers

JULY 21, 2022

Main Roads Western Australia has joined the Peppol e-invoicing network and become e-invoice compliant.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

FICO

JULY 18, 2022

Home. Blog. FICO. FICO Fact: Can unconstrained AI/ML expand access to credit? FICO has been a pioneer in the use of machine learning (ML) in the financial services industry for over 25 years. FICO. Tue, 07/02/2019 - 02:45. by Can Arkali. expand_less Back To Top. Mon, 07/18/2022 - 18:40. FICO leverages machine learning (ML) in solutions ranging from fraud detection to marketing.

National Merchants Association

JULY 14, 2022

Companies that qualify for low-risk merchant accounts often pay lower service fees and benefit from other perks that help them succeed. Can your business take advantage of low-risk merchant account processing? Learn more about what constitutes a low-risk merchant account, so you can focus on the best processing options that match your business’s features.

Payments Dive

JULY 8, 2022

LeafLink and Bespoke are building up their business in cannabis payments as their CEOs count on a rebound in prices for reefer.

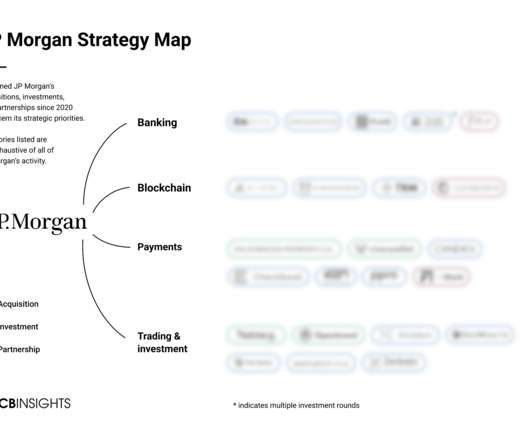

CB Insights

JULY 14, 2022

JP Morgan (JPM) is one of the leading financial institutions globally with over $3T in assets. While the company is largely known for its wealth management services, it has made key acquisitions and investments in the last 2 years that expand its offerings. JPM’s investment activity reveals a deliberate strategy to develop its technological and geographical footprint.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Axway

JULY 28, 2022

One player in the B2B market, Progress (formerly Ipswitch) recently announced they will be discontinuing their MessageWay product effective May 31, 2024.

The Paypers

JULY 19, 2022

Global retail bank, payments, and shopping service Klarna has announced the opening of its first US-based retail pop-up store, Klarna Oasis.

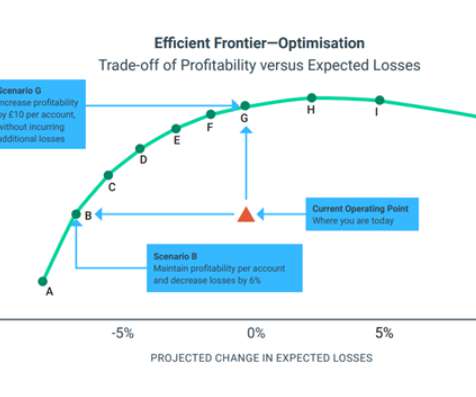

FICO

JULY 15, 2022

Home. Blog. FICO. Optimization and Automation Point the Way for Insurance Claims. In uncertain times, optimization and automation offer insurance claims departments what's needed most - speed, scale and control. FICO. Tue, 07/02/2019 - 02:45. by Darran Simons. expand_less Back To Top. Fri, 07/15/2022 - 10:05. Optimization and automation are fundamentally changing the way insurers use data and AI to operate and better serve customers.

Let's personalize your content