Fed to review debit card fee cap next week

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

Payments Dive

OCTOBER 20, 2023

The Fed hasn’t changed a debit card fee cap since it was put in place in 2011, but it's planning to take up the issue at a meeting next week.

VISTA InfoSec

OCTOBER 20, 2023

In the digital era, Electronic Health Records (EHRs) are crucial in healthcare, making Electronic Protected Health Information (ePHI) an essential asset. However, ePHI is vulnerable to threats like cyber attacks and natural disasters, making disaster recovery planning (DRP) vital. Healthcare organizations must implement HIPAA-compliant DRPs to protect ePHI, ensuring continued operation during disasters.

PCI Security Standards

OCTOBER 18, 2023

Welcome Cielo, a new Principal Participating Organization (PPO) at the PCI Security Standards Council! In this special spotlight edition of our PCI Perspectives Blog, Cielo’s CISO Glauco Sampaio introduces us to his company and how they are helping to shape the future of payment security.

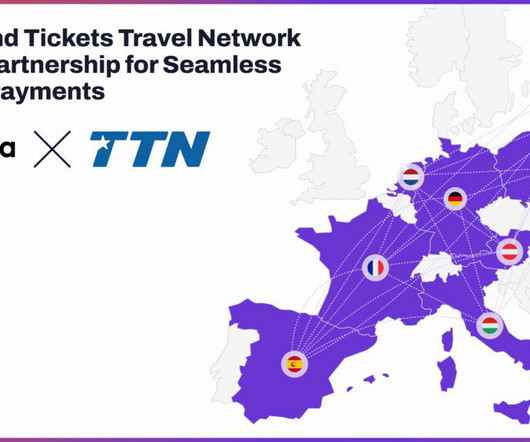

The Payments Association

OCTOBER 20, 2023

The partnership enables streamlined payment processes across multiple European destinations, with a focus on delivering convenient and efficient payment solutions to travellers.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

OCTOBER 20, 2023

The rule makes it easier for consumers to share deposit account and credit card data with fintechs, the Consumer Financial Protection Bureau said.

Payments Next

OCTOBER 16, 2023

By Patrick Bucquet, VP Capgemini Invent In the new metaversal economy, blockchain enables many kinds of transactions with a single source of The post New metaverse assets create new opportunities for FIs first appeared on Payments NEXT.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Payments Association

OCTOBER 20, 2023

Richard Dunlop of fscom summarises the major points of the 2023 Financial Crime Compliance Report and highlights key issues in anti-money laundering strategies that have been identified.

Payments Dive

OCTOBER 20, 2023

Businesses are increasingly turning to same-day ACH payments this year, according to Nacha, a national clearinghouse that manages electronic money movement.

Nanonets

OCTOBER 18, 2023

Introduction Welcome to our guide of LlamaIndex! In simple terms, LlamaIndex is a handy tool that acts as a bridge between your custom data and large language models (LLMs) like GPT-4 which are powerful models capable of understanding human-like text. Whether you have data stored in APIs, databases, or in PDFs, LlamaIndex makes it easy to bring that data into conversation with these smart machines.

The Paypers

OCTOBER 18, 2023

UK-based X-Press Legal has added Open Banking to its online banking system, X-Press Pay, via Ordo , enabling consumers to directly pay for disbursements.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Payments Association

OCTOBER 20, 2023

American Express releases new research revealing that UK businesses are investing in modernising their payment systems to boost efficiency and protection against fraudulent activity.

Payments Dive

OCTOBER 16, 2023

Carat’s recent expansion of its relationship with customer Inspire Brands “is what ‘good’ looks like in many ways for us,” said Casey Klyszeiko, the head of Fiserv’s global commerce platform for large clients.

Finezza

OCTOBER 19, 2023

The microfinance sector has evolved rapidly since Muhammad Yunus pioneered the movement around three decades ago. India, one of the fastest-growing economies in the world, banks on microfinance for sustainable growth and economic development due to the significant rise in the number of micro, small, and medium (MSMEs) seeking swift, organised, and streamlined access to […] The post 6 Ways Tech in Finance is Transforming Microfinance Institutions appeared first on Finezza Blog.

The Paypers

OCTOBER 20, 2023

Australia-based fintech has Data Zoo expanded to the North American Market by leveraging a US patent to deliver digital identity solutions for banks and prevents identity theft.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Inai

OCTOBER 19, 2023

If you are running an online business, you already understand the importance of requesting and accepting payments from customers on the Internet. Most times, if a customer does not have a seamless payment experience while shopping on your platform, they will not return a second time, or worse still, they might abandon their purchase midway.

Payments Dive

OCTOBER 16, 2023

In a recent web post, the National Consumer Law Center issued a number of policy recommendations for states seeking to regulate earned wage access companies.

M2P Fintech

OCTOBER 19, 2023

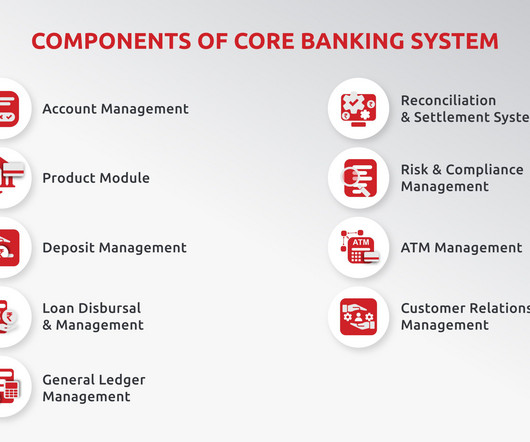

Modern core banking solutions are every banker’s secret sauce. Irrespective of whether the banks are traditional or new-age, robust core banking solutions are imperative to operational efficiency, customer experience, compliance, and security. Globally, the core banking solutions market is valued at over $14 Bn. And in India, the market is projected to grow at around 16% CAGR to reach $1510.92 Mn by 2028.

The Paypers

OCTOBER 19, 2023

US-based Intuit has announced the launch of QuickBooks Bill Pay, in order to expand its money platform and deliver B2B payments with AP automation to small businesses.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Open Banking

OCTOBER 19, 2023

Over 1 in 9 Brits now use open banking services as open banking payments reach record high 9.7m payments made in June 2023, an increase of 88% on the same month in 2022. We have seen further growth since the cut-off point for this report (June 2023), with 10.8m payments made in August 2023. Double the volume of payments in the first six months of 2023 than was seen in the first six months of 2022.

Payments Dive

OCTOBER 19, 2023

Federal Reserve Governor Michelle Bowman said the U.S. already has a “safe and efficient payment system” that could be disrupted by CBDCs or stablecoins.

FloQast

OCTOBER 18, 2023

About the Author: Katie Thomas, CPA, is a content creator, 2021 & 2022 40 under 40 CPA Practice Advisor recipient, Top 50 Women in Accounting recipient, and the owner of Leaders Online, where they help accounting professionals increase their impact, influence, and income through thought leadership and digital marketing. Feel free to visit Leaders Online or connect with her on LinkedIn to get in touch with Katie.

The Paypers

OCTOBER 18, 2023

Poland-based financial technology solutions provider Verestro has announced the integration of the Quicko Wallet money transfer service within the Slack application.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

NACHA

OCTOBER 18, 2023

Nacha announced today that Goldman Sachs has joined its growing community of Direct Members. Nacha now has 46 Direct Members, consisting of financial institutions and Payments Associations. "We look forward to working closely with Goldman Sachs to advance and promote the modern ACH Network," said Jane Larimer, President and CEO of Nacha.

Payments Dive

OCTOBER 18, 2023

The new council is tasked with providing “strategic guidance” to the San Francisco-based card giant’s Washington think tank, but none of the initial members are based in the U.S.

Segpay

OCTOBER 18, 2023

5 minute read Transaction laundering is a deceptive and illicit financial activity in which a legitimate merchant’s payment processing system is exploited to disguise illegal transactions or the sale of prohibited or counterfeit goods and services. MasterCard defines transaction laundering as “ the action whereby a merchant processes payment card transactions on behalf of another merchant.

The Paypers

OCTOBER 17, 2023

Singapore-based fiat-crypto payment gateway Alchemy Pay has partnered with travel travel-themed NFT collection Trekki NFT.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Nanonets

OCTOBER 18, 2023

Automate your sales processes and unlock the full potential of your CRM with Nanonets integrated Pipedrive Workflow Automation. In today's fast-paced business world, staying ahead of the competition requires efficiency, productivity, and strategic decision-making. And that's where workflow automation comes into play. By automating repetitive tasks and streamlining business processes, you can free up valuable time and resources to focus on what truly matters – closing deals and d

Payments Dive

OCTOBER 18, 2023

While investments in payments startups dropped during the third quarter, U.S. companies attracted the most funding, according to a CB Insights report.

EBizCharge

OCTOBER 17, 2023

Every day, billions of dollars in transactions are processed around the world. While payment methods vary depending on location, merchant, and type of transaction, ACH payments are one of the most used electronic payment systems in the U.S. This article will explore the processes involved in ACH payments, explaining how to distinguish returns vs. reversals and answering common questions such as what is an ACH return and can you reverse an ACH payment?

Core

OCTOBER 16, 2023

For government agencies, a revenue report is not just a financial document. It’s a strategic tool to guide budgetary decisions, resource allocation, and long-term government planning—ultimately contributing to the overall efficiency of government operations. Despite the breadth of information in revenue reports, agencies often face challenges in interpreting and leveraging this data effectively.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content