Are digital wallets safer than debit cards?

Payments Dive

MAY 31, 2024

Research shows young people see digital wallets as a more secure option than debit and credit cards. Cybersecurity professionals mostly agree, despite caveats.

Payments Dive

MAY 31, 2024

Research shows young people see digital wallets as a more secure option than debit and credit cards. Cybersecurity professionals mostly agree, despite caveats.

The Fintech Times

MAY 26, 2024

A key part of open banking is regulated third-party providers (TPP). They act as intermediaries between the bank and the customer. Open banking’s growth has got to a point now that more TPPs are able to offer their services outside of their domestic markets. Konsentus , the open finance ecosystem creator and manager, has revealed which countries are leading the way when it comes to exploring new open banking markets.

Finextra

MAY 29, 2024

The Interledger Foundation, an organisation dedicated to the creation of an open, interoperable payment network, is promising to fund fintechs that use its protocol to bring payments to emerging markets and underserved populations.

Payments Next

MAY 29, 2024

By Jason Kolbenheyer, Chief Product Officer, Edenred Pay Few technologies have generated as much excitement as artificial intelligence (AI). Using machines to The post The transformative impact of AI on invoice-to-pay functions first appeared on Payments NEXT.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

MAY 28, 2024

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

The Fintech Times

MAY 30, 2024

PayPal USD (PYUSD), PayPal ‘s USD stablecoin, will now be available on the Solana blockchain. The news was announced at Consensus 2024 , the long-running cryptocurrency, blockchain and web3 event. PYUSD availability on Solana will provide users with the choice of multiple blockchains allowing for increased flexibility and control. Furthermore, the announcement builds upon Solana’s reputation for processing massive amounts of transactions at high speeds with extremely low costs.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

MAY 28, 2024

Brazillian challenger bank Nubank is to bundle a digital travel eSIM into its package for premium customers in partnership with Telecom-as-a-Service platform Gigs.

Payments Dive

MAY 29, 2024

Roughly 72% of consumers say they swipe, dip or tap a debit card at the point of sale, a larger portion than credit cards, checks and digital wallets, according to a consumer survey by research firm J.D. Power.

Fintech News

MAY 28, 2024

The meteoric ascent of Brazilian neobank Nubank has sent shockwaves through the Latin American banking industry. In just over a decade, Nubank has amassed upwards of 100 million customers across the region, becoming the largest fintech company in Latin America. As digital banks in the Asia Pacific (APAC) region aim to replicate this success, there are valuable lessons to be learned from the unconventional Nubank approach to banking.

The Fintech Times

MAY 29, 2024

This month, The Fintech Times is focusing on the world of digital assets. The idea that digital assets are exclusively some form of currency has been slowly dispelled, as new use cases emerge and are rapidly adopted across the globe. But digital currencies are far from irrelevant. Cryptocurrencies, central bank digital currencies (CBDCs) and stablecoins remain prominent and continue to see innovation worldwide; particularly in the Middle East and Africa (MEA).

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

MAY 31, 2024

Southeast Asia Commercial Joint Stock Bank, SeABank and Visa Inc. further tightens their comprehensive cooperative partnership by a strategic cooperation agreement on developing digital payments.

Payments Dive

MAY 29, 2024

The Stockholm-based buy now, pay later company said more than a third of its first-quarter savings on sales and marketing expense was attributable to artificial intelligence.

TechCrunch Fintech

MAY 29, 2024

Owners of small- and medium-sized businesses check their bank balances daily to make financial decisions. But it’s entrepreneur Yoseph West’s assertion that there’s typically information and functions missing from bank accounts that owners could really use. “SMBs make up 44% of U.S. GDP, underpin the economy and have a deep impact on all of us,” […] © 2024 TechCrunch.

The Fintech Times

MAY 28, 2024

On this week’s episode of News & Views, The Fintech Times Podcast team speak about what it would take to see an NFT revival and INZMO launching a new AI chatbot, RentalBot to help tenants and landlords get the legal info they need to resolve disputes. Unfortunately, the Podcast team was once again down a member. With Polly away, Tom and Francis took the reigns and discussed INZMO’s new service being launched in Germany.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

MAY 28, 2024

PayPal is building an advertising platform, tapping into its trove of customer data to help merchants better target their ads.

Payments Dive

MAY 31, 2024

“The scale of fraud on the Zelle platform is unacceptably high,” National Consumers League Vice President John Breyault said.

Basis Theory

MAY 31, 2024

The new wave of payments, often touted as Payments 3.0 , gives merchants more control to unbundle payments from all-in-one payment processors. As merchants embrace this freedom, they’ll encounter some tough decisions on how to best achieve this.

Fintech News

MAY 29, 2024

Southeast Asian superapp Grab and OpenAI have announced a strategic collaboration to develop and implement advanced AI solutions aimed at enhancing the experience for users, partners, and employees. The initial phase of the collaboration will target three key areas, which are accessibility, customer support, and mapping. Grab aims to make its services more accessible by utilising state-of-the-art text and voice capabilities, particularly for visually impaired or elderly users who may struggle wi

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Finextra

MAY 30, 2024

Visa and Mastercard have agreed to pay $197 million to settle a long-running class action lawsuit accusing them of keeping ATM fees artificially high.

Payments Dive

MAY 31, 2024

The card issuer joins its tech and payments peers in integrating crypto into the traditional financial system.

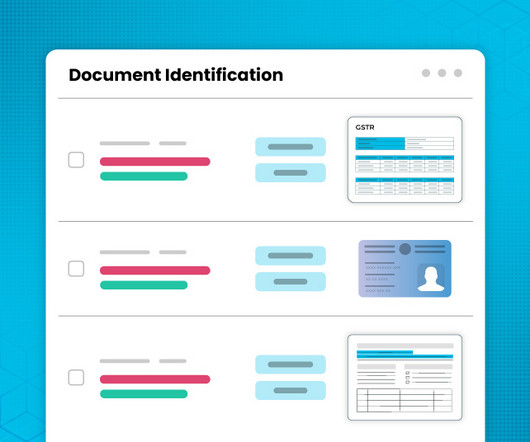

Finezza

MAY 29, 2024

When potential borrowers apply for a loan, they must submit a wide range of documents, from identity documents to financial documents such as bank statements. As the number of loan applicants escalates and the volume of documents grows, lenders face a unique challenge. They struggle to extract raw data efficiently, accurately, and quickly from such […] The post Finezza’s Document Identification Framework: Enhancing Lender Accuracy appeared first on Finezza Blog.

Fintech News

MAY 27, 2024

Central bank digital currencies (CBDCs) have largely existed in the virtual realm, with transactions initiated primarily through web and mobile interfaces. However, a significant shift has occurred with the launch of Eurasia’s first CBDC cards in Kazakhstan, providing 20 million consumers with a new, tangible way to manage CBDC funds. The first CBDC card transaction in Eurasia was successfully made on 15 November 2023.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

MAY 29, 2024

Commonwealth Bank of Australia is to help validate bank account details used in international payments to Australia by integrating its NameCheck technology with JPMorgan's blockchain network Liink.

Payments Dive

MAY 28, 2024

The new offering by the digital payments pioneer will be led by Mark Grether, who helped grow Uber Advertising into a $1 billion business.

The Fintech Times

MAY 26, 2024

In recent years, digital currencies have been all the rave. However, the idea that digital assets are exclusively some form of currency is slowly falling by the wayside as different use cases are emerging and being rapidly adopted. This May, The Fintech Times is looking to showcase some of these new methods and explore how the digital asset ecosystem is evolving.

Fintech News

MAY 29, 2024

Indonesian fintech company JULO has announced that it has provided insurance coverage to over 200,000 customers in just three months with its JULO Protect Plus product. It is a new feature embedded in the company’s virtual credit card solution. JULO collaborated with Qoala , an Indonesian insurtech company, and Sompo Insurance, a global general insurer with 48 years of experience in Indonesia, to develop this insurance cover.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Finextra

MAY 29, 2024

Commonwealth Bank of Australia is to help validate bank account details used in international payments to Australia by integrating its NameCheck technology with JPMorgan's blockchain network Liink.

Payments Dive

MAY 28, 2024

The big bank-backed digital wallet is now accepted by about 80,000 "primarily small" merchants according to Early Warning Services Managing Director James Anderson.

The Payments Association

MAY 31, 2024

Edenred Payment Solutions has appointed Rehana Mitha as its new managing director to enhance offerings and strategic partnerships in the UK and Europe.

Fintech News

MAY 29, 2024

E-wallets are gaining significant traction in Singapore, with predictions indicating they will become the primary payment method by 2027. According to the 2024 Global Payments Report by payment processing company Worldpay, e-wallets are expected to handle over 50% of online spending in Singapore by 2027. In 2023, e-wallets were used for 70% of online spending in the Asia-Pacific region.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content