Visa’s next CEO sees a world of growth

Payments Dive

NOVEMBER 21, 2022

Ryan McInerney, who will become CEO of the card network juggernaut next year, recently detailed the areas where he sees opportunities for the company.

Payments Dive

NOVEMBER 21, 2022

Ryan McInerney, who will become CEO of the card network juggernaut next year, recently detailed the areas where he sees opportunities for the company.

Axway

NOVEMBER 22, 2022

Regardless of a business’s products and services, B2B transactions are central to operations — whether communications with suppliers, customers, distributors, or even end consumers.

Agile Payments

NOVEMBER 23, 2022

How to Manage Your Investment Portfolio as a SaaS Business.

The Paypers

NOVEMBER 25, 2022

The Paysera network of financial technology companies has announced it is expanding to Georgia, where the first Paysera bank will open its doors.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

NOVEMBER 22, 2022

The news report on workforce reductions at the payments processor follows its announcement earlier this month that it would embark on a $500 million cost-cutting program.

Axway

NOVEMBER 22, 2022

The director of the?Consumer Financial Protection Bureau (CFPB) has just announced the coming of a new U.S. open banking rule , accelerating the move toward open banking in North America.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finance Magnates

NOVEMBER 24, 2022

IS Bank in Türkiye is one of the banks that I use. Their mobile app has something I have not witnessed with any other app I may have used. I am sure it exists, but I haven’t seen it with anyone else. It is the welcome screen depending on the time of day it is, and also on holidays & seasons. Something as simple as this welcome screen makes me happy.

Payments Dive

NOVEMBER 22, 2022

Consumer demand for credit cards rose this year over prior years, and card issuers increasingly approved their applications despite the worsening economic climate.

Axway

NOVEMBER 20, 2022

On December 12-15th, Axway and EasiRun are sponsoring the digital IT Days in Germany to highlight API security as the key to business success for organizations in Europe’s German-speaking countries (DACH region).

Evolve Payment

NOVEMBER 21, 2022

Table of Contents Marginal Improvements Throughout Your Merchant Account When it comes to preparing for an economic downturn and weathering the storm after it arrives, there’s never a foolproof solution to protect yourself. The traditional methods businesses choose are well-known – price increases, layoffs, slashes in marketing/advertising spending, and the list goes on.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

FICO

NOVEMBER 21, 2022

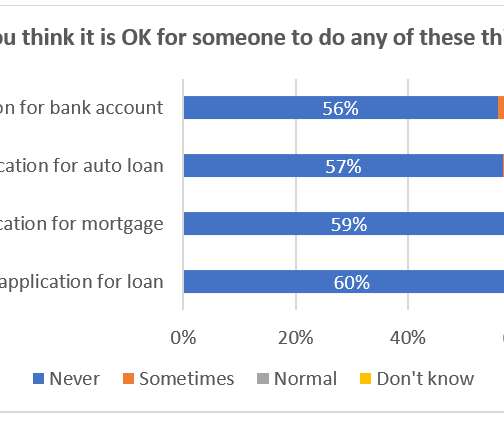

Home. Blog. FICO. First-Party Fraud Must Be Stopped Across the Customer Lifecycle. Financial institutions face first-party risks “inside the wire” - 14% of customers worldwide think it is normal to exaggerate income on a mortgage application. FICO Admin. Tue, 07/02/2019 - 02:45. by Sarah Rutherford. expand_less Back To Top. Mon, 11/21/2022 - 15:15. FICO’s 2022 global consumer survey on financial services and fraud produced some surprising results, but none more alarming than the 25% to 30% of fi

Payments Dive

NOVEMBER 21, 2022

Families of all income levels plan to increase holiday spending this year, and they expect to rely more heavily on credit cards for their purchases.

Axway

NOVEMBER 22, 2022

The director of the Consumer Financial Protection Bureau (CFPB) has just announced the coming of a new U.S. open banking rule , accelerating the move toward open banking in North America.

The Finance Weekly

NOVEMBER 20, 2022

CFOs are no longer turning to the same old sources of inspiration when looking for quick solutions to workplace challenges. Finance directors in the past may have been persuaded to purchase software by clever advertising efforts or information they acquired at a CFO conference on the other side of the globe. Decision-making CFOs are now looking to something completely different for quick solutions to queries about people, processes, or technology.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

FICO

NOVEMBER 21, 2022

Home. Blog. FICO. FICO Ranks Top 5 in the 2023 Chartis RiskTech100® Report. FICO awarded first place in six categories on risk and compliance technology in the 2023 Chartis RiskTech100 ® Report, including Innovation for the sixth year in a row. asokolowski. Fri, 06/03/2022 - 12:24. by Darryl Knopp. expand_less Back To Top. Mon, 11/21/2022 - 20:30. I am thrilled to announce that the annual 2023 Chartis RiskTech100® Report ranking risk and compliance technology companies is live!

Payments Dive

NOVEMBER 22, 2022

The buy now-pay later provider and the travel booking company are teaming up to allow consumers to spread out payments for flights and hotels.

The Paypers

NOVEMBER 25, 2022

US-based neobank Novo has raise a USD 125 million Series B round to scale operations and reach more customers in the near future.

Axway

NOVEMBER 25, 2022

How difficult can it be to create a file transmissions gateway? Why bother investing in a vendor solution when SFTP is freely available?

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payments Dive

NOVEMBER 22, 2022

Heavy users of buy now-pay later ? which researchers said inspires consumers to spend beyond their means — showed larger declines in financial health, a recent academic study determined.

Payments Dive

NOVEMBER 21, 2022

While one card network giant has grabbed center stage at the World Cup event in Qatar, other payments companies have landed bit roles too.

Payments Dive

NOVEMBER 22, 2022

The green light comes more than two years after the bank submitted paperwork to the U.S. Patent and Trademark Office, and is at odds with some statements by its CEO.

Payments Dive

NOVEMBER 23, 2022

The payments company’s board adopted the executive severance policy this week even though it opposed a similar shareholder proposal in May.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Payments Dive

NOVEMBER 21, 2022

The fintech aims to extend buy now-pay later financing options to consumers for healthcare payments.

Axway

NOVEMBER 23, 2022

In collaboration with Trustlink , Axway recently hosted an “Open Everything” event with local and international contributors.

The Paypers

NOVEMBER 25, 2022

The International Monetary Fund (IMF) has proposed an increase in regulation and better consumer protection in Africa’s cryptocurrency market.

The Paypers

NOVEMBER 25, 2022

The financial regulator of South Korea, Financial Supervisory Service (FSS) has announced it is reviewing the Apple Pay service launch clause submitted by Hyundai Card.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Paypers

NOVEMBER 25, 2022

Spain has pushed ahead with its plan to impose windfall taxes on banks and energy companies as lawmakers approved the move despite the concerns of international institutions.

The Paypers

NOVEMBER 25, 2022

The Paypers has launched Crypto Payments and Web 3.0 For Banks, Merchants, and PSPs , an essential guide to accepting crypto payments and the cash management around it.

The Paypers

NOVEMBER 25, 2022

Experian has announced its appointment by the Singapore FinTech Association (SFA) and the Buy Now, Pay Later (BNPL) Working Group as a BNPL bureau operator.

The Paypers

NOVEMBER 25, 2022

Europe-based Open Banking platform Tink has announced the launch of Balance Check, a key feature enabling Tink customers to verify account balances.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content