Amazon, Google stake out bigger foothold in payments

Payments Dive

SEPTEMBER 23, 2024

The tech giants are inserting themselves into more retail transactions to build loyalty and harvest customer data.

Payments Dive

SEPTEMBER 23, 2024

The tech giants are inserting themselves into more retail transactions to build loyalty and harvest customer data.

Open Banking Excellence

SEPTEMBER 27, 2024

Mexico in Focus: Open Banking and Financial Inclusion A briefing for banks and fintechs, with key insights and details of the opportunities available in LatAm’s third-largest nation. Open Banking represents an important possibility for both financial institutions and the Mexican population. Today, a significant portion of the Mexican population has limited or no access to traditional banking services.

Fintech News

SEPTEMBER 22, 2024

Financial institutions around the world are facing a surge in fraud and cyberattacks. A new report by LexisNexis Risk Solutions explores the state of digital fraud, revealing a 17% increase in digital fraud attacks within the financial services sector in 2023. According to the report, human-initiated attacks in financial services rose to 1.2% last year, up 8% year-over-year (YoY).

Fintech Finance

SEPTEMBER 24, 2024

Finastra has announced that First Pacific Bank , a Southern California-based community bank that offers custom financial solutions for individuals and businesses, has selected Finastra Payments To Go to modernize its payments infrastructure. The cloud-based, SaaS payments hub solution will help the bank to deliver FedNow send and receive services 24/7, support ISO 20022 compliance, and enable its projected growth.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

SEPTEMBER 24, 2024

The card network may soon be sued by the Department of Justice over its debit card practices, according to multiple news reports citing anonymous sources.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

SEPTEMBER 22, 2024

PayPal has used its own stablecoin to make an additional investment in blockchain risk management specialist Chaos Labs.

Fintech News

SEPTEMBER 22, 2024

Indonesia’s GoTo Group has partnered with Chinese multinational tech conglomerate Tencent to enhance its cloud infrastructure and digital services. Under the five-year agreement, Tencent Cloud will provide GoTo with a range of cloud solutions and Platform as a Service (PaaS) offerings, aimed at strengthening GoTo’s enterprise and consumer-focused services.

Payments Dive

SEPTEMBER 26, 2024

The international wire transfer company has restarted some services after a cyberattack, but is battling to fulfill transactions after taking its systems offline for much of the week.

Open Banking Excellence

SEPTEMBER 25, 2024

23-24th October 2024 Live Event Linkedin Twitter NexGen Banking Summit The NexGen Banking Summit , scheduled for October 23rd and 24th, 2024 at the Hilton Hotel in London, brings together industry leaders, banking institutions, and technology companies. This pivotal event explores how cutting-edge technologies—such as AI, biometrics, and open banking—are reshaping the financial landscape.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

SEPTEMBER 24, 2024

The US Justice Department has sued Visa, accusing the payments giant of illegally monopolising debit network markets.

Fintech News

SEPTEMBER 25, 2024

Commonwealth Bank of Australia ( CBA ) has announced the sale of approximately 5% of its shares in Vietnam International Commercial Joint Stock Bank (VIB). The transaction, executed on 24 September 2024, is expected to generate gross proceeds of approximately A$160 million (US$ 109.5 million) for CBA. CBA has been a shareholder in VIB since 2010, contributing to its development as a joint-stock commercial bank in Vietnam.

Payments Dive

SEPTEMBER 24, 2024

The company, which offers payments processing software, has kept its plans close to the vest, but industry insiders say they’ve seen clues.

Open Banking Excellence

SEPTEMBER 23, 2024

23-24th October 2024 Live Event Linkedin Twitter ASEAN Symposium Be inspired by women making waves in the ASEAN payments industry and beyond. Join us at the 2024 Symposium! Our theme for this year is “ Leading Through Volatility “ Our keynotes, panels, and break-out sessions will help strengthen your skills while keeping you on top of industry trends.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

SEPTEMBER 24, 2024

Klarna has joined forces with accountancy software provider Xero to enable small businesses to accept buy now, pay later payments.

Fintech News

SEPTEMBER 24, 2024

Indonesia’s GoTo Group has unveiled Dira, an AI-powered voice assistant integrated into the GoPay app. Dira understands and responds to commands in Bahasa Indonesia, leveraging Google Cloud’s generative AI technologies, including Vertex AI, speech-to-text AI, and the Gemini 1.5 Flash large language model. GoPay is GoTo’s digital wallet and payment platform widely used across Indonesia.

Payments Dive

SEPTEMBER 27, 2024

The venture between the payments processor and the bank will expire in April, prompting a cash payment from one to the other.

Open Banking Excellence

SEPTEMBER 23, 2024

21-22nd November 2024 Live Event Linkedin Twitter Australia Symposium Be inspired by women making waves in the Australia payments industry and beyond. Join us at the 2024 Symposium! Our theme for this year is “ Growth Powering Payments “ Our keynotes, panels, and break-out sessions will help strengthen your skills while keeping you on top of industry trends.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Finextra

SEPTEMBER 26, 2024

Visa has signed a definitive agreement to acquire British AI-powered financial fraud fighting outfit Featurespace for an undisclosed sum.

Fintech News

SEPTEMBER 25, 2024

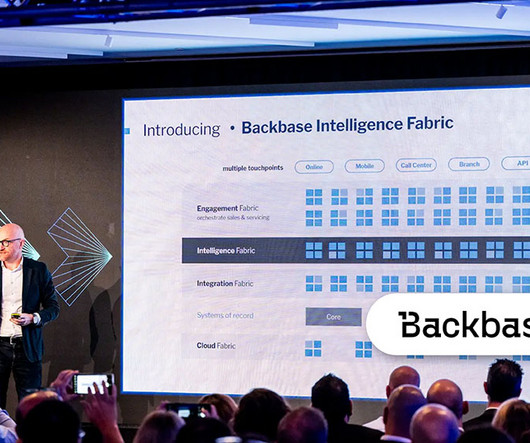

Digital banking software provider Backbase has expanded its Engagement Banking Platform with the introduction of the Intelligence Fabric. This embeds advanced AI and data infrastructure to enhance productivity in customer service and sales operations. A key feature is Agentic AI, which enables banks to deploy AI agents that autonomously manage customer journeys and workflows.

The Fintech Times

SEPTEMBER 22, 2024

Payments giant Mastercard has partnered with Kenyan mobile network operator Safaricom , to accelerate the adoption of payment acceptance and cross-border remittance services across Kenya. Through the Mastercard and Safaricom partnership, the two entities hope to benefit the 636,000 merchants in Kenya using M-PESA, Safaricom’s mobile money service and the preferred way to make a payment across Africa.

Fintech Finance

SEPTEMBER 25, 2024

NETSTARS Co., Ltd. (Head Office: Chuo-ku, Tokyo; President & CEO: Tsuyoshi Ri;hereinafter “NETSTARS”) has partnered with ACI Worldwide (Head Office: United States; CEO & President: Thomas W. Warsop, III; hereinafter “ACI”) to support the further international development of cashless payments in Japan. The two companies will join forces to offer a one-stop payment acceptance solution for payment service providers and merchant acquirers to create a seamless and secu

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

SEPTEMBER 26, 2024

The Bank of England (BoE) is calling on financial services firms to join its artificial intelligence (AI) consortium designed to oversee the use of the technology within the sector.

Fintech News

SEPTEMBER 24, 2024

audax, a digital banking technology solutions provider backed by Standard Chartered, and global consultancy Synpulse have partnered to modernise banking infrastructure for financial institutions. The collaboration focuses on integrating advanced digital banking technology with Synpulse’s expertise to enable banks to upgrade existing systems and transition to cloud-based platforms without disrupting operations.

The Fintech Times

SEPTEMBER 26, 2024

India-based Web3 association, Bharat Web3 Association , is expanding into Australia, after signing agreements with the Digital Economy Council of Australia (DECA), the voice for businesses and innovators utilising blockchain and distributed ledger technology (DLT), and Asosiasi Blockchain Indonesia , a non-profit organisation looking to mobilise blockchain technology in the region.

Finovate

SEPTEMBER 23, 2024

You’ve seen the hype around Generative AI (GenAI). And perhaps you even have an AI strategy in place at your organization. But because the development of AI moves faster than any enabling technology we’ve seen in banking in the past, it’s important to think ahead to the next iteration. In this case, the next evolution of GenAI is Agentic AI.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Finextra

SEPTEMBER 26, 2024

R3, the financial markets digital solutions firm and Ownera, a leading provider of tokenization interoperability routers based on the open FinP2P protocol, have partnered to enable interoperability across the largest number of live production-grade use cases and networks for digital assets and digital currencies.

Fintech News

SEPTEMBER 24, 2024

Gan Kim Yong will join Singapore’s sovereign wealth fund GIC ‘s Board as a Director, effective 1 October 2024. Gan Kim Yong He is currently serving as Singapore’s Deputy Prime Minister and Minister for Trade and Industry, and also chairs the Monetary Authority of Singapore. Gan is involved in the Strategy Group within the Prime Minister’s Office and is a member of both the Research, Innovation and Enterprise Council and the National Research Foundation Board.

The Fintech Times

SEPTEMBER 24, 2024

2024 is proving another standout year for the regulatory space, finding itself under the spotlight, for better and worse reasons. This month, The Fintech Times will look at some of the biggest issues regarding compliance and financial rules, as well as the solutions hoping to ease the compliance journey for firms and make the fintech world fairer and safer.

Let's personalize your content