Pavilion Payments plots growth

Payments Dive

APRIL 11, 2023

The gaming payments service provider, previously part of processor Global Payments, aims to increase business by investing in technology and more staff.

Payments Dive

APRIL 11, 2023

The gaming payments service provider, previously part of processor Global Payments, aims to increase business by investing in technology and more staff.

Nanonets

APRIL 14, 2023

Documents are ubiquitous in business and serve as the foundation for data, information, and knowledge. From invoices and contracts to emails and memos, documents are an essential part of the daily document processing workflow. According to Statistica.com , there has been an exponential increase in the total amount of data (from various documents) being created, captured, copied, and consumed globally.

Payment Savvy

APRIL 14, 2023

In today’s globalized world, understanding a country’s economic health is crucial to comprehending its overall well-being and development. There are several metrics that can be used to determine how well the country is performing, and one of them is called income per capita. In this article, we will be talking about what it is and why it’s so important for policymakers and economists to calculate it regularly.

Axway

APRIL 12, 2023

The announcement of Axway’s Amplify Platform receiving Common Criteria EAL4+ certification has been welcomed by the API community as a major step forward in securing information systems.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

APRIL 13, 2023

San Francisco police arrested an IT worker in the murder of Bob Lee, who was knifed to death in the early morning hours of April 4. Police declined to discuss a motive at a Thursday press conference.

CB Insights

APRIL 11, 2023

The post What’s Next For Fintech?: Investment Trends to Watch appeared first on CB Insights Research.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Payment Savvy

APRIL 13, 2023

When it comes to investing, one of the most important things to consider in terms of a company is its financial health. You cannot make a fully conscious decision about whether you should invest your hard-earned money in a business if you don’t know if it will be profitable. That’s when the TIE ratio or Times Interest Earned ratio comes into play.

Payments Dive

APRIL 12, 2023

Payment processors and their merchant clients are bracing for Visa’s surcharge cap next week. “Don’t fight Visa right now – you’re not going to win,” advises one consultant.

Evolve Payment

APRIL 12, 2023

Evolve Payment’s Partnership with Glenwood State Bank Marnie Ochs-Raleigh, Founder & CEO of Evolve Payment, discussed with Teri Etienne, Treasury Management Lead at Glenwood State Bank , how their community bank has been able to elevate their business offerings and transform their cash management operations through their partnership with Evolve Payment.

Nanonets

APRIL 14, 2023

It’s no secret that businesses are always on the hunt for ways to increase revenue. However, many overlook the benefits of tightening their belts and finding ways to save money. That's where business spend management comes in. It's like a financial detective, ferreting out all the sneaky ways your company spends money and subjecting them to deeper scrutiny.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

FICO

APRIL 12, 2023

Home Blog FICO The FICO® Score is Built to Last For more than 30 years, the FICO ® Score has been carefully developed to be robust and reliable assessments of credit risk throughout the credit cycle FICO Admin Thu, 12/19/2019 - 16:29 by Ethan Dornhelm expand_less Back To Top Wed, 04/12/2023 - 15:00 The current FICO® Score 10 Suite leverages the most comprehensive credit bureau data available and outperforms all previous FICO® Score models.

Payments Dive

APRIL 13, 2023

Using the new merchant category code for gun and ammunition sales “could help identify dangerous patterns,” one advocacy group lawyer argues.

Payments Dive

APRIL 11, 2023

Visa will help connect PayPal and its Venmo unit via a new P2P tool that will also draw in other payments players, including DailyPay and Western Union.

Payments Dive

APRIL 10, 2023

Capital One failed to meet standards outlined in the contract, such as issuing replacement cards and promptly processing payments and posting transactions, Walmart alleged.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Payments Dive

APRIL 12, 2023

The bureau's chief, Rohit Chopra, urged users who maintain balances on their digital wallets and money-transfer apps to move that uninsured money to a bank account.

Payments Dive

APRIL 11, 2023

Eleven of the specialty grocery chain’s locations in Colorado are now equipped with Amazon One technology, the e-commerce giant’s palm-based frictionless checkout option.

Payments Dive

APRIL 10, 2023

Charlie Youakim, co-founder of the buy now, pay later company, said the company has defied the odds in carving its own path. “Every step is a little bit unusual," he said.

Payments Dive

APRIL 13, 2023

The Bitcoin Depot ATMs will be installed in every state where the convenience chain operates — Idaho, Nevada, Oregon, Utah, California, Washington and Arizona.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payments Dive

APRIL 12, 2023

Venture capital firms face challenges in picking payments and fintech investments amid the wreckage, and waiting for the right prices.

Payments Dive

APRIL 14, 2023

The card giant is set to impose a new surcharge cap of 3% tomorrow, but many payments processing professionals are still searching for details about it.

Payments Dive

APRIL 12, 2023

A new rule, which takes effect May 11, ends a 40-year moratorium on admitting new nonbank lenders to the agency’s 7(a) loan program.

Payments Dive

APRIL 13, 2023

Facing stiff competition, Block’s merchant services unit Square is adding tools for its merchant clients.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Nanonets

APRIL 14, 2023

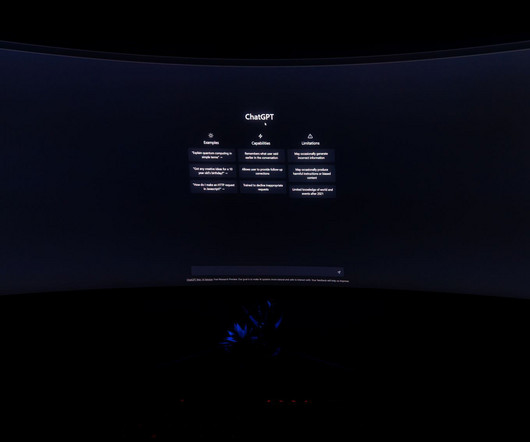

Do you know what the future of accounting looks like? ChatGPT is the technology that will revolutionize the accounting field, making it faster and more efficient than ever before. With ChatGPT, accountants can use computer-aided automation to streamline tasks and processes, leaving more time for analysis and insights. In this article, we'll look at how you can use ChatGPT in accounting to help simplify tedious tasks, generate financial projections quickly, create accurate audit reports, ass

Nanonets

APRIL 13, 2023

The Automated Clearing House (ACH) payment system facilitates the movement of billions of dollars every day, operating behind the scenes in the U.S. financial system. It's a sophisticated system that many of us have benefited from, whether by using online bill pay or receiving direct deposit paychecks. In this article, we'll explore the ACH network and ACH payments, how ACH payments function, and the ways in which it impacts our daily financial transactions.

Nanonets

APRIL 12, 2023

Tail spend, the long-tail of a company's procurement expenditure which has become increasingly important in recent years as companies seek to optimize their procurement processes and reduce costs. Often representing over 80% of total transactions, tail spend includes low-value purchases that are fragmented across multiple departments and suppliers, making it difficult to manage and control.

Nanonets

APRIL 12, 2023

Spend management has become increasingly important for businesses today as it enables them to control costs, improve procurement processes, and optimize profitability. According to a McKinsey report , spend management is the “forgotten hero” of business and marketing excellence, freeing up as much as 20% of budgets to serve as a catalyst for organizational growth.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Nanonets

APRIL 12, 2023

The global SaaS industry is projected to grow from $251.17 billion in 2022 to $883.34 billion by 2029, at a CAGR of 19.7%. Businesses regularly purchase SaaS subscriptions to manage various operations, which leads to its own overhead. Purchases may be made in silos with the procurement or finance teams, leading to low visibility and accountability. SaaS spends can thus increase rapidly, leading to poor ROI and other business risks.

FICO

APRIL 12, 2023

Home Blog FICO Why Credit Scores are Crucial to Healthy Securities The value of asset-backed security is determined by the cash flows generated by the underlying assets and understanding the predictability of those cash flows FICO Admin Thu, 08/22/2019 - 12:37 by Joe Zeibert expand_less Back To Top Wed, 04/12/2023 - 15:00 What you will learn: What can increase the value and liquidity of securities How FICO Score 10 T can help you better model cash flows and analyze securities Today there is ap

Nanonets

APRIL 11, 2023

The loan origination process has historically been a complex and time-consuming endeavor for both commercial lenders and borrowers. But in recent years, advancements in technology have paved the way for digitizing this process, which has revolutionized the lending industry by streamlining processes and improving operational efficiency. A report by McKinsey states that by embracing digital lending processes, leading banks have brought down the “time to yes” from weeks to minutes, an

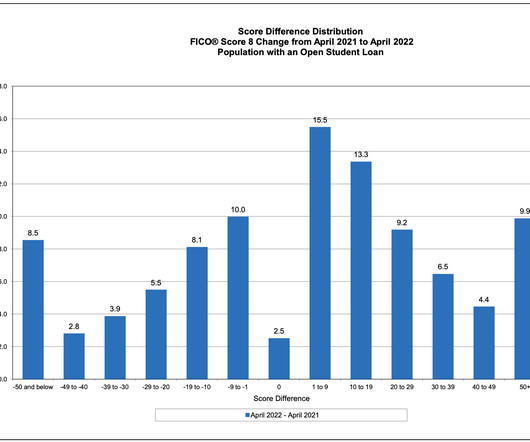

FICO

APRIL 11, 2023

Home Blog FICO Are Student Loan Holders at Risk as Deferments Expire? Factors driving credit score decreases observed among student loan holders involved behaviors such as delinquency on credit products including bankcards, auto loans, and mortgages Saxon Shirley Thu, 05/12/2022 - 07:46 by Paul Panichelli expand_less Back To Top Tue, 04/11/2023 - 15:00 As many federal student loan holders exit accommodations made during the pandemic period to suspend student loan payments, they are now faced wit

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content