Gun merchant code approved for card purchases

Payments Dive

SEPTEMBER 10, 2022

An international standards body approved a new merchant code that will apply to gun sellers for transactions using credit card networks like Visa and Mastercard.

Payments Dive

SEPTEMBER 10, 2022

An international standards body approved a new merchant code that will apply to gun sellers for transactions using credit card networks like Visa and Mastercard.

Synapse Payment Systems

SEPTEMBER 12, 2022

When you’re running a small business, every dollar counts. One of the biggest expenses that many companies overlook is their payment processing. Every time you run a customer’s credit card, your payment processing company charges you a small transaction fee. While this charge may seem negligible, it quickly adds up if you’re processing hundreds or thousands of daily transactions.

Faster Payments Council

SEPTEMBER 12, 2022

The Fall Member Meeting will bring together FPC members for two days filled with presentations on the most pressing issues in faster payments, panel discussions with industry experts, roundtables on timely topics, and engaging networking opportunities. This in-person event will take place on September 14-15, 2022 at the Delta Hotels Minneapolis Northeast in Minneapolis, MN.

The Paypers

SEPTEMBER 16, 2022

US-based Ripple , an enterprise blockchain and crypto solutions provider, has partnered with Travelex Bank to introduce crypto-enabled payments in Brazil.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

SEPTEMBER 16, 2022

The Consumer Financial Protection Bureau is weighing new rules and guidance for the fast-growing buy now-pay later industry after wrapping up a comprehensive report on it.

Synapse Payment Systems

SEPTEMBER 12, 2022

Clover is one of the most trusted brands in point-of-sale systems because they are constantly introducing new products geared toward helping merchants grow their business and increase revenue. Businesses are now able to accept recurring payments and automatically charge customers at an agreed-upon interval. This is essentially a “membership” or “subscription,” and enabling this option can result in greater customer retention and less friction at checkout.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Paypers

SEPTEMBER 14, 2022

A multi-country consortium comprising Europe’s most trusted identity experts has announced its proposal to deliver an EU digital wallet pilot.

Payments Dive

SEPTEMBER 16, 2022

The Biden administration wants the Securities and Exchange Commission and the Commodity Futures Trading Commission to “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.

CB Insights

SEPTEMBER 13, 2022

What is mobile POS? Mobile point-of-sale (mPOS) companies are creating software or portable points-of-sale that enable a smartphone or tablet to function as a cash register. Businesses can receive payments instantly by downloading a mobile app that connects a smartphone or tablet to a card reader. Some mPOS systems automatically flag when inventory is low, reducing the manual labor needed for inventory management. download the STATE OF FINTECH Q2 2022 report. hbspt.forms.create({. onFormReady: f

Axway

SEPTEMBER 14, 2022

The following article is an adapted transcript based on the audio recording of Season 3, Episode 5 of the Mr. Open Banking podcast. The audio version is available here.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Paypers

SEPTEMBER 14, 2022

US-based fintech FIS has augmented the way SMBs gain access to embedded payments and finance through software providers with the launch of Worldpay for Platforms.

Payments Dive

SEPTEMBER 13, 2022

The instant payments brand is highlighting a double-digit growth rate for its peer-to-peer payments tool and downplaying scams on its system.

FICO

SEPTEMBER 15, 2022

Home. Blog. FICO. Saudi Credit Bureau Delivers Access To Loans For Millions with Score. SIMAH wins FICO ® Decisions Award for financial inclusion using FICO ® Scores. Saxon Shirley. Fri, 09/09/2022 - 03:42. by Nikhil Behl. expand_less Back To Top. Thu, 09/15/2022 - 06:00. Vision, Advocacy And Education. The Saudi Credit Bureau (SIMAH) , a leader in credit bureau information management in the Middle East and North Africa (MENA), has administered the successful rollout and adoption of the FICO® Sc

The Finance Weekly

SEPTEMBER 14, 2022

What’s their rescue plan? Once the golden child of big-box stores, Bed Bath & Beyond is now struggling to stay afloat. 2020 appeared to be a turning point in Bed Bath & Beyond's turnaround strategy, with the company remodeling its stores, launching private labels, overhauling its C-suite, and selling off underperforming banners. The retailer, like others in the home goods industry, benefited from increased demand at the start of the pandemic as consumers actively sought new products for

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Paypers

SEPTEMBER 14, 2022

Norges Bank officials have announced that Norway’s central bank digital currency (CBDC) prototype is based on Ethereum infrastructure.

Payments Dive

SEPTEMBER 16, 2022

The chief financial officers at American Express and Discover each said this week that pre-pandemic credit metrics for delinquencies and charge-offs won’t soon return.

FICO

SEPTEMBER 13, 2022

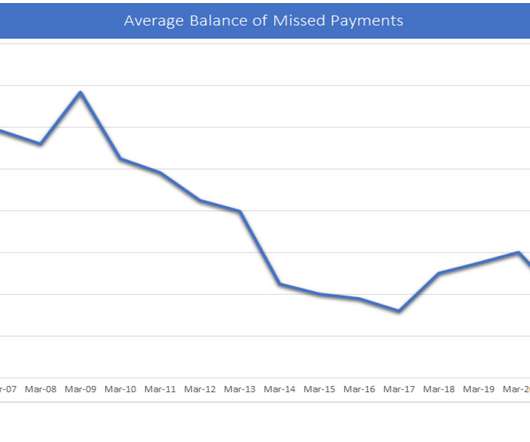

Home. Blog. FICO. UK Credit Card Trends: From 2008 Crash to Cost-of-Living Crisis. Changes in card management, customer behaviour and regulations make card delinquencies and other trends very different from the crash of 2008. Darcy Sullivan. Tue, 11/10/2020 - 12:17. by Liz Ruddick. expand_less Back To Top. Tue, 09/13/2022 - 09:25. As the UK economy transitions from the pandemic to the cost-of-living crisis, is there anything that can be learnt from how the 2008 financial crisis impacted credit c

Axway

SEPTEMBER 15, 2022

In line with our brand-new feature released last week, Griffins at Work , I’m excited to announce Griffin Heroes , an update to our existing Griffin Spotlight feature.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

The Paypers

SEPTEMBER 16, 2022

Financial messaging network SWIFT has announced it is trialling an enterprise blockchain platform to make corporate action workflows more efficient.

Payments Dive

SEPTEMBER 12, 2022

The biggest U.S. bank is buying the payments company as competition in the checkout and card processing ecosystem mounts.

CB Insights

SEPTEMBER 14, 2022

What are omnichannel payments? Omnichannel payments solutions allow businesses to accept payments through multiple channels, including online, mobile, and in-store. These platforms offer data integration across payments, marketing, and sales channels so that customers can shop and transact the same way online and offline, giving businesses a single view into the customer journey.

Center for Payments

SEPTEMBER 15, 2022

By Jennifer Stadler, CPP, CCE SVP, Marketing, Strategy, and Communications, PaymentsFirst The United States is prone to its share of disasters. Depending on where your financial institution is located, wildfires, tsunamis, hurricanes, earthquakes, droughts, floods, landslides, tornadoes, lightning, riots, cybersecurity risks, medical emergencies, and economic crises can create havoc on society.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

SEPTEMBER 12, 2022

The Reserve Bank of India (RBI) has consulted with public sector banks and fintechs such as FIS in order to test out a central bank digital currency.

Payments Dive

SEPTEMBER 16, 2022

The company, which aims to simplify freight shipment payments, plans to use $26 million in new capital and $100 million in debt financing to scale and give customers access to working capital.

CB Insights

SEPTEMBER 13, 2022

The claims experience is the primary way many customers interact with their insurer. While a positive experience can lock in a customer for life, a bad one can lead them to switch insurers. At the same time, the claims process is growing more complex and costly for insurers. Claims evaluation & settlement solutions are helping insurers gain insight into their claims, ultimately enabling them to automatically settle simple claims and shift resources toward more complicated tasks. download the

Payments Dive

SEPTEMBER 13, 2022

The big credit card company forecast an increase in spending by consumers for the yearend U.S. holiday shopping season.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Payments Dive

SEPTEMBER 16, 2022

PayPal SVP of Capital Markets Gabrielle Rabinovitch will step in for her second round as interim CFO as Blake Jorgensen departs for medical leave.

Payments Dive

SEPTEMBER 12, 2022

Card network juggernaut Visa said it will adhere to a new standard for identifying independent gun shops with a unique merchant code after an international body adopted the new approach last week.

Payments Dive

SEPTEMBER 16, 2022

BNPL players under the microscope at the Consumer Financial Protection Bureau pushed back against the federal agency’s plan to increase regulation of the industry.

Payments Dive

SEPTEMBER 14, 2022

CEO Frank Bisignano said expenses related to “synergy work” have tapered off, with benefits becoming visible in the second half of the year.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content