Visa to boost credit card fees next year

Payments Dive

NOVEMBER 25, 2024

The network is expected to increase some fees it charges for credit card payments, according to a notice referenced during a Senate hearing last week.

Payments Dive

NOVEMBER 25, 2024

The network is expected to increase some fees it charges for credit card payments, according to a notice referenced during a Senate hearing last week.

PCI Security Standards

NOVEMBER 26, 2024

The PCI Security Standards Council (PCI SSC) has published version 1.1 of the PCI Mobile Payments on COTS (MPoC) Standard, designed to support the evolution of mobile payment acceptance solutions. PCI MPoC builds on the existing PCI Software-based PIN entry on COTS (SPoC) and PCI Contactless Payments on COTS (CPoC) Standards, addressing security requirements for solutions that enable merchants to accept cardholder PINs or contactless payments using a smartphone or other commercial off-the-shelf

Fintech Finance

NOVEMBER 29, 2024

The European Central Bank (ECB) and Norges Bank signed an agreement for Norway to join the Eurosystem’s TARGET Instant Payment Settlement (TIPS) service. This will make the Norwegian krone the fourth currency available for settlement in TIPS, in addition to the euro, the Swedish krona and the Danish krone, which is scheduled to join in April 2025. The inclusion of the Norwegian krone in TIPS, which is part of the Eurosystem’s TARGET Services, is planned for the first half of 2028 and will enable

Finextra

NOVEMBER 29, 2024

The European Commission has adopted rules for the core functionalities and certification of the European Digital Identity Wallets as 2026 deadline nears.

Speaker: Becky Parisotto

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Payments Dive

NOVEMBER 27, 2024

Consumers’ credit card delinquencies have risen this year, along with their balances, according to an annual Federal Reserve Board report.

Fintech Review

NOVEMBER 27, 2024

Small and medium enterprises (SMEs) are the backbone of emerging economies. In many regions, they create jobs, drive innovation, and stimulate local economies. Yet, they often face financial challenges, struggling to access credit, manage cash flow, and navigate complex financial systems. Fintech solutions are changing this landscape, offering SMEs tailored tools to overcome these barriers.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

NOVEMBER 29, 2024

Norway has struck a deal to add the krone to the Eurosystem’s Target Instant Payment Settlement (Tips) service.

Payments Dive

NOVEMBER 27, 2024

With credit card interest rates at a historic high, consumers are likely to gravitate to lower-cost alternatives, including potentially buy now, pay later options, industry consultants say.

Fintech Finance

NOVEMBER 26, 2024

Tranglo, a leading cross-border payment hub, has expanded its footprint in Africa, now supporting payouts in Ethiopia, Kenya, Liberia, Madagascar, Mali, Senegal, and Zambia. This strategic expansion aims to boost financial inclusion by providing efficient, affordable cross-border payment solutions to one of the world’s fastest-growing economic regions.

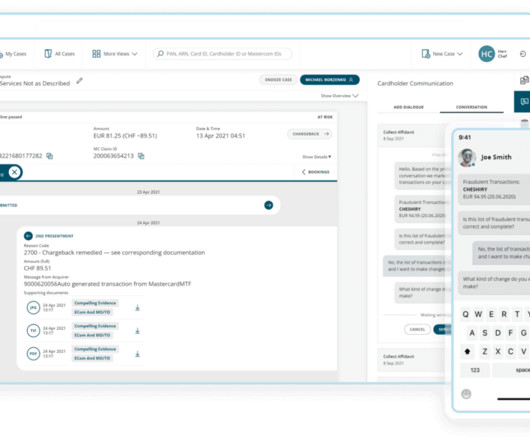

The Payments Association

NOVEMBER 29, 2024

Managing fraud cases has been a top challenge for card issuers, according to recent studies. Rising operations and outsourcing costs and burgeoning fraud recovery caseloads make it especially challenging for issuers to meet chargeback deadlines and avoid cardholder write-offs. Developed years ago, legacy banking systems are ill-equipped to deal with current fraud volumes.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Finextra

NOVEMBER 26, 2024

HSBC has launched a one-stop domestic and cross-border payments platform for businesses looking to grow internationally.

Fintech News

NOVEMBER 27, 2024

Deutsche Bank has joined the extended Series B funding round for blockchain-based fintech firm Partior , bringing the total raised to US$80 million and marking the close of the round. The Series B initially secured US$60 million in July 2024, led by Peak XV Partners, with participation from J.P. Morgan, Jump Trading Group, Standard Chartered, Temasek, and Valor Capital Group.

Fintech Finance

NOVEMBER 28, 2024

Serenity , a tech and blockchain solution provider, and IDEMIA Secure Transactions (IST), a global leader in payment and connectivity solutions, announced the launch of sAxess , a biometric security card to improve data access control, security, and recovery. The partnership with IDEMIA Secure Transactions brings its extensive connections and expertise in payment and connectivity solutions, with 1,900 financial institutions and FinTechs clients worldwide, together with Serenity’s knowledge in bl

The Payments Association

NOVEMBER 28, 2024

KPMG are launching our second annual Payments Modernisation report, based on a global survey of 1,500 senior leaders across financial institutions and retailers covering Europe, APAC, North America and the Middle East, and we have found the pace of transformation is not slowing down, and not restricted to banks. Our first payment modernisation report in 2023 found financial institutions in the UK were embarking on significant payments modernisation initiatives, with expected benefits as well as

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

NOVEMBER 28, 2024

Hackers have breached the Central Bank of Uganda's firewalls and stolen $17 million from Treasury accounts.

Fintech News

NOVEMBER 27, 2024

Maybank Singapore has introduced a new feature in its myimpact SME programme , SMEs to calculate carbon emissions and report core environmental, social, and governance (ESG) metrics. The initiative, which leverages ESGpedia ’s online enabler tool, is designed to help SMEs navigate sustainability reporting requirements and gain a competitive edge in securing sustainable financing and business opportunities.

Fintech Finance

NOVEMBER 27, 2024

Worldpay ® has launched a first-of-its-kind service that delivers near instant refunds, depending on the receiving financial institution. This helps to close the gap between consumer expectations and merchant capabilities. The faster refund capability is available to the vast majority of UK shoppers using Mastercard and Visa cards when making purchases at participating retailers, including HMV.

The Payments Association

NOVEMBER 28, 2024

The payments ecosystem in the UK and EU is in constant flux, driven by regulatory guidance and technological advances. In the UK, consumers and businesses make around 1,500 transactions every second. The government aims to simultaneously boost the economy and drive innovation in payments, via the National Payments Vision and Strategy, which has been shaped by views and inputs of over 100 financial institutions.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Finextra

NOVEMBER 28, 2024

Australia's Commonwealth Bank says early implementation of GenAI is helping it to substantially reduce fraud rates.

Segpay

NOVEMBER 26, 2024

In today’s digital world, online ID verification has become a crucial component of customer onboarding. As we move our personal, financial, and governmental interactions to digital platforms, the need for reliable and efficient digital identity verification processes has become critical. Whether we are setting up a new bank account, making a purchase online, or accessing government services, confirming who we are in the virtual space is crucial to ensuring our security, the protection of o

Fintech Finance

NOVEMBER 26, 2024

Mollie , one of Europe’s fastest-growing financial service providers has announced a strategic partnership with PayPal , which will deliver best-in-class payment solutions for marketplace platforms across Europe. This partnership marks a significant milestone as PayPal remains one of the preferred payment options for Mollie’s customers, offering seamless payment flows, improved shopping experiences and business growth for marketplaces.

The Payments Association

NOVEMBER 28, 2024

Aryze is proud to introduce eGOLD, a revolutionary digital token fully backed by physical gold. The collaboration between Aryze and BCIFGold , a renowned leader in precious metals, represents a significant leap toward making gold investment more accessible, secure, and efficient for everyone. Unlock the potential of your assets with Aryze Aryze empowers businesses to create their own stablecoins backed by real-world assets.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Finextra

NOVEMBER 25, 2024

Just five months after BBVA distributed 3,000 ChatGPT Enterprise licenses among its employees, 83 percent have incorporated it into their work routine and have created nearly 3,000 adaptations of the tool for specific tasks, ranging from financial data analysis to help to solve legal questions from clients in less than 24 hours or provide customer insights.

Basis Theory

NOVEMBER 26, 2024

The Merchant Risk Council hosted a webinar that Basis Theory CEO Colin Luce presented at. We recap what Colin calls payments 3.0 for merchants.

Fintech Finance

NOVEMBER 29, 2024

MontyPay has been awarded the “Payment Innovation of the Year” accolade at the eCommerce Expo 2024, held in London. MontyPay has been contributing to the payment landscape with cutting-edge solutions that meet the ever-evolving needs of global businesses, which culminated in this prestigious recognition. The eCommerce Awards celebrate excellence and innovation in the online retail space.

Payments Dive

NOVEMBER 25, 2024

U.S. fraud losses due to push payment scams are rising, partly because of more real-time payments, according to a report from the payments company ACI Worldwide.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Finextra

NOVEMBER 26, 2024

As fraudsters gear up to take advantage of the Christmas period, NatWest has launched an advent calendar designed to educate Brits on the threat of common purchase scams.

Fintech News

NOVEMBER 25, 2024

Singapore Gulf Bank is reportedly planning to acquire a stablecoin payments provider and is seeking investments to fund this move, Bloomberg reports. Sources indicate the Bahrain-licensed bank is aiming to secure at least US$50 million by selling a minority stake, likely below 10%, to a Middle Eastern sovereign wealth fund and other investors. This equity raise, expected to be finalised in early 2025, will primarily support the bank’s expansion efforts.

Fintech Finance

NOVEMBER 25, 2024

Leading global digital payments company, Checkout.com , today announced its expansion into Japan supported by new direct acquiring capabilities. This strategic move reflects Checkout.com’s continued commitment to delivering high-performance, localized payment solutions across APAC, designed to meet the evolving needs of both domestic and global merchants.

The Payments Association

NOVEMBER 25, 2024

De-risking endangers financial inclusion, driving MSBs out and boosting unregulated markets, calling for urgent reform. As professionals deeply embedded in the payments industry, we are acutely aware of the delicate balance between risk management and financial inclusion. However, a pressing issue demands our collective attention: the de-risking practices that are inadvertently crippling legitimate money service businesses (MSBs) and empowering black-market alternatives.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Let's personalize your content