Visa to boost credit card fees next year

Payments Dive

NOVEMBER 25, 2024

The network is expected to increase some fees it charges for credit card payments, according to a notice referenced during a Senate hearing last week.

Payments Dive

NOVEMBER 25, 2024

The network is expected to increase some fees it charges for credit card payments, according to a notice referenced during a Senate hearing last week.

Fintech Finance

NOVEMBER 29, 2024

The European Central Bank (ECB) and Norges Bank signed an agreement for Norway to join the Eurosystem’s TARGET Instant Payment Settlement (TIPS) service. This will make the Norwegian krone the fourth currency available for settlement in TIPS, in addition to the euro, the Swedish krona and the Danish krone, which is scheduled to join in April 2025. The inclusion of the Norwegian krone in TIPS, which is part of the Eurosystem’s TARGET Services, is planned for the first half of 2028 and will enable

Finextra

NOVEMBER 28, 2024

The fallout from the collapse of Synapse continues, with several partner banks facing a lawsuit alleging mishandling of customer funds, and one of those banks insisting that end user funds it once held were moved by the BaaS platform before it went bankrupt.

Finezza

NOVEMBER 29, 2024

The growing demand for credit access among retail consumers and businesses has led to the accelerated growth of alternative lending in India. The key factors driving growth include limited credit access within traditional banking, fintech innovation, and widespread smartphone penetration. The market size of this category is expected to grow from $7.53 billion in 2023 […] The post The Paradox of Alternative Lending: How It Can Both Simplify and Complicate the Lending Process appeared first

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

NOVEMBER 27, 2024

With credit card interest rates at a historic high, consumers are likely to gravitate to lower-cost alternatives, including potentially buy now, pay later options, industry consultants say.

Fintech Finance

NOVEMBER 28, 2024

Serenity , a tech and blockchain solution provider, and IDEMIA Secure Transactions (IST), a global leader in payment and connectivity solutions, announced the launch of sAxess , a biometric security card to improve data access control, security, and recovery. The partnership with IDEMIA Secure Transactions brings its extensive connections and expertise in payment and connectivity solutions, with 1,900 financial institutions and FinTechs clients worldwide, together with Serenity’s knowledge in bl

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

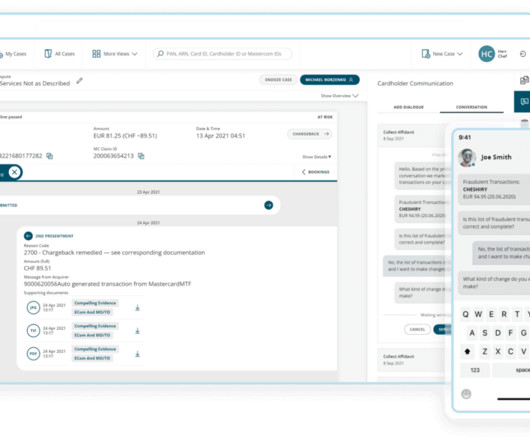

The Payments Association

NOVEMBER 29, 2024

Managing fraud cases has been a top challenge for card issuers, according to recent studies. Rising operations and outsourcing costs and burgeoning fraud recovery caseloads make it especially challenging for issuers to meet chargeback deadlines and avoid cardholder write-offs. Developed years ago, legacy banking systems are ill-equipped to deal with current fraud volumes.

Payments Dive

NOVEMBER 27, 2024

Consumers’ credit card delinquencies have risen this year, along with their balances, according to an annual Federal Reserve Board report.

Finovate

NOVEMBER 26, 2024

Agentic AI solutions provider for community banks and credit unions, interface.ai , has introduced a pair of new tools to help fight deepfake fraud. The company has launched two flagship products — device biometric authentication and Generative AI (GenAI) bot training — designed to help financial institutions defend themselves and their customers from fraud and unauthorized access. interface.ai’s device biometrics solution uses device-based fingerprint and facial recognition te

Bank Automation

NOVEMBER 26, 2024

Citi Wealth tapped Eric Lordi as head of platform and experience this month and he assumes the new role on Jan. 29, a Citi spokesperson told Bank Automation News. He will be responsible for the digital experience for Citi Wealth clients, advisers and bankers, the spokesperson said. Lordi replaces Julia Carreon who left […] The post Movers and Shakers: Citi Wealth names Eric Lordi head of platform and experience appeared first on Bank Automation News.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Fintech News

NOVEMBER 27, 2024

Indonesian peer-to-peer (P2P) lending platform Amartha has completed the acquisition of PT Bosowa Multi Finance, a leasing company previously part of the Bosowa Group conglomerate, according to DealStreetAsia. The deal was carried out through PT Amartha Nusantara Raya (ANR), the holding company that oversees Amartha’s operations, including its P2P lending platform and credit scoring unit, Ascore.

The Fintech Times

NOVEMBER 27, 2024

The Financial Conduct Authority (FCA) has unveiled a roadmap outlining key dates for the development of its ‘crypto regime’, as it aims to introduce a clear regulatory framework for the UK’s crypto industry. As of August 2024, around 12 per cent of UK adults own some sort of crypto asset – equivalent to around seven million people – while around 93 per cent have at least heard of them, according to new FCA research revealed on Tuesday.

TechCrunch Fintech

NOVEMBER 24, 2024

Heading into 2024, Mike Packer, a partner at fintech-focused QED Investors, predicted we’d hit the bottom for funding to Latin American fintech startups during the year. While momentum wasn’t a straight shot up and to the right, Packer’s prediction may still have come true. The volume of venture capital dollars invested into fintech companies based […] © 2024 TechCrunch.

Bank Automation

NOVEMBER 25, 2024

Ten years in the making, the Consumer Financial Protection Bureau’s recently finalized open banking rule is making waves. The rule, Section 1033, was finalized Oct. 22 and states that consumers can transfer their financial data to another financial institution (FI) provider at no cost, using the framework for secure payments and comparing financial services at […] The post Open banking: Decoding Section 1033 appeared first on Bank Automation News.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Fintech Review

NOVEMBER 27, 2024

Small and medium enterprises (SMEs) are the backbone of emerging economies. In many regions, they create jobs, drive innovation, and stimulate local economies. Yet, they often face financial challenges, struggling to access credit, manage cash flow, and navigate complex financial systems. Fintech solutions are changing this landscape, offering SMEs tailored tools to overcome these barriers.

Fintech News

NOVEMBER 27, 2024

DBS and Japan Finance Corporation (JFC), a government-owned financial institution, have signed a MoU to help Japanese SMEs expand into Asia. This first-of-its-kind partnership allows SMEs to access six key markets—China, Hong Kong, India, Indonesia, Singapore, and Taiwan—through a single banking partner. The collaboration leverages DBS ’ regional expertise and services, including digital cross-border payments, trade financing, and connections to professional service providers offering legal, acc

The Fintech Times

NOVEMBER 25, 2024

The latest MENA Web3 hackathon, Web3 Unleashed hosted by cryptocurrency exchange, Bybit in partnership with DMCC (Dubai Multi Commodities Centre) Crypto Centre , has concluded, celebrating the transformative power of blockchain technology. Blockchain technology can be used across various industries and looking to prove just this, 15 project teams presented their ideas to a panel of Web3 experts and prominent figures from the crypto industry.

Finextra

NOVEMBER 26, 2024

Tranglo, a leading cross-border payment hub, has expanded its footprint in Africa, now supporting payouts in Ethiopia, Kenya, Liberia, Madagascar, Mali, Senegal, and Zambia.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Fintech Finance

NOVEMBER 26, 2024

Mollie , one of Europe’s fastest-growing financial service providers has announced a strategic partnership with PayPal , which will deliver best-in-class payment solutions for marketplace platforms across Europe. This partnership marks a significant milestone as PayPal remains one of the preferred payment options for Mollie’s customers, offering seamless payment flows, improved shopping experiences and business growth for marketplaces.

Fintech News

NOVEMBER 25, 2024

HSBC has announced a series of senior management changes, effective 1 January 2025, including the departure of its Group Chief Sustainability Officer, Celine Herweijer. Celine Herweijer According to a Reuters report , Herweijer’s exit follows a recent reshuffle that removed her role from the bank’s executive committee, sparking concerns among investors about HSBC’s climate priorities.

The Fintech Times

NOVEMBER 26, 2024

Financial advice can be a sensitive topic – those giving it don’t want to mislead customers, while customers are wary about the level of trust they can place in their advisers. Nonetheless, done correctly, investing can be a very beneficial way for someone to use their funds. This November we are exploring all the aspects of wealthtech and how the industry has developed this year.

Finextra

NOVEMBER 26, 2024

HSBC has launched a one-stop domestic and cross-border payments platform for businesses looking to grow internationally.

Speaker: David Nisbet, Everett Zufelt, and Michaela Weber

Once upon a time, in the vast realm of online commerce, there lived a humble checkout button overlooked by many. Yet, within its humble click lay the power to transform a mere visitor into a loyal customer. 🧐 💡 Getting checkout right can mark the difference between a successful sale and an abandoned cart, yet many businesses fail to make payments a part of their commerce strategy even when it has a direct impact on revenue.

Fintech Finance

NOVEMBER 27, 2024

With this year’s Black Friday falling on 29th November and Cyber Monday on 2nd December, aka “Cyber Weekend”, retailers across the UK are gearing up for the year’s biggest spending event in the run-up to the Christmas holiday season. Last year’s Black Friday achieved record sales of £13.3 billion, up 7.6% from 2022. Lloyds Bank Merchant Services, the bank’s card payments processing and acceptance unit, is encouraging retail merchants to ensure that their payment platforms are ready to capitalise

Fintech News

NOVEMBER 27, 2024

Global verification provider Sumsub has partnered Elliptic, a cryptoasset risk management firm, to bolster its crypto transaction monitoring and Travel Rule solutions. This collaboration integrates Elliptic’s blockchain analytics into Sumsub’s platform, providing clients with enhanced tools to screen cryptocurrency wallets, identify fraudulent activity, and assess risk in transactions.

The Fintech Times

NOVEMBER 29, 2024

Financial advice can be a sensitive topic – those giving it don’t want to mislead customers, while customers are wary about the level of trust they can place in their advisers. Nonetheless, done correctly, investing can be a very beneficial way for someone to use their funds. This November we are exploring all the aspects of wealthtech and how the industry has developed this year.

Finextra

NOVEMBER 28, 2024

Australia's Commonwealth Bank says early implementation of GenAI is helping it to substantially reduce fraud rates.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Fintech Finance

NOVEMBER 27, 2024

Worldpay ® has launched a first-of-its-kind service that delivers near instant refunds, depending on the receiving financial institution. This helps to close the gap between consumer expectations and merchant capabilities. The faster refund capability is available to the vast majority of UK shoppers using Mastercard and Visa cards when making purchases at participating retailers, including HMV.

Fintech News

NOVEMBER 26, 2024

Singapore Management University ( SMU ) and DBS have partnered to launch the “Sustainable Finance in Action” course. This new programme designed to equip senior executives with the knowledge and skills needed to navigate the complexities of sustainable finance. The four-day intensive course, running from 25-28 November 2024, will cover key areas such as green, transition, blended, and biodiversity financing, utilising a combination of academic and applied learning methods.

Payments Dive

NOVEMBER 25, 2024

U.S. fraud losses due to push payment scams are rising, partly because of more real-time payments, according to a report from the payments company ACI Worldwide.

Finextra

NOVEMBER 29, 2024

Norway has struck a deal to add the krone to the Eurosystem’s Target Instant Payment Settlement (Tips) service.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content