Square CEO to depart

Payments Dive

SEPTEMBER 18, 2023

Alyssa Henry, CEO of Block’s merchant business Square, will leave the company just days after a service outage left merchant clients unable to process payments.

Payments Dive

SEPTEMBER 18, 2023

Alyssa Henry, CEO of Block’s merchant business Square, will leave the company just days after a service outage left merchant clients unable to process payments.

Open Banking Excellence

SEPTEMBER 21, 2023

The EU’s Digital Operational Resilience Act comes into force in just two years. Cybersecurity experts Duncan McDonald, Global Head of Compliance Services & Wayne Scott, Regulatory Compliance Lead, from The NCC Group explain how to prepare for DORA compliance and why the new legislation will enhance cyber resilience across the financial sector and its supply chain.

PCI Security Standards

SEPTEMBER 20, 2023

Do not pass up the chance to collaborate and gain knowledge on the latest developments in payment security at the upcoming PCI SSC Community Meetings. These events feature presentations from some of the sharpest minds in payment security. Below Ian Robinson , Chief Architect, Titania provides a preview of his presentation on Continuously Viewing and Managing PCI DSS Compliance Through An Attacker’s Lens.

Payments Next

SEPTEMBER 18, 2023

By Dave Glaser, CEO, Dwolla By now, when business leaders hear about digital transformation, they should think, “Been there, done that.” However, The post Why prioritizing faster payments is crucial for your digital transformation checklist first appeared on Payments NEXT.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

SEPTEMBER 17, 2023

Small business owners envision a cashless future, according to card giant Visa, even as some legislators move to protect unbanked and underbanked consumers.

The Paypers

SEPTEMBER 19, 2023

A group of banks such as JP Morgan and Bank of America have revealed their plans to launch a mobile wallet named Paze in a bid to compete with Big Tech companies.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Nanonets

SEPTEMBER 22, 2023

E-tendering is a powerful solution that can transform your business by streamlining procurement processes and driving efficiency. In today's fast-paced and dynamic business environment, the use of technology, such as e- procurement systems, has revolutionized procurement practices. By automating tasks and improving accuracy, e-tendering unlocks new levels of efficiency and cost savings.

Payments Dive

SEPTEMBER 21, 2023

The state’s lawmakers approved a bill that would ban the use of plastic for gift cards by 2027, but it’s still waiting on the governor’s signature.

The Paypers

SEPTEMBER 20, 2023

Sweden-based Froda has announced its partnership with Visa and Checkout.com in order to enable Visa Direct for embedded business loans payouts.

Axway

SEPTEMBER 19, 2023

France’s AIFE (Agence pour l’Informatique Financiere de l’Etat — Agency for State Financial IT) leverages Axway’s Amplify Platform to enable thousands of users across the country to publish and consume APIs. Here’s a look at how they do it.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Nanonets

SEPTEMBER 22, 2023

In today's competitive business landscape, optimizing operations and effectively managing relationships with external vendors are key priorities for any organization. Vendor management solutions play a crucial role in achieving these objectives by streamlining processes and ensuring seamless collaboration with third-party vendors. Vendor management solutions offer a range of benefits, including centralized documentation, access control, performance tracking, and comp

Payments Dive

SEPTEMBER 18, 2023

The proposed digital dollar would create an electronic version of the U.S. currency, but it wouldn’t be the same as a central bank digital currency.

The Paypers

SEPTEMBER 18, 2023

Taiwan’s Crypto Association has engaged with El Salvador for guidance in establishing stronger crypto regulations.

Axway

SEPTEMBER 20, 2023

Value-added networks (VANs) grew fast amid the rise of electronic data interchange (EDI). At first, these networks came with significant costs. Years later, more cost-effective internet protocols emerged as an alternative.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Inai

SEPTEMBER 22, 2023

As businesses try to reach customers across the globe, understanding local payment preferences becomes essential for success. This understanding is even more crucial in Canada, a country known for its solid digital economy.

Payments Dive

SEPTEMBER 20, 2023

Fiserv, Shift4 and rival payments players are vying aggressively for a bigger share of the market catering to pro teams, stadiums and other venues.

The Paypers

SEPTEMBER 20, 2023

UK-based biometric authentication tech provider iProov has announced a new integration with Ping Identity ’s Ping One DaVinci system.

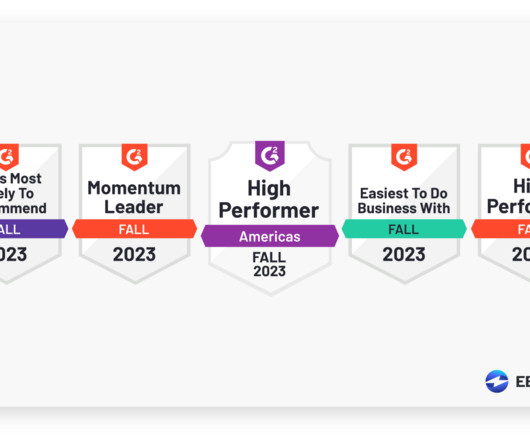

EBizCharge

SEPTEMBER 22, 2023

EBizCharge is recognized as a High Performer, Momentum Leader, Easiest to Do Business With, Users Most Likely to Recommend, and more in the Fall 2023 G2 report, ranking competitively among top payment gateways and payment processors in the industry. EBizCharge is a leading all-in-one payment platform that offers a payment gateway, merchant services, and over 100 payment integrations.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Nanonets

SEPTEMBER 22, 2023

Sales orders and invoices are essential documents in business transactions, but they serve different purposes and play distinct roles in the sales process. A sales order is filled out by the customer to initiate a sale, specifying the goods or services they wish to purchase. On the other hand, an invoice is sent by the business to request payment from the customer after the products or services have been delivered.

Payments Dive

SEPTEMBER 19, 2023

The state is instituting new lending regulations that are likely to apply to some earned wage access providers starting next month.

BitPay

SEPTEMBER 21, 2023

Every four years, the oncoming supply of new Bitcoin rewarded to miners gets reduced by 50%. This event has come to be known as “the halving.” Historically, this four-year Bitcoin halving cycle has shown a strong relationship to the asset’s legendary booms and busts. Because the halving event increases the scarcity of Bitcoin, prices tend to rise during the year of the halving, with the sharpest increases coming in the following year, during which time the price tends to reach record highs.

Nomentia

SEPTEMBER 20, 2023

We are delighted to share a significant milestone in Nomentia’s journey – all Nomentia solutions are now seamlessly accessible from a unified platform. Since the merger of Nomentia and TIPCO in the fall of 2021, the company has continuously expanded its offerings, empowering treasury and finance professionals to excel in their roles.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Nanonets

SEPTEMBER 22, 2023

Accounts payable and accounts receivable play a crucial role in a company's financial health and should be managed effectively for optimal cash flow and accurate balance sheet reporting. Accounts payable (AP) refers to the money a company owes to vendors and suppliers for goods or services purchased on credit.

Payments Dive

SEPTEMBER 18, 2023

FedNow is driving adoption of instant payments— here’s what financial institutions need to know.

Global Fintech & Digital Assets

SEPTEMBER 21, 2023

In its second action involving NFTs, the SEC targets an offering tied to fundraising and promises of future value. By Ghaith Mahmood , Nima H. Mohebbi , Stephen P. Wink , Douglas K. Yatter , Adam Zuckerman , Luca Marquard , and Deric Behar On September 13, 2023, the Securities and Exchange Commission (SEC) issued a cease-and-desist order (the Order) against Stoner Cats 2, LLC (SC2) for an alleged unregistered securities offering relating to SC2’s sale of $8.2 million worth of non-fungible tokens

Inai

SEPTEMBER 20, 2023

South Africa's journey mirrors the global trend toward digitization. The country is not just following the digital revolution – it's actively shaping it to fit its unique needs and circumstances. And the result is a vibrant and diverse digital payment ecosystem that offers something for everyone.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Nanonets

SEPTEMBER 22, 2023

Accounts receivable is a crucial aspect of financial management for businesses, and understanding how to effectively manage it is essential for maintaining a healthy cash flow and business growth. Accounts receivable (AR) refers to the money that a company will receive from customers for purchasing products or services on credit. It is considered an asset on a company's balance sheet.

Payments Dive

SEPTEMBER 22, 2023

How many companies does it take to process a credit card payment?

Seon

SEPTEMBER 20, 2023

The core pain point of KYC onboarding is friction. No customer wants to encounter it when they sign up with an organization. Nor is it just applicants who can be inconvenienced by onboarding. According to McKinsey, banks use up to 40% of their onboarding time on KYC and due diligence processes. This time and labor can strain organizations’ ability to welcome new customers.

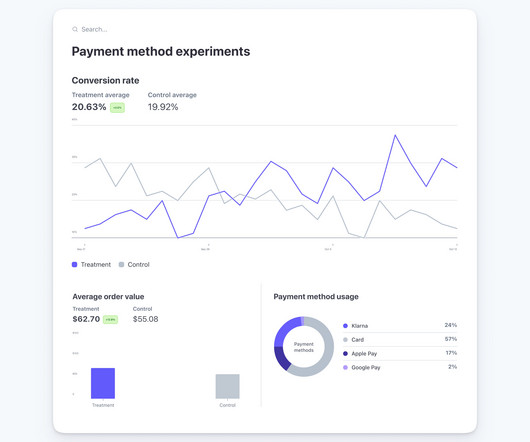

Stripe

SEPTEMBER 19, 2023

Businesses spend vast resources attracting customers, only to lose sales at the very last stage of the customer journey—the checkout. This week we’re releasing new features to our optimized checkout suite to help businesses change that.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content