Feds crack down on improper payments

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

Payments Dive

JULY 20, 2022

A federal government report released this week takes aim at the problem of fraudulent public benefit payments, which mushroomed to $281 billion for fiscal year 2021.

FICO

JULY 21, 2022

Home. Blog. FICO. Continuous Financial Education for Women Small Business Owners. FICO-hosted panel at NAWBO’s 2022 Advocacy Days discusses how financial education impacts access to capital and business growth for small businesses. FICO. Tue, 02/18/2020 - 14:57. by Joanne Gaskin. expand_less Back To Top. Thu, 07/21/2022 - 15:30. In June, I had the pleasure of participating in a panel discussing credit access and financial education for women small business owners at the National Association of W

The Finance Weekly

JULY 19, 2022

FP&A software assists CFOs, finance leaders, and FP&A experts in ensuring the financial health of their organization by tracking and analyzing current outcomes and forecasting future performance. These cutting-edge tools aid teams in streamlining, automating, and improving the accuracy and efficacy of tactical and strategic initiatives. With providers of all shapes and sizes offering FP&A software, selecting the right platform for your specific needs can be difficult.

CB Insights

JULY 19, 2022

Global fintech funding fell 33% quarter-over-quarter (QoQ) to hit $20.4B — its lowest level since Q4’20. Deals also hit a 6-quarter low, dropping 17% QoQ to reach 1,225. In line with this trend, $100M+ mega-rounds also accounted for a smaller percentage of total deals (4%) and funding (47%) than they did at any quarterly point last year. Below, check out a handful of highlights from our 197-page, data-driven State of Fintech Q2’22 Report.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

JULY 20, 2022

“Challengers frequently believe BNPL 1.0 is what it is, and will not evolve,” writes Brian Shniderman, CEO of Opy, a U.S. subsidiary of Australian payments fintech Openpay. “But it can, and very recently, it has proven that it will.

The Paypers

JULY 21, 2022

GoCardless , a provider of direct bank payments, has partnered with Xero , a small business platform, to provide its Instant Bank Pay feature to Xero’s customers in the UK.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

FICO

JULY 19, 2022

Home. Blog. FICO. Wolf, Goat and Cabbage: The Digital Customer Experience Riddle. Disjointed digital customer experiences are causing banking and insurance customers to flee in record numbers. FICO. Tue, 07/02/2019 - 02:45. by Jim Neumann. expand_less Back To Top. Tue, 07/19/2022 - 14:55. Building compelling, digital customer experiences that are validated by analytics is the key to successful digital transformation strategies… and a vexing challenge for banks and insurance companies facing ever

Payments Dive

JULY 18, 2022

The company has more than doubled its headcount over the past year to meet demand for its payments software from clients like Marqeta and Gusto. Now, it plans more expansion for real-time services.

The Paypers

JULY 20, 2022

Crypto.com has received registration and regulatory approval from the Organismo Agenti e Mediatori (OAM) in Italy as a provider of virtual currency and digital wallet services.

Axway

JULY 21, 2022

On Transform It Forward , we’re often discussing emerging new technologies, exciting innovations, and the digital revolution. But no matter how advanced our technology becomes, there will always be a fundamental human need for powerful storytelling.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

FICO

JULY 18, 2022

Home. Blog. FICO. FICO Fact: Can unconstrained AI/ML expand access to credit? FICO has been a pioneer in the use of machine learning (ML) in the financial services industry for over 25 years. FICO. Tue, 07/02/2019 - 02:45. by Can Arkali. expand_less Back To Top. Mon, 07/18/2022 - 18:40. FICO leverages machine learning (ML) in solutions ranging from fraud detection to marketing.

Payments Dive

JULY 19, 2022

Following its second acquisition as a public company, Boston-based Flywire will continue to look for purchase opportunities that expand the payments company’s reach globally, said CEO Mike Massaro.

The Paypers

JULY 21, 2022

Ondato , a Lithuania-based technology company that streamlines Know Your Customer (KYC) and anti-money laundering (AML) processes, has launched Ondato Risk Scoring.

Axway

JULY 18, 2022

The following article is an adapted transcript based on the audio recording of Season 3, Episode 2 of the Mr. Open Banking podcast. The audio version is available here.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

CB Insights

JULY 22, 2022

What are payment APIs & infrastructure? Payment APIs & infrastructure companies enable businesses to seamlessly manage payments. APIs provide direct connections to payment infrastructure, allowing for faster, more secure, and lower cost transaction processing. download the state of fintech Q2 2022 report. First name. Last name. Email. Company name.

Payments Dive

JULY 18, 2022

An experienced commerce partner can help provide the technology needed to help merchants keep up.

The Paypers

JULY 20, 2022

The central banks of Indonesia, Malaysia, the Philippines, Singapore, and Thailand have partnered to develop an interoperable cross-border payments system.

Axway

JULY 20, 2022

An important part of API management revolves around analytics. When building an API platform, it is essential to have in place a dashboard to measure API performance.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

CB Insights

JULY 22, 2022

What are underwriting data platforms? Underwriting data platforms collect third-party alternative datasets, such as social media, public records, and demographic information. Insurers can tap into these data sources to augment their own internal datasets — with the goal of improving and expediting underwriting decisions. download the state of fintech Q2 2022 report.

Payments Dive

JULY 22, 2022

The spending behaviors of American Express customers don’t suggest an economic downturn is imminent, CEO Steve Squeri asserted during Friday’s second quarter earnings call.

The Paypers

JULY 19, 2022

Global retail bank, payments, and shopping service Klarna has announced the opening of its first US-based retail pop-up store, Klarna Oasis.

Axway

JULY 19, 2022

Companies all over the globe are accelerating their moves to adopt digital transformation and cloud technologies.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

CB Insights

JULY 18, 2022

As fraud and cyber threats become more prevalent and sophisticated, retail banks’ mandate to protect their customers, comply with regulatory mandates, and assess risk across their entire organization has become more important than ever. In response to heightened threats and the costs associated with them, banks are prioritizing technology solutions that make fraud prevention, identity verification, and risk management more effective. get the state of fintech q2 2022 report before anyone el

Payments Dive

JULY 22, 2022

The digital payments pioneer is distributing shares of its beat-up stock to hundreds of new workers in a bid to hang onto employees after cutting others earlier this year. A spokesperson said the distribution was a “normal course” of action.

The Paypers

JULY 18, 2022

The central banks of five Southeast Asian countries have agreed to link their payment systems by November 2022 to provide seamless transactions for travellers within the region.

Fintech Labs Insights

JULY 20, 2022

Small business owners often have a love/hate relationship with their banks and financial providers. When I looked for data to support that claim, I was surprised to see the JD Powers research that concluded small businesses were pretty happy with their banks last year. But remember, banks were facilitating a bunch of money giveaways in the form of government-backed PPP grants during 2020/2021.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Payments Dive

JULY 21, 2022

As Resolve’s customers manage cash closely and navigate supply chain snags, CEO Chris Tsai expects the company’s BNPL model for B2B will stand out in a challenging economic environment.

Payments Dive

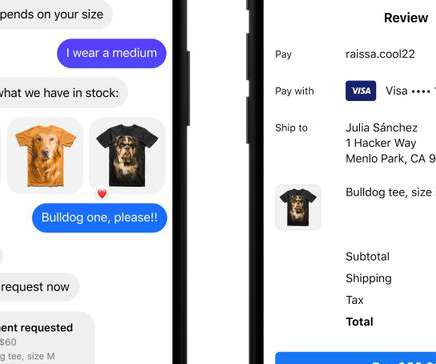

JULY 18, 2022

Meta-owned Instagram will allow users to make purchases from small businesses directly within messages sent in the app.

Payments Dive

JULY 21, 2022

Discover Financial Services CEO Roger Hochschild said executives at the company “hope” an internal investigation of its student loan practices concludes this year, as he side-stepped analyst queries on the subject.

Payments Dive

JULY 19, 2022

Demand for ClassWallet’s education digital payments tools increased during the coronavirus pandemic, and that rise has continued this year in the company’s signing of new state contracts.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content