Payments buyout burst in August signals more M&A

Payments Dive

AUGUST 9, 2022

A burst of acquisitions in the payments industry this month portend a jump in deal-making for the remainder of the year.

Payments Dive

AUGUST 9, 2022

A burst of acquisitions in the payments industry this month portend a jump in deal-making for the remainder of the year.

FICO

AUGUST 8, 2022

Home. Blog. FICO. Where Are We Now? 2022 Data Science and AI Predictions Revisited. Within my AI predictions for the year, interpretable machine learning (ML) models have surprised me by garnering greater awareness from data science leaders. Saxon Shirley. Thu, 05/12/2022 - 07:46. by Scott Zoldi. expand_less Back To Top. Mon, 08/08/2022 - 15:30. One of my favorite things to think about is my annual data science and artificial intelligence (AI) predictions blog.

The Paypers

AUGUST 11, 2022

UK-based cross-border payments platform Currencycloud has teamed with regtech Clausematch to implement its policy management solution.

Axway

AUGUST 12, 2022

The following article is an adapted transcript based on the audio recording of Season 3, Episode 4 of the Mr. Open Banking podcast. The audio version is available here.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

AUGUST 11, 2022

The restaurant software management company placed its digital tools at another 6,000 locations in the second quarter, for the biggest quarterly jump in that figure.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

The Paypers

AUGUST 9, 2022

US-based decentralized video delivery network Theta Network has partnered with Samsung and other South Korean retailers in order to provide NFT holders more utilities in retail stores.

Axway

AUGUST 10, 2022

Managed File Transfer has evolved significantly since its early days decades ago: modern MFT solutions offer features such as workflows automation, high availability, analytics, and audit capabilities for compliance, as well as advanced security protocols and encryption.

Payments Dive

AUGUST 10, 2022

Higher interest rates may make it more expensive for buy now-pay later providers to offer financing while inflation may put off lower-income consumers.

National Merchants Association

AUGUST 10, 2022

Businesses require merchant accounts to process credit and debit card transactions. There are several types of merchant accounts—some are considered low-risk while others are high-risk. For example, a bank or credit card processing service provider might consider a business high-risk due to increased regulations or potential monetary loss. Contrary to how it sounds, “high-risk” isn’t necessarily bad.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

The Paypers

AUGUST 8, 2022

Five Turkish banks have adopted Russia’s Mir payments system, Turkey’s President Recep Tayyip Erdogan said after talks with President Vladimir Putin.

FICO

AUGUST 10, 2022

Home. Blog. FICO. Covid to Cost-of-Living: Assessing Affordability in Uncertain Times. The removal of the mortgage market affordability test in the UK could pose challenges at a time when affordability is an important lending issue. FICO. Tue, 07/02/2019 - 02:45. by Matt Cox. expand_less Back To Top. Wed, 08/10/2022 - 11:55. As the pandemic finally starts to abate and related restrictions, as well as support, eases around the globe, we’ve moved swiftly into a global cost-of-living crisis.

Payments Dive

AUGUST 11, 2022

Green Dot disclosed in its recent quarterly report that it’s in a dispute with ride-share company Uber over their agreements. It also noted its failure to renew contracts with several other customers.

National Merchants Association

AUGUST 10, 2022

Businesses require merchant accounts to process credit and debit card transactions. There are several types of merchant accounts—some are considered low-risk while others are high-risk. For example, a bank or credit card processing service provider might consider a business high-risk due to increased regulations or potential monetary loss. Contrary to how it sounds, “high-risk” isn’t necessarily bad.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Paypers

AUGUST 11, 2022

Digital wallet DANA has raised USD 250 million from local conglomerate Sinar Mas and Alibaba.com-owned Lazada Group to expand in Indonesia.

Axway

AUGUST 9, 2022

In a prior blog post we looked at using Stoplight with API Builder and described some tips.

Payments Dive

AUGUST 10, 2022

Jack Henry management expects the Payrailz purchase to help its bank, credit union and other financial institution clients modernize their payments services.

National Merchants Association

AUGUST 10, 2022

Businesses require merchant accounts to process credit and debit card transactions. There are several types of merchant accounts—some are considered low-risk while others are high-risk. For example, a bank or credit card processing service provider might consider a business high-risk due to increased regulations or potential monetary loss. Contrary to how it sounds, “high-risk” isn’t necessarily bad.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

The Paypers

AUGUST 8, 2022

ING has announced it will trial a carbon footprint tracking app offered by fintech firm Cogo , with 350,000 mobile clients.

FICO

AUGUST 8, 2022

Home. Blog. FICO. 2023 FICO Decisions Awards Now Open. Call for analytics and digital transformation champions! Saxon Shirley. Thu, 08/04/2022 - 10:01. by Nikhil Behl. expand_less Back To Top. Mon, 08/08/2022 - 15:10. I am excited to announce that our 2023 FICO Decisions Awards are now open! We are calling on our customers who are achieving outstanding success using analytics and decision management solutions from FICO to submit nominations for the awards. .

Payments Dive

AUGUST 8, 2022

Banks that issue credit cards and the retailers who hate their fees are lining up allies on Capitol Hill to fight over a new bill that calls for more competition in the industry. Visa and Mastercard are at the center of the conflict.

CB Insights

AUGUST 9, 2022

Global payments funding fell 43% quarter-over-quarter (QoQ) to hit $5.1B — its lowest level since Q4’20. Deals also fell 18% QoQ to reach 256. Mega-rounds also hit a 6-quarter low in Q2’22, falling 39% QoQ to 14 deals. This was the first time in 5 quarters that the space saw fewer than 20 mega-rounds. Want the full post? Become a CB Insights customer.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

The Paypers

AUGUST 11, 2022

Sweden-based fintech for Open Banking payments, Trustly , has partnered with Conotoxia , a multi-currency company from Poland, to provide users with a fast, secure, and safe way to transfer funds internationally through their bank accounts.

Fintech Labs Insights

AUGUST 8, 2022

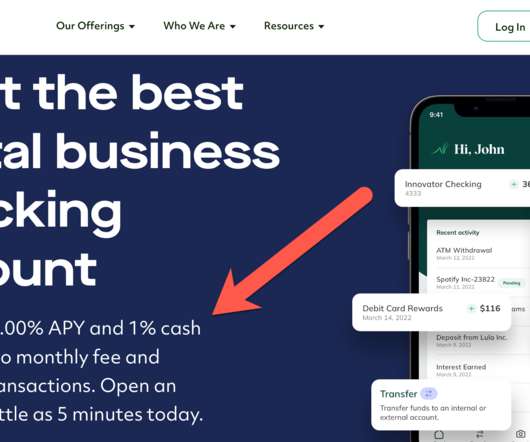

FintechLabs follows the small business digital banking space closely. While the summer is typically slow in terms of marketing initiatives, Grasshopper Bank is the exception in the small business banking space touting a 1% APY in the first paid result on a recent Google search ( see screenshot below ). Grasshopper is becoming more aggressive after rebooting its efforts under new management last March.

Payments Dive

AUGUST 9, 2022

Paystand’s purchase of the Mexico-based company was its first acquisition, and the company said it’s prepared to do more deals.

Payments Dive

AUGUST 8, 2022

While card issuers are bracing for economic headwinds, consumer spending has continued to rise recently, including for apparel, jewelry and travel.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Payments Dive

AUGUST 12, 2022

U.S. Bank is using The Clearing House’s real-time payments system to offer auto dealers the option for speedier delivery of loan funding.

Payments Dive

AUGUST 11, 2022

The payments software company posted a second-quarter loss despite client wins being higher than usual and revenue jumping more than 50 percent.

The Paypers

AUGUST 10, 2022

US-based instant card-to-card Funding-as-a-Service Astra has announced it is using Visa Direct – Visa’s real-time payments service.

Let's personalize your content