EPC girds for 2024 CCCA fight

Payments Dive

DECEMBER 22, 2023

The Electronic Payments Coalition is “fully funded” for the continuing fight over the proposed Credit Card Competition Act next year, said the organization’s executive chairman.

Payments Dive

DECEMBER 22, 2023

The Electronic Payments Coalition is “fully funded” for the continuing fight over the proposed Credit Card Competition Act next year, said the organization’s executive chairman.

Stax

DECEMBER 20, 2023

When you research payment solution providers , you’ll start hearing the term “interchange” used when talking about payments. Interchange is the fee that credit card companies like Visa and Mastercard charge businesses to accept their cards. The interchange fee depends on a number of factors and isn’t always easy to understand. In this article, we will break down credit card interchange fees so you will know exactly how much you’re spending when running your business.

The Fintech Times

DECEMBER 18, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re pleased to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Fintech News

DECEMBER 17, 2023

Traditional banking systems, burdened by age and complexity, can cripple innovation, restrain time to value, and strain customer relationships. This is not an isolated challenge; many incumbent banks struggle to keep ownership and maintenance costs in check and swiftly expand product offerings to compete with nimble challenger banks. Digital transformation is no longer a choice; it’s a lifeline.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

DECEMBER 20, 2023

This primer fills in the gaps on how digital wallets work, what companies compete to provide such payment tools and what to expect from them in the future.

Finextra

DECEMBER 18, 2023

Apple, Visa and Mastercard are facing a class action lawsuit over allegations that they conspired to suppress competition in the market for point-of-sale payment card services.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Fintech News

DECEMBER 19, 2023

The global fintech landscape is witnessing a staggering growth, fueled by booming consumer adoption, supportive regulatory efforts and technological advancements. Between 2015 and 2019, consumer adoption of digital money transfer and payment services grew from a mere 18% to an impressive 75%, findings from a Statista survey found. Insurtech, alternative lending and online savings and investment recorded similar spectacular growths, surging between 20 to 40 points during the period.

Payments Dive

DECEMBER 19, 2023

Beating back fraud can feel “a bit like a vicious circle,” as the industry improves its capabilities and fraudsters pivot, said Tina Eide, an executive vice president focused on fraud at the card issuer.

TechCrunch Fintech

DECEMBER 17, 2023

Welcome back to The Interchange, where we take a look at the hottest fintech news of the previous week. If you want to receive The Interchange directly in your inbox every Sunday, head here to sign up! What a year This is the last edition of The Interchange for 2023 — it’s hard to believe that the […] © 2023 TechCrunch. All rights reserved. For personal use only.

The Fintech Times

DECEMBER 21, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re excited to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

DECEMBER 18, 2023

Real-time payments platform Volt has teamed up with sustainability fintech ekko to help retailers and their customers support the removal of plastic bottles from the ocean.

Payments Dive

DECEMBER 21, 2023

Google’s settlement with attorneys general this week includes a lengthy list of changes the tech titan must make in its approach to in-app payments.

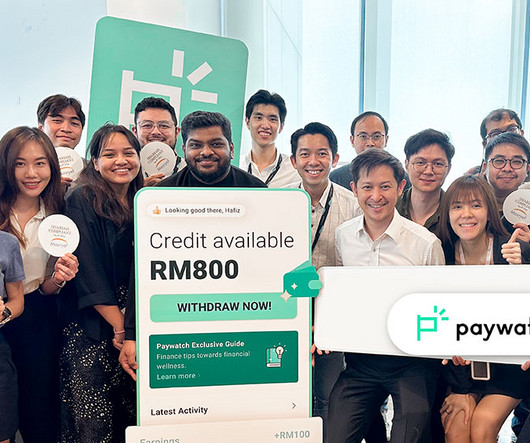

Fintech News

DECEMBER 17, 2023

Paywatch, an earned wage access (EWA) provider, announced that it has officially expanded its services into Indonesia following its Philippines’ launch in October this year The firm revealed that it had recently partnered with an unnamed local banking partner to launch its bank-backed EWA service in Indonesia. Since the launch of that partnership, Paywatch said that it has grown within the local manufacturing and financial sectors.

The Fintech Times

DECEMBER 19, 2023

Buy now, pay later (BNPL) services have become significant in the realm of short-term unsecured consumer finance, often tied to specific products and offering instalment repayments, without accruing interest. The BNPL transaction involves three key players: the consumer, the merchant, and the BNPL service provider. Despite the similarities with traditional credit products, there is an ongoing discussion about whether BNPL services should be subject to comparable regulatory measures.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Payments Association

DECEMBER 22, 2023

Thames Technology, one of Europe’s leading card manufacturers, has experienced substantial business growth in recent months and is pleased to announce a strategic recruitment drive across various departments to support […] Read more

Payments Dive

DECEMBER 20, 2023

The Minneapolis-based lender flagged a CFPB probe into prepaid card use last year. The OCC added a separate penalty Tuesday.

Fintech News

DECEMBER 20, 2023

JULO, an Indonesian fintech offering digital peer-to-peer lending, announced that it has launched ‘JULO Cares’, an embedded insurance coverage. This new offering, backed by global general insurer Sompo, provides device protection for users availing of JULO’s digital credit services. Throughout 2023, JULO has focused on launching new products aimed at supporting Indonesia’s underbanked and unbanked populations.

The Fintech Times

DECEMBER 21, 2023

Exploring the rich possibilities within Africa’s fintech ecosystem, The Fintech Times delves into Visa ‘s inaugural fintech accelerator, dedicated to nurturing the evolving fintech sector in Africa. The fintech startup scene in Africa is growing at an exceptional rate, with the overall number up 125.2 per cent between 2017 and 2023. ¹ However, even with compelling growth prospects across the continent, there is still plenty of work to be done.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Stax

DECEMBER 20, 2023

Although credit cards have been around since the 1950s, in recent years, they’ve started to dethrone cash from its position as king of payment methods. With a whopping 84% of American adults owning at least one credit card (the average is 3 credit card accounts per person), card payments reached $9.43 trillion in 2021. In fact, that’s the fastest growth rate for card payments…ever.

Payments Dive

DECEMBER 20, 2023

PayPal, Block and Global Payments representatives contributed to the Atlanta Federal Reserve Bank’s research on how to draw more people into the digital payments sphere.

Fintech News

DECEMBER 20, 2023

Payment giant Mastercard has partnered with PT MRT Jakarta (Perseroda) to provide more payment options to commuters for cashless transit experiences. This announcement coincides with the renaming of Senayan Station to Senayan Mastercard Station. Travelers can now top up their MRT cards using Mastercard debit cards at station counters. Additionally, for the first time, Mastercard credit cards are now accepted for ticket purchases through the MyMRTJ app.

The Fintech Times

DECEMBER 17, 2023

The UAE has established itself as a frontrunner in the fintech innovation space, boasting a market currently valued at $39.3billion in terms of transaction value, as reported by Mordor Intelligence. Emirates NBD , a banking group in the MENAT region, aims to further bolster and expedite this growth with the launch of its National Digital Talent Incubator (NDTI) programme.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Stax

DECEMBER 20, 2023

Offering payment processing services is a move that makes sense for a lot of SaaS companies, particularly if your software helps your customers run their business. For example, if you have a project management app, then you can add payment features that allow people to use your software to take payments from their clients. Similarly, if you provide appointment scheduling solutions, then it’s worth offering payment tools so your users can leverage your solution to take upfront payments and deposi

Payments Dive

DECEMBER 20, 2023

Teaming with emerging fintechs is “a way of staying very, very relevant,” said Jim Schinella, Visa’s global head of digital partnerships.

Finovate

DECEMBER 19, 2023

Agency execution specialist Liquidnet has turned to investment technology company bondIT to give new tools to traders on its Fixed Income electronic trading platform. Liquidnet will leverage bondIT’s Scorable Credit Analytics to help traders better anticipate market trends. The technology will also help them mitigate credit risk and make more informed decisions quicker. “With this integration, our goal is to give access to crucial information to investment firms of all sizes,”

The Fintech Times

DECEMBER 21, 2023

Digital payments company Visa has teamed up with TECH5, a biometrics and digital identity management company, to focus on the development and enhancement of digital government ecosystems on a global scale. The two organisations will collaborate on creating a comprehensive plan that encompasses various initiatives and projects aimed at establishing a strong foundation for advancing digital payments, digital identity management as well as other services within the ecosystem.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Stax

DECEMBER 20, 2023

Just starting out with your small business? Finding great credit card processing rates may seem impossible, but there’s hope. By following these simple tips, you’ll be able to secure credit card processing rates that make big businesses jealous. Learn More TL;DR Not all credit card processing companies are created equal. To ensure that you’re able to take payments in a cost-effective way, be sure to carefully compare their fee structures, contract terms, and available features.

TechCrunch Fintech

DECEMBER 22, 2023

As 2023 comes to a close, we’re here to look back at the biggest fintech stories of the year. Silicon Valley Bank’s implosion felt like a fintech story in that a number of startups (Brex, Arc and Mercury, for example) in the space leapt to fill the hole left by its collapse. But it truly […] © 2023 TechCrunch. All rights reserved. For personal use only.

Finextra

DECEMBER 20, 2023

Walmart has struck a deal with Affirm to offer buy now, pay later options at self-checkout kiosks at over 4500 US stores.

The Fintech Times

DECEMBER 16, 2023

EBANX, a global fintech company specialising in payment solutions for emerging economies, has announced a strategic partnership with Bancolombia bank to integrate payment method Botón Bancolombia into its array of payment options in Latin America. This collaboration aims to enhance the digital banking experience in Colombia, enabling convenient access to the global digital commerce market, boosting conversion rates, and improving payment processing efficiency.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content