FedNow aims to avoid Zelle-type fraud

Payments Dive

FEBRUARY 23, 2023

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

Payments Dive

FEBRUARY 23, 2023

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

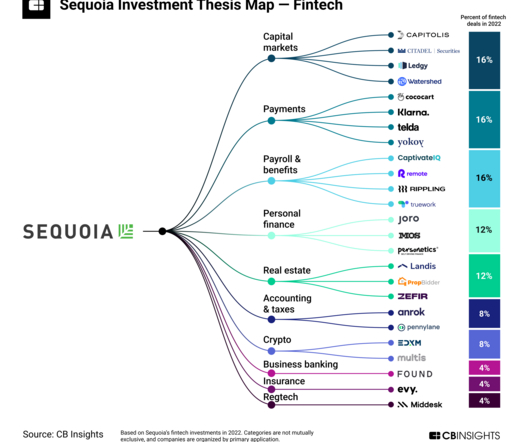

CB Insights

FEBRUARY 21, 2023

Sequoia Capital is one of the world’s oldest and most accomplished venture capital firms, with its long list of early tech investments-turned-home runs including Airbnb, Apple, Instagram, Square, and WhatsApp. While 2022 was a down year for venture capital at large, Sequoia remained active with over 100 investments. Fintech was Sequoia Capital’s top investment category in 2022, representing nearly a quarter of the firm’s deals. dive deeper into Sequoia’s top 3 fintech Targets Download thi

Payment Savvy

FEBRUARY 24, 2023

Real-time payments have revolutionized how we make financial transactions, providing unparalleled speed, convenience, and security. With real-time payments, money can be transferred almost instantly from one person to another, anywhere in the world. This makes it possible for people and businesses to send and receive money at a moment’s notice, without having to wait for traditional payment methods such as bank transfers or cheques to clear.

Agile Payments

FEBRUARY 24, 2023

The Future of Payments: Trends and Technologies to Watch in 2023

Speaker: Becky Parisotto

Fulfillment is no longer just about getting products from point A to point B – it's about crafting seamless, scalable, customer first experiences. Flexible fulfillment strategies are more important than ever for those aiming to stay ahead and build resilience as retail enters a new era in 2025. Learn how to optimize fulfillment processes, tackle complex, multi-vendor orders, and create seamless customer experiences – from white-glove delivery for high-value items to quick-ship solutions for ever

Payments Dive

FEBRUARY 24, 2023

GoDaddy now offers its business owner clients a digital payment tool that is customizable to their company branding.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

CB Insights

FEBRUARY 23, 2023

What is crypto market data & intelligence? Crypto market data & intelligence companies provide blockchain data and analytics platforms for institutional investors and traders. Clients can track crypto portfolios, tokens, protocols, and exchanges to inform their strategies. They do this through real-time dashboards, APIs, research reports, and risk management tools.

Agile Payments

FEBRUARY 21, 2023

9 Effective Growth Hacking Strategies to Skyrocket Your Startup Photo by Campaign Creators on Unsplash Although the term growth has been thrown around a lot, especially in the start-up community, many entrepreneurs still need to be made aware of what growth hacking is and how it works. By using growth hacks, organizations can get started to achieve success.

Payments Dive

FEBRUARY 21, 2023

The newly published code will be part of Discover’s policy and product update for merchants and payment partners in April, a spokesperson told Reuters.

The Paypers

FEBRUARY 20, 2023

US-based financial technology company Payoneer has received an Electronic Money License (EMI) from the UK’S Financial Conduct Authority ( FCA ).

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

CB Insights

FEBRUARY 23, 2023

What is institutional DeFi? Institutional decentralized finance (DeFi) companies provide decentralized financial products to financial institutions with strict compliance needs. Institutional DeFi is made possible through whitelisting and knowing your customers’ pools of participants. The space includes compliance and tracking tools, advanced custody and security, or index products tracking DeFi tokens.

Axway

FEBRUARY 23, 2023

This month: an API Green Score could promote more sustainable digital transformation and airlines are tackling the tech troubles that caused massive flight cancellations over the Holidays. Plus, banks are opening up with APIs and shifting priorities; Mr.

Payments Dive

FEBRUARY 22, 2023

Block-owned Square made its name catering to owners of small businesses, but the company is now setting its sights on bigger clients for growth.

The Paypers

FEBRUARY 23, 2023

The Web3 Domain Alliance has announced the addition of 51 new members in order to support the development of digital identity technology in Web3.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

CB Insights

FEBRUARY 23, 2023

What is institutional crypto trading & prime brokerage? Institutional crypto trading & prime brokerage companies in this market provide cryptocurrency trading platforms tailored for institutional investors and hedge funds. They offer secure trade execution and access to liquidity. download the state of blockchain 2022 report Get the latest data on blockchain funding trends, unicorns, exits, and more.

Axway

FEBRUARY 22, 2023

There are many motivations for a Finance transformation project, but regardless of the reason, they all require improving data processing. What will it take to help the finance department meet its current challenges?

Payments Dive

FEBRUARY 24, 2023

The banking-as-a-service company posted profits in the final quarter of last year even as it recovered from the loss of clients.

The Paypers

FEBRUARY 22, 2023

Deutsche Bank has acquired a stake in DataMesh to accelerate the buildup and service offering of the bank’s merchant solutions across the Asia Pacific.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payment Savvy

FEBRUARY 23, 2023

If you are using the Automated Clearing House (ACH) method to process customers’ transactions, you are likely to see three-digit codes if a problem arises. Whenever there is an issue with a direct debit or credit card transaction, one of the parties involved in the payment processing will send a code. This code is your key to fixing or at least identifying what has blocked the transaction.

Axway

FEBRUARY 24, 2023

Universal API management is an emerging term that characterizes an expended set of capabilities beyond traditional API management.

Payments Dive

FEBRUARY 23, 2023

Last year’s same-day ACH limit increase helped nearly double that category’s total payment compared to 2021, Nacha said.

The Paypers

FEBRUARY 24, 2023

Cryptocurrency exchange Binance has partnered with France-based paytech Ingenico to enable in-store payments in France.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

The Finance Weekly

FEBRUARY 22, 2023

In 2021, there were roughly 5.4 million new businesses established in the US and over 800,000 in the UK. However, based on historical trends, it's expected that by the end of 2022, nearly 1.2 million (or almost 20%) of these businesses will have ceased operations and by the end of 2025, over half of the new businesses created in 2021 will likely have disappeared.

Axway

FEBRUARY 23, 2023

API adoption in large organizations may have been slow at first, but statistics show it is growing — with no signs of slowing down soon.

Payments Dive

FEBRUARY 22, 2023

The card company is betting its soon-to-be relaunched debit account services will help it better compete with fintech and neobank rivals.

The Paypers

FEBRUARY 24, 2023

US-based financial institution JP Morgan has announced the decision to restrict its employees from using the artificial intelligence program ChatGPT.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

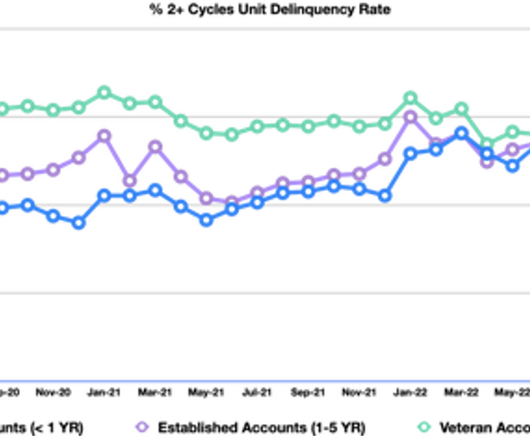

FICO

FEBRUARY 21, 2023

Home Blog FICO Canada Bankcard Industry Benchmarking Trends: Q4 2022 Update Ready for a recession? An insider look at bankcard and consumer trends in Canada FICO Admin Tue, 07/02/2019 - 05:19 by Amir Sikander expand_less Back To Top Tue, 02/21/2023 - 16:00 Recession talks have increased over the last few months. Canadian consumers are being hit with the rising cost of goods and borrowing.

Open Banking

FEBRUARY 20, 2023

Combined CMA9 data shows 7 million consumers and SMEs used Open Banking services during January. Open Banking is benefiting millions of UK citizens with innovative financial management and payment tools. With key recommendations about the future of Open Banking imminent, OBL Chair & Trustee calls on the whole ecosystem to keep up momentum and encourage continued user adoption.

Payments Dive

FEBRUARY 21, 2023

The Consumer Financial Protection Bureau has threatened action over card issuers not reporting full consumer payment data for tracking credit histories.

Let's personalize your content