Square/Stripe Has Terminated Your Account and Labeled You a High-Risk Merchant. What Now?

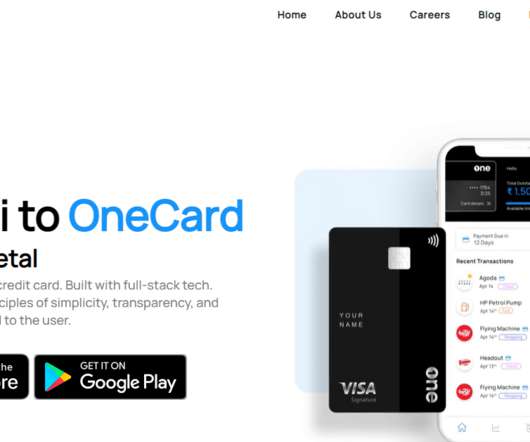

International Payments Processing

JANUARY 7, 2022

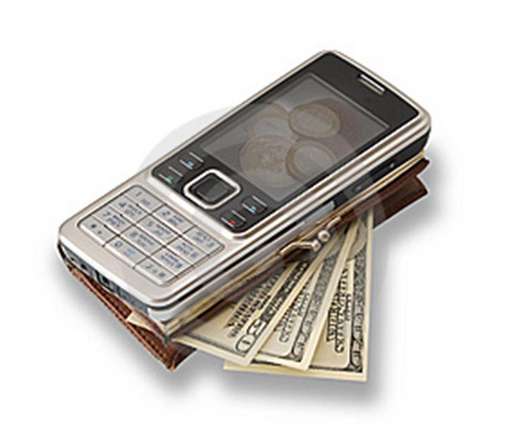

What To Do If You’ve Been Labeled As A High-Risk Merchant By Your Payment Service Providers Having a reliable payment provider is critical to keeping your business operations running smoothly. However, for high-risk merchants, such as those involving online gaming and gambling, cannabis, health, beauty, nutra, and CBD, finding a payment service provider who sticks around can be a challenge.

Let's personalize your content