Amex bets on millennials, Gen Z for growth

Payments Dive

MARCH 14, 2023

As it pursues younger consumers, the company is angling to ensure its high-fee cards offer enough value for millennials and Gen Zers.

Payments Dive

MARCH 14, 2023

As it pursues younger consumers, the company is angling to ensure its high-fee cards offer enough value for millennials and Gen Zers.

Faster Payments Council

MARCH 15, 2023

The Spring Member Meeting will bring together FPC members for two days filled with presentations on the most pressing issues in faster payments, panel discussions with industry experts, roundtables on timely topics, and engaging networking opportunities. This in-person event will take place on March 20-21, 2023, at the Loews Kansas City Hotel. MEETING AGENDA Monday, March 20 10:00am-12:30pmCT: Registration/Check-In (City Beautiful Foyer) 12:30pm-12:40pmCT: Opening Remarks (City Beautiful Ballroo

The Finance Weekly

MARCH 16, 2023

The quick and unexpected collapse of the second and third largest bank collapses in US history sent shock waves throughout the markets. Silicon Valley Bank (SVB) collapsed last Friday and it sent both private and public companies scrambling to address what exposures they had with SVB and other banks that might be at risk. To top it off, this occurred on a Friday, meaning many executives and CFOs had to wait all weekend until Monday to take real action.

FICO

MARCH 14, 2023

Home Blog FICO Claims Automation for Health Plans: Transformation with a Small “t” By focusing on transformation with a small “t” that addresses measurable performance gaps, health plans and administrators can use claims automation to control costs and risk FICO Admin Tue, 07/02/2019 - 02:45 by Paul Crowder expand_less Back To Top Tue, 03/14/2023 - 14:15 Some time ago, I witnessed a plea for help in a global healthcare summit from a Director of Claims Management for assistance in automating thei

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

MARCH 13, 2023

As the banking crisis spread, payments players, such as FIS, and venture-backed firms, including Payoneer, were caught in the contagion.

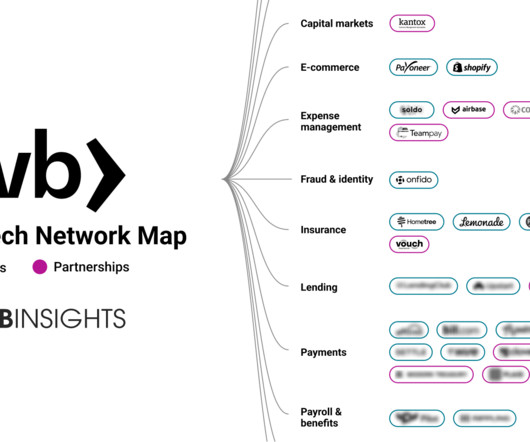

CB Insights

MARCH 14, 2023

For its 2,690+ fintech clients, Silicon Valley Bank (SVB) is more than just a bank. In addition to the venture debt financing and startup banking that it’s known for, SVB is a gateway for commercial payments and online payments acceptance. In fact, it markets itself not as a bank, but as a financial technology partner. According to SVB, its clients account for 71% of all fintech IPOs since 2020.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Open Banking

MARCH 16, 2023

Open Banking Limited (OBL) today announced that Claudio Pollack has been appointed to the Board as an independent Non-Executive Director (NED). Claudio brings significant regulatory, competition and consumer policy expertise to the OBL Board. His appointment will strengthen the organisation as it continues to prepare for transition. Previous positions include over a decade at Ofcom, the UK’s telecoms regulator, as well as being a part of the team at alternative telecommunications provider Cable

Payments Dive

MARCH 15, 2023

As bank card issuers faltered this past weekend, the card networks monitored payments closely, Visa and Mastercard executives said at a conference.

FICO

MARCH 15, 2023

Home Blog FICO Top 5 2023 Trends Redefining Banking Today FICO’s 2023 Trends Report reveals what’s impacting the financial services industry Saxon Shirley Wed, 05/25/2022 - 03:43 by Darryl Knopp expand_less Back To Top Wed, 03/15/2023 - 18:00 We are currently at an apex where several profound transformations are converging on the banking landscape – machine intelligence is positioned to complement (and even exceed) human intelligence, there are significant advancements in analytics and AI, and t

The Paypers

MARCH 17, 2023

Customer relationship management platform Salesforce has announced it is expanding its client services to include management of NFT loyalty programs.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Axway

MARCH 13, 2023

The director of the Consumer Financial Protection Bureau (CFPB) announced the coming of a new U.S. open banking rule in late 2022 , accelerating the move toward open banking in North America.

Payments Dive

MARCH 16, 2023

The central bank is targeting July, as opposed to the earlier end of its prior range, for starting its new real-time payments service.

FICO

MARCH 14, 2023

Home Blog FICO Rank Distillation: Operationalizing AI Continuity in the Corpus AI New models can underperform alarmingly easily if you take your eyes off the Corpus AI FICO Admin Tue, 07/02/2019 - 02:45 by Scott Zoldi Chief Analytics Officer expand_less Back To Top Tue, 03/14/2023 - 15:00 Decision management systems are complex, consisting of numerous components such as machine learning (ML) models, decision strategies, rules systems, alert management and performance monitoring.

The Paypers

MARCH 17, 2023

Swift Go has been launched in 2021 as a solution for completing low-value cross-border payments, and there are over 600 banks that support it.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Axway

MARCH 13, 2023

On any given day, businesses exchange all types of data and documents with other businesses: a purchase order that creates an agreement for a sale, an invoice as a record and request for payment, and the list goes on.

Payments Dive

MARCH 15, 2023

Payments processors’ CEOs this week described how their companies were affected by the recent bank industry turmoil, downplaying the impact.

Center for Payments

MARCH 17, 2023

By Meagan Norlund, VP, Marketing & Communications, NEACH As the industry well knows by now, the Federal Reserve anticipates that FedNow SM will be available sometime between May and July of this year, ahead of schedule and only a few short months away. While the accelerated timeframe may cause a bit of anxiety for financial institutions still considering FedNow implementation or preparing their systems and processes for the capability, it doesn’t have to.

The Paypers

MARCH 15, 2023

Payment service provider Clik2Pay has announced its partnership with global small business platform Xero to save a part of Canadian SMEs’ credit card fees.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Payments Dive

MARCH 16, 2023

The Silicon Valley Bank downfall that sent shockwaves through the financial industry forced fintechs, such as Affirm and Marqeta, to react fast.

Payments Dive

MARCH 17, 2023

As buy now, pay later use rises, consumers are learning about the payment option at checkout, more so than from social media or family and friends.

Payments Dive

MARCH 13, 2023

In a world where merchants expect fast and easy payments, the time required for ISOs and ISVs to complete arduous technical onboarding processes can cost sales and damage reputations.

Payments Dive

MARCH 14, 2023

The payments startup has a new team of top executives to spearhead payments for gaming, social media and other next-generation marketplaces.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Payments Dive

MARCH 17, 2023

After a week of several high-profile bank failures and near-failures, some fintechs don’t see jumping ship as an option.

Payments Dive

MARCH 16, 2023

The Midwestern grocer is the first of the food waste solution company’s partners to make the payment method accessible on the company’s app.

Payments Dive

MARCH 13, 2023

The merchants explained how the SVB situation had affected their sales, online commerce, payments and finances.

The Paypers

MARCH 15, 2023

National Australia Bank (NAB) has completed its first intra-bank cross-border transaction using its own stablecoin via Ethereum.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

The Paypers

MARCH 17, 2023

Germany-based online broker FXFlat has announced partnering with the fintech RIDE to launch the brokerage solution RIDE Low-tax Broker, which is aimed exclusively at corporate customers, including limited liability companies (GmbH).

The Paypers

MARCH 13, 2023

Lloyds Banking Group has invested GBP 10 million into digital ID company Yoti to develop its app-based identity verification software, which is launching later in 2023.

The Paypers

MARCH 17, 2023

Ukrainian Processing Center (UPC) and Tietoevry Banking have announced a partnership to develop Open Banking services in Ukraine.

The Paypers

MARCH 15, 2023

UK-based fintech company BankiFi has announced its partnership with Financielle to launch a new playbook for SMEs, aimed to improve their business management.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content