New York enacts surcharge law

Payments Dive

JANUARY 3, 2024

The state’s new law will force merchants to limit credit card surcharges and more clearly disclose them to consumers. If the businesses don’t, they could face a $500 penalty.

Payments Dive

JANUARY 3, 2024

The state’s new law will force merchants to limit credit card surcharges and more clearly disclose them to consumers. If the businesses don’t, they could face a $500 penalty.

Payments Next

JANUARY 3, 2024

by Donna Blum of BHMIChargebacks are a significant and growing challenge in the payments industry. The rapid growth in e-commerce, rise in The post Five reasons to get a handle on chargebacks first appeared on Payments NEXT.

Bank Automation

JANUARY 2, 2024

Industry experts predict adoption of real-time payments as well as the increased use of FedNow and digital wallets in 2024 as consumer demand for instant payments continues to grow.

Finextra

JANUARY 4, 2024

Visa has launched a Web3 loyalty engagement offering to help firms reward customers not just for their purchases but for their engagement and interactions.

Speaker: Michael Veatch, Senior Director, Implementations & Ella Aguirre, Director of Solution Consulting

Embedding payments can be a transformative step for software companies looking to enhance their platform capabilities, boost customer satisfaction, and drive long-term growth. However, the success of payments hinges on a single thing: implementation. Drawing on real-world insights and experiences, payments implementation experts Michael Veatch and Ella Aguirre will explore actionable strategies that can lead to a transparent, friction-free launch and mitigate potential challenges like technical

Payments Dive

JANUARY 3, 2024

New York Gov. Kathy Hochul is seeking to require buy now, pay later providers to obtain a license to operate in the state, in addition to other potential regulations for the industry.

The Fintech Times

DECEMBER 31, 2023

It’s a time of reflection and anticipation at The Fintech Times throughout December, as we look back at developments and trends over the last 12 months and forward to the year ahead. We’re excited to share the thoughts of fintech CEOs and industry leaders from across the globe to 2023’s key takeaways and what we should expect to be top of the agenda in 2024.

Payments Space brings together the best content for payment processing professionals from the widest variety of industry thought leaders.

Finextra

JANUARY 4, 2024

New data from Nationwide shows that cash usage continues to rise as many households respond to the cost-of-living crisis by budgeting with physical money.

Payments Dive

JANUARY 3, 2024

The consulting firm’s global marketing head explained in an interview why a bank-backed digital wallet won’t be “the PayPal killer” and why the U.S. hasn’t seen a super app for payments.

TechCrunch Fintech

JANUARY 2, 2024

Ruth Foxe Blader has left her role as partner at Anthemis Group after nearly seven years to start her own venture firm, Foxe Capital, TechCrunch learned exclusively today. Blader is joined by former Anthemis investment associate Kyle Perez. Sophie Winwood is serving as an operating partner. Winwood previously co-founded WVC:E, an organization that pledges to […] © 2023 TechCrunch.

Fintech News

JANUARY 2, 2024

Bank of Ayudhya (Krungsri), a part of Mitsubishi UFJ Financial Group (MUFG), has recently expanded its services in the ASEAN region by launching cross-border QR payments between Thailand and Hong Kong. Travelers from Thailand and Hong Kong can make payments by using mobile payment apps to scan Hong Kong’s FPS QR code and Thailand’s PromptPay QR Code displayed at the merchants’ point of sale.

Advertisement

Large enterprises face unique challenges in optimizing their Business Intelligence (BI) output due to the sheer scale and complexity of their operations. Unlike smaller organizations, where basic BI features and simple dashboards might suffice, enterprises must manage vast amounts of data from diverse sources. What are the top modern BI use cases for enterprise businesses to help you get a leg up on the competition?

Finextra

JANUARY 2, 2024

HSBC is looking to take on money transfer behemoth Wise with the launch of a global currency conversion app.

Payments Dive

JANUARY 4, 2024

Fintech trade groups asked the Consumer Financial Protection Bureau to extend the comment period on a proposal formalizing its oversight of big tech companies’ digital wallets.

BlueSnap

JANUARY 3, 2024

Digital payment transactions surpassed $1 trillion in 2023, making it essential for businesses to find ways to optimize them to help grow revenue. The post Why Next-Generation Payment Orchestration Is Our 2024 Payment Trend of the Year appeared first on BlueSnap.

TechCrunch Fintech

JANUARY 3, 2024

In 2023, India introduced a series of regulations and tweaked policies that borrowed from Europe’s antitrust approach and Chinese-style government surveillance, alarming executives and investors in the world’s most populous market. Additional regulations are on the horizon in 2024 as New Delhi continues a regulatory shift to more tightly govern the tech sector.

Speaker: Jennifer Wright and Nick Barron

2025 is right around the corner, and with it comes a new wave of consumer expectations, competitive pressures, and operational challenges. Success lies in finding the balance between operational flexibility and creating experiences that keep customers coming back. The future of retail belongs to those who can stay ahead of shifting customer preferences and marketing trends. 🔮 In this session, we’ll dive deep into what it takes to keep customers engaged and your operations nimble, no matt

Stax

JANUARY 5, 2024

Many merchants face the trouble of sifting through numerous credit card machine options, looking for a terminal that fits with their business. There are many different types of payment terminals to choose from, and you need one that’s going to help your business operate the most efficiently. Selecting the right payment processing terminal will not only help reduce your processing costs, but it’ll also increase your profits.

Payments Dive

JANUARY 5, 2024

Lawmakers in the state are considering legislation that would require merchants to accept cash payments.

Basis Theory

JANUARY 4, 2024

What is Payments Vaulting? Merchants are said to be ‘vaulting payments’ when they contract with a partner, which stores sensitive cardholder data securely and provides the merchant with an undecryptable token string. By vaulting customer payments data, the merchant is able to offload some of the PCI-DSS compliance activities (as they never actually ‘see’ customers’ card data in plain text), and potentially simplify their payment process.

TechCrunch Fintech

JANUARY 4, 2024

Indian financial services startup MobiKwik seeks to raise about $84.2 million through issue of new shares in an initial public offering in the home market, it said in a draft prospectus filed with the local markets regulator Friday. This is the second time MobiKwik has filed the paperwork for an IPO. The startup, backed by […] © 2023 TechCrunch.

Advertisement

Build a sustainable merchant services portfolio with practical strategies to ensure long-term success. Diversify across industries to spread risk and stabilize income, balancing high-risk and low-risk clients for a robust mix. Combine large and small merchants to create a resilient payment portfolio, leveraging each type's strengths. Foster long-term relationships through exceptional service and personalized support.

Stax

JANUARY 3, 2024

With the constant demand for greater efficiency and convenience in the retail experience, it’s not surprising that self-checkouts have entered the mainstream. Once a relatively niche offering, the COVID-19 pandemic saw retailers accelerate the rollout of self-checkout systems, their contactless nature making them a lot more appealing than traditional checkouts for many consumers.

The Payments Association

JANUARY 3, 2024

Software as a service (SaaS) has sparked a paradigm shift in the corporate domain in the past five years, revolutionising pivotal industries like finance, transactions, and insurance.

Basis Theory

JANUARY 3, 2024

What are Payment Orchestration Platforms (POPs)? Payment orchestration providers, also known as payment orchestration platforms (POPs), offer a range of payment and routing services. Choosing the right POP, whether that is a more ‘black box’ experience where they hold the payment gateway relationships, or one that offers a greater depth of flexibility in subscriptions management or treasury and payables management , is based on the needs of the merchant’s business.

Paystand

JANUARY 5, 2024

Magic: The Gathering, a renowned trading card game, has left an indelible mark on the gaming industry. However, its impact extends beyond entertainment, laying the foundation for integrating blockchain technology into finance.

Speaker: Brad Pinneke, VP of Business Development at Payrix and Worldpay for Platforms

In this webinar, Brad Pinneke, Vice President of Business Development at Payrix and Worldpay for Platforms, will dive into the 7 must-have criteria for evaluating payments partners, helping you maximize both efficiency and the long-term value of your investment. From assessing technology capabilities to leveraging business development opportunities, this session will give you a clear, actionable strategy to select the right partner for scaling your business.

Stax

JANUARY 3, 2024

Whether businesses are on the road or staff are simply moving about in-store, mobile point of sale systems (mPOS systems) are becoming an increasingly popular POS option for small businesses. Around since the 2000s, mPOS systems have come a long way from their origin as a glitchy solution used primarily by micro-businesses to process payments. Today, they’re known for their robust services, enhanced security, user-friendly interfaces, and the integration of advanced data analytics.

The Fintech Times

DECEMBER 30, 2023

Over the past year, The Fintech Times team has had the pleasure of exploring and reading the latest books published in the industry. Though we get news and insights in our inboxes every day, there is something special about sitting down with a tea and enjoying a good book. With this in mind, we want to share our favourite fintech books from 2023. The financialisation of everything The Great Transition: The Personalization of Finance is Here by Emmanuel Daniel delves into the future of finance an

TechCrunch Fintech

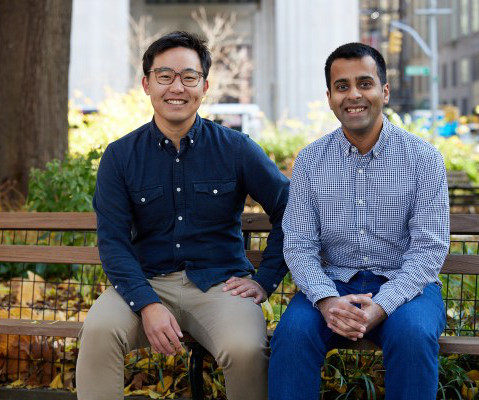

JANUARY 4, 2024

Exponent Founders Capital, an early-stage venture firm founded by alumni of startups such as Plaid, Robinhood and Ramp, has closed on $75 million in capital commitments, TechCrunch is the first to report. The firm, which is emerging from stealth today, raised $50 million for its first fund in November of 2021. Managing Partners Charley Ma […] © 2023 TechCrunch.

Fintech News

JANUARY 3, 2024

Singapore-based payments service provider dtcpay has announced the appointment of Anson Zeall , formerly the Head of Compliance, as its new Chief Strategy Officer (CSO). Anson Zeall During his tenure as Head of Compliance, Zeall played a pivotal role in guiding dtcpay through the complex regulatory environment of the blockchain and cryptocurrency sectors.

Advertisement

The complexity of financial data, the need for real-time insight, and the demand for user-friendly visualizations can seem daunting when it comes to analytics - but there is an easier way. With Logi Symphony, we aim to turn these challenges into opportunities. Our platform empowers you to seamlessly integrate advanced data analytics, generative AI, data visualization, and pixel-perfect reporting into your applications, transforming raw data into actionable insights.

Stax

JANUARY 1, 2024

Business savings accounts are crucial to a sound organizational strategy. Savings act as a financial buffer and can become a strategic asset. It can weather an organization through fluctuating market conditions and unforeseen expenses, providing a much-needed safety net and ensuring liquidity and financial stability. While business savings stats are hard to come by, the average U.S. resident has only $1000 or less in their personal savings account.

Chargebee

DECEMBER 31, 2023

The success of any subscription-based business isn’t dependent solely on your customer acquisition efforts, but rather on the number of customers you retain. Your employees play a vital role in improving retention rates, from communicating value during the sales process to providing first-class customer service. However, automation — in the form of customer feedback surveys, personalized offers, and onboarding workflows — can save time and money by streamlining processes and freeing up employees

Payments Dive

JANUARY 4, 2024

BNPL usage hit an all-time high during the season, with Cyber Monday as the largest day on record for the payment method, according to Adobe.

Fintech News

JANUARY 2, 2024

Singapore-based multi-currency e-wallet YouTrip has announced a substantial increase in wallet holding and spending limits for its users effective immediately. YouTrip users can now hold up to S$20,000 in their wallets, a significant jump from the previous S$5,000 limit, and have access to an annual spending limit of S$100,000, previously capped at S$30,000.

Speaker: Shaunna Bruton, Danielle Wyllie, and Kailey Holmes

Say goodbye to one-size-fits-all retail, and say hello to experiences that keep your customers coming back for more! Customer loyalty isn’t just earned - it’s cultivated through meaningful engagement with the help of data. This webinar will take you behind the scenes of how top retailers turn customer data into personalized experiences that drive engagement and retention.

Let's personalize your content