Leveraging an ACH API for SaaS Payment Integration

Agile Payments

AUGUST 8, 2023

ACH API integration for SaaS platforms offers multiple benefits to the platforms end users. Learn how to leverage API's

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Fintech Finance

OCTOBER 15, 2024

A pioneer in open banking, Neonomics unveils an innovative new product suite launched as Nello, with the goal to bring open banking to the next level through AI-driven solutions and seamless payments. Nello AI will be available as a white-label integration for financial institutions and others to easily integrate.

Exact Payments

FEBRUARY 5, 2024

In today’s ever-evolving digital landscape, integrated payment processing has emerged as a key to business success. Whether you’re running an e-commerce platform, a cutting-edge software-as-a-service (SaaS) solution, or any digital enterprise, choosing the right integrated payment provider is paramount.

Exact Payments

NOVEMBER 9, 2023

Embedded versus integrated payments: what exactly is the difference? Are these two payment models actually one in the same? Keep reading as we explain the key differences between embedded and integrated payments. However, there are variations in each integration approach. of integrated payments.

Fintech Finance

JULY 18, 2024

Conferma , the leading virtual card provider, has entered into a strategic partnership with the ground transportation automation and management platform, GroundSpan to facilitate simple, virtual payments for ground transportation. The strategic partnership was formed in direct response to customer demand for ground transportation integration.

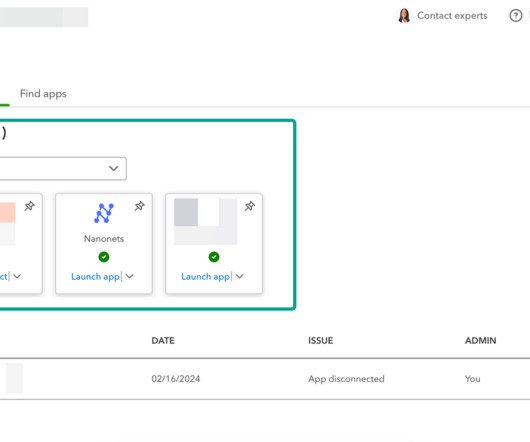

Nanonets

APRIL 19, 2024

For those wanting to do more with QuickBooks, hundreds of third-party integrations step in to offer additional features and benefits beyond QuickBooks' native offerings. Still, with as many integrations as are available, some may find themselves overwhelmed.

The Payments Association

OCTOBER 23, 2024

Noda , a leading provider of open banking, has introduced Pay & Go, a solution designed to streamline the user journey for merchants who require registration, KYC verification, and payment processing. How Pay & Go works Integrating Pay & Go is simple.

Fintech Finance

JUNE 12, 2024

In a major leap for subscription services, Trustly , the global leader in open banking payments, today unveiled its innovative AI-powered recurring payments solution poised to revolutionise how merchants handle repeat transactions through a single integration.

PYMNTS

DECEMBER 1, 2019

Small business accountants have said they are now forced to manually transfer data between payroll and human resources solution providers Gusto and Zenefits after the two companies abruptly ended their application programming interface (API) integration, AccountingToday reported.

Fintech Finance

JULY 9, 2024

Through its wire transfer API, Galileo connects fintechs partnering with Community Federal Savings Bank (“CFSB”) with Fedwire via sponsor bank CFSB. This service is in high demand for businesses and consumers that need immediate and secure transactions, for example, large transactions such as a home sale, tuition payments or vendor payments.

The Fintech Times

APRIL 27, 2024

Global tech firm Veritran has partnered with Swift , the world’s leading provider of financial messaging services, to enable financial institutions to offer an enhanced, streamlined and more transparent cross-border payment experience to their customers.

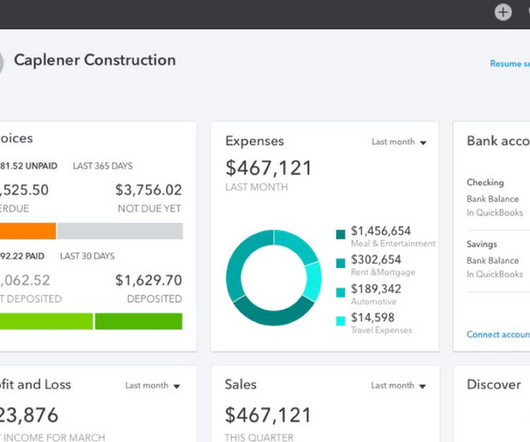

The Finance Weekly

APRIL 28, 2024

What really sets it apart for a lot of companies is the ton of integrations available. What is Quicbkbooks Integration? QuickBooks Integration is all about linking QuickBooks Online with other apps or systems. Integration steps up reporting by bringing data from various sources together and minimizes errors.

PYMNTS

OCTOBER 16, 2017

From an acronym known mostly by programmers in the early 2000s to something thousands of innovators have embraced to ignite numerous innovative solutions, it’s been an electric journey for the application program interface (API). The API hype cycle has all but ignored what it takes to use APIs,” David Koch noted.

Fintech Finance

JUNE 7, 2024

EvonSys , a Global Elite Pega Partner and Platinum Sponsor for Pega World 2024, announces the launch of the EvonSys Payments Platform (EPP). This innovative platform is set to transform the landscape of cross-border payments, delivering new standards in traceability, transparency, and efficiency.

Agile Payments

FEBRUARY 25, 2019

For software applications that have an end-user base in a subscription model or include recurring transactions, an ACH Processing API is a must.

Fintech Finance

APRIL 30, 2024

Veritran and Swift announce their collaboration that will enable financial institutions to offer an enhanced and streamlined cross-border payments experience to their customers. Users will also have full visibility of a payment cost, including the FX rate, upfront.

PYMNTS

DECEMBER 8, 2020

million in a funding round to go toward the startup's goal of providing a way for third parties to integrate banking services through an application programming interface (API), according to a report from TechCrunch. Unit has raised $18.6

Fintech Finance

AUGUST 7, 2024

Tribe Payments , the pioneering digital payments and infrastructure orchestrator which specialises in issuer and acquirer processing, has been selected by embedded financial services platform, Orenda Finance , to provide its issuer processing services. Ensuring a smooth process with Tribe is key for end-user functionality.

Stax

MARCH 21, 2024

In this article, we’ll explore the many benefits of SaaS and how to implement SaaS payments. SaaS applications are hosted on cloud computing networks and users can access their functionality on-demand through the internet resulting in significant cost savings, scalability, flexibility, security, and convenience.

PYMNTS

JULY 8, 2019

What it comes down to is a lack of integration and automation on both sides of the transaction.”. Instead, Grouchy said, application programming interface (API) technology can enable seamless integration of data within back-office systems and between the systems of two different businesses without forcing them into a particular solution.

PYMNTS

DECEMBER 16, 2019

The capabilities to unlock bank data and integrate new services into emerging FinTech platforms via API integrations is a FinTech trend that hasn’t ignored the B2B payments arena. Service providers are increasingly understanding that, like consumers, businesses demand a better and more seamless end-user experience.

PYMNTS

JANUARY 30, 2020

When it comes to payments in commerce, what — and who — you don’t know can hurt you. For software companies and platforms that seek to integrate payments and provide value-added services to merchants, there is the never-ending challenge of balancing trust and risk. Risks for Merchants — and Providers. The Partnerships.

Stax

APRIL 18, 2024

ISVs, or Independent Software Vendors, are businesses that develop and distribute software products to end-users. ISV software products are tailored to meet the specific needs of industries and users. Customer Support In-house support teams maintain direct relationships with end-users for assistance.

The Fintech Times

JULY 31, 2024

SDK.finance , a white-label Lithuanian fintech platform for digital payments, has partnered with Salt Edge , the open banking solution provider, aiming to help fintechs of all sizes develop open banking-enabled financial services and applications.

PYMNTS

JANUARY 12, 2021

These days, with the emergence of the cloud, open banking and application programming interfaces (APIs, the moniker “as-a-Service” applies to pretty much any business function that is now able to be outsourced to a third party. Technology brings the concept of flexible payments into reality. Flexibility Is Key.

Fintech News

FEBRUARY 19, 2024

The conversation delved into the transformation journey of Currencycloud into Visa Cross-Border Solutions , a foreign exchange and cross-border payments solution within Visa, and how it addresses the challenges of cross-border payments in today’s fintech landscape.

PYMNTS

APRIL 16, 2019

To paraphrase a TV show that many are no doubt watching (or binge watching to catch up), replete with dragons, thrones and rather grisly games: The application program interface (API) is coming. For B2B, it seems, the advent of the open API cannot come fast enough. For banks to be competitive, they need to provide APIs.”.

Fintech Finance

MAY 2, 2024

Orum , the simplest API for fast, reliable payments, today announced the launch of No Code Verify, which helps businesses and institutions determine whether a bank account is open and valid before initiating payments — all without integrating an API.

EBizCharge

MAY 23, 2024

How we pay for goods and services constantly evolves, from bartering to banknotes to modern times with digital wallets and embedded payments. Embedded payments represent the latest frontier of integrating financial transactions into everyday software. What are embedded payments?

PYMNTS

APRIL 16, 2018

Foursquare is offering small businesses (SMBs) and startups access to its geolocation API, according to VentureBeat reports on Friday (April 13). Now, Foursquare is extending this service to SMBs via its Places API for Startups.

Fintech Finance

MAY 23, 2024

Finastra , a global provider of financial software applications and marketplaces, today announced it has been selected by LGT to roll out instant payment services in Austria and Liechtenstein, with other markets to follow. Finastra’s payment hub provides banks with a future-proof, scalable and resilient payment processing system.

Finovate

AUGUST 20, 2024

Features Leverage free API gateway for real-time vendor monitoring Elevate operations and engagement with intuitive web admin portal Scale platform with patent-pending branding technology Who’s it for? Banks, credit unions, payment providers, and financial institutions focused on unsecured consumer lending.

PYMNTS

SEPTEMBER 22, 2020

No longer is open banking solely for consolidating financial information into a single platform for one end user. Integrated into its ERP solution, the new feature links electronic banking fees to corporate card spend, allowing for automated receipt creation. ClearBank Dives Into Multicurrency Accounts Via API.

PYMNTS

DECEMBER 22, 2020

Increasingly, consumer and corporate end users of various platforms are seeking a more seamless experience, and the owners of those platforms are finding a big opportunity to integrate a range of financial products and services, from payments to financing. But across use cases, Bloh said two key themes are emerging.

Exact Payments

NOVEMBER 8, 2023

As merchants look to accept payments with ease, and as software developers seek to diversify their revenue-earning strategies, the PayFac model has risen to the forefront. For businesses that choose to become payment facilitators, the benefits are tremendous. What is the PayFac Model? These technologies are often third-party solutions.

PYMNTS

MARCH 9, 2018

Foreign exchange solutions company OANDA is enhancing its application programming interface (API) that opens up its foreign exchange (FX) technology to third-party apps. The company announced news on Thursday (March 8) that its Exchange Rates API has been updated to include real-time FX rates.

Fintech Finance

JANUARY 15, 2024

NYSE: JBL) today announced ongoing innovation between its payment solutions business unit and Revolut , a digital banking pioneer and global financial super app provider, to support the neobank’s rapid growth trajectory and global expansion in merchant acquiring.

Stax

JANUARY 17, 2024

Automated Clearing House (ACH) payments are a type of electronic bank-to-bank payment system in the US. Unlike payments facilitated by card networks like Visa or Mastercard, ACH payments are managed by a body called the National Automated Clearing House Association (NACHA). Let’s get started.

PYMNTS

DECEMBER 3, 2020

While FinTech innovators continue to drive competition with a focus on product functionality and an optimal end user experience, businesses are often forced to use outdated tools, according to Frank Dux , managing director of CoCoNet. The Drive To Upgrade. It can be much easier for banks to buy out-of-the-box solutions," he said.

PYMNTS

JANUARY 26, 2021

marked its third anniversary of adopting its open banking framework, making it the leading market to drive the concept of unlocking customers’ bank account data for integration with third-party solution providers. The partnership, which will see the bank adopting its B2B payments platform to finance trade of its corporate customers.

Fi911

FEBRUARY 29, 2024

Understanding the VAR Sheet Consider the VAR Sheet as a vital handbook for payment processing setup. It is a comprehensive document containing the necessary details and configurations that payment processors use to accurately prepare a merchant’s system for accepting payments. When is a VAR Sheet Unnecessary?

PYMNTS

JANUARY 21, 2020

While Open Banking initiatives and data integrations between banks and FinTech firms have begun to target corporate and small business (SMB) end users, new research out of the U.K. HSBC Targets Treasurers With APIs. In an announcement , HSBC revealed the launch of its Treasury APIs for corporate clients across 27 markets.

PYMNTS

JANUARY 12, 2021

These days, with the emergence of the cloud, open banking and application programming interfaces (APIs, the moniker “as-a-Service” applies to pretty much any business function that is now able to be outsourced to a third party. Technology brings the concept of flexible payments into reality. Flexibility is Key.

The Fintech Times

MAY 9, 2024

” Paymentology leverages its technology and robust payment card solutions to empower clients in the creation, distribution, and management of cards. “We take pride in establishing the capability to create secure stores of value within a regulated framework and seamlessly integrate systems through simplified APIs.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content