Fed, FDIC, OCC update guidance on third-party risk management

Payments Dive

JUNE 8, 2023

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

JUNE 8, 2023

The guidance is aimed at helping banks address the operational, compliance and strategic risks of third-party tie-ups, such as those with fintech firms.

The Fintech Times

MARCH 6, 2024

The regulatory tides may be changing in the US, as the Office of the Comptroller of the Currency (OCC) suggests banks should be doing more to manage risks related to partnering with fintech firms. Rick Kuci, COO of FundKite “Unfortunately, many banks caused this risk issue for themselves.

PYMNTS

JANUARY 25, 2019

Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) all released a joint report saying that due to a healthy economy, prospects for loan repayment look good. However, the portion of loans owed by strongly leveraged borrowers is still high. Reuters reported that the U.S.

Finovate

APRIL 10, 2024

Office of the Comptroller of the Currency (OCC). Bunq withdrew its application earlier this year citing issues between Dutch regulators, the OCC, and the Federal Deposit Insurance Corporation (FDIC). ” That said, it has not been easy for financial institutions outside the U.S.

The Paypers

JANUARY 4, 2023

The Federal Reserve, FDIC and OCC have released a joint statement in order to warn banks about the risks associated with crypto assets.

Payments Source

DECEMBER 20, 2018

The Office of the Comptroller of the Currency has gotten the ball rolling for financial technology firms trying to operate a national platform, but the FDIC and Federal Reserve should act to remove other policy roadblocks.

PYMNTS

JANUARY 7, 2021

FDIC) and the Treasury Department are looking to see if American Express Co. The paper reported that the Office of the Comptroller of the Currency (OCC) is looking into business card sales tactics at the company as well, citing unnamed sources. A representative for the OCC would not comment on the matter, WSJ reported.

PYMNTS

MAY 24, 2018

The Office of the Comptroller of the Currency (OCC) issued a new guidance encouraging banks to offer responsible short-term, small-dollar loans to their customers. In 2013, the OCC had discouraged short-term lending by banks with limitations on what could be offered to customers depending on their credit.

Finovate

MAY 6, 2024

FDIC and CFPB have issued multiple consent orders to banks, citing their BaaS relationships as the cause. regulators– the Board of Governors of the Federal Reserve System, the FDIC, and the OCC– have published a new third party risk management guide for community banks. Since late 2023, the U.S.

Global Fintech & Digital Assets

JANUARY 12, 2024

Endnotes [1] The FFIEC members are the Board of Governors of the Federal Reserve System (FRB), the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), the Consumer Financial Protection Bureau (CFPB), the National Credit Union Administration (NCUA), and the State Liaison Committee. [2]

PYMNTS

OCTOBER 24, 2019

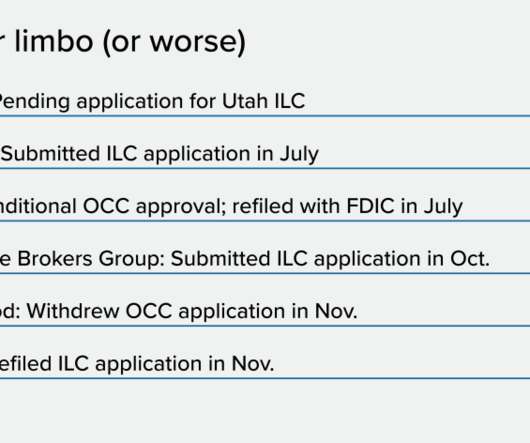

The Office of the Comptroller of the Currency (OCC) debuted a special purpose charter in 2016 that would have given FinTechs a leg up on competing with traditional financial services companies. But Federal Deposit Insurance Corporation (FDIC) coverage — which protects deposits — proved a sticking point this week.

PYMNTS

OCTOBER 31, 2016

The Office of the Comptroller of the Currency (OCC) disclosed it was hacked in September, reported The Wall Street Journal last week. WSJ cited an OCC spokesman as saying the data included information “related to OCC activities and employees.” The incident occurred in Nov.

Payments Source

SEPTEMBER 19, 2019

A federal judge blocked state regulators from suing the agency over its new charter, but it’s still unclear whether fintechs would even apply.

PYMNTS

DECEMBER 10, 2018

Separately, but still within the scope of efforts from the Federal Reserve and the OCC, along with the FDIC, the agencies last week released a proposal that would increase the threshold of real estate transactions that require appraisal from $250,000 to $400,000. This would be the first boost in 25 years.

PYMNTS

DECEMBER 3, 2019

The Federal Reserve Board, the Federal Deposit Insurance Corporation (FDIC), FinCEN , the OCC and the Conference of State Bank Supervisors participated in issuing the definitions and guidelines. Banks no longer have to submit a suspicious activity report (SAR) just because a business is growing or cultivating hemp.

PYMNTS

SEPTEMBER 30, 2020

Overseen by the Office of the Comptroller of the Currency (OCC), the charter would allow firms like Facebook, Google or Amazon to bypass the process by which they need to collect money transmitter licenses state by state. This isn’t the OCC’s first attempt to create a special banking charter that would benefit tech firms.

Payments Source

FEBRUARY 27, 2018

A decision by the Federal Deposit Insurance Corp. soon to be under new management — on Square’s ILC application could foreshadow how other fintech firms seek banking powers.

Payments Source

OCTOBER 9, 2018

Fintechs can get what they need from a traditional bank charter with the FDIC, as long as the agency is willing to play ball and step up its approach to innovation.

FICO

JANUARY 13, 2020

In December, the FDIC and OCC issued a proposed rule to modernize the Community Reinvestment Act (CRA). In addition, the Federal Reserve did not join the FDIC and OCC on the proposal. Political commentators are quick to note that currently there are few bipartisan issues left on Capitol Hill, but this is one of them.

PYMNTS

JANUARY 13, 2021

FDIC) and the Treasury Department have reportedly launched an inquiry into American Express Co. Other sources said the Office of the Comptroller of the Currency (OCC) is also looking into the matter. Other sources said the Office of the Comptroller of the Currency (OCC) is also looking into the matter.

PYMNTS

NOVEMBER 20, 2020

In a July interview with the Financial Times , acting head of the Office of the Comptroller of the Currency (OCC) Brian Brooks said banks should not use the pandemic as a reason to close branches permanently. Officially the regulatory powers that govern banking aren’t on board with this switch.

PYMNTS

APRIL 29, 2019

Last week Robinhood, the company behind the free mobile trading app, filed an application to open an online bank that would be FDIC insured and offer high rates on savings and low rates on credit cards. retail consumers,” it says in its application to the OCC, according to the report.

PYMNTS

NOVEMBER 23, 2020

In terms of mechanics, he explained, having a national bank charter in hand from the OCC means Figure will not have to obtain licenses to provide financial services on a state-by-state basis, but instead will be enabled to deliver its offerings on a nationwide basis while tailoring its compliance to the mandates of the OCC as sole regulator.

PYMNTS

NOVEMBER 23, 2017

22) report by American Banker , New York Venture Bank, which will be headquartered in New York, needs the nod of the Office of the Comptroller of the Currency (OCC) before it can launch operations. FDIC), the news report noted the new bank will begin with $100 million in capital. According to a Wednesday (Nov.

PYMNTS

OCTOBER 25, 2019

The Commodity Futures Trading Commission ( CFTC ), Federal Deposit Insurance Corporation ( FDIC ), Office of the Comptroller of the Currency ( OCC ), and the Securities and Exchange Commission ( SEC ) have announced that they are joining the Global Financial Innovation Network ( GFIN ).

PYMNTS

FEBRUARY 19, 2019

The average merger review time at the Office of the Comptroller of the Currency (OCC) declined between 2016 and 2018, too, reports in The Wall Street Journal said. ” Other critics have raised the issue that the OCC is advising examiners to take community group concerns into consideration separately from their M&A approval processes.

PYMNTS

SEPTEMBER 21, 2020

Separately, last month, five federal regulatory agencies – including the Federal Reserve System, the Federal Deposit Insurance Corporation (FDIC), the Financial Crimes Enforcement Network (FinCEN), the National Credit Union Administration (NCUA) and the Office of the Comptroller of the Currency (OCC) – issued a joint statement designed to address questions (..)

FICO

MAY 6, 2019

The Federal Reserve, OCC and FDIC have all recognized the importance of such careful monitoring, and issued regulatory guidance (SR 11-7 and OCC 11-12) that requires lenders to validate their models annually. Shift in Odds to Score ? Score Inflation.

FICO

DECEMBER 20, 2018

We began to see a resurgence in small-dollar lending in 2018 with new regulatory guidance from the OCC and FDIC encouraging banks to compete with payday lenders. Payday Lenders Will Face More Robust Competition. small-dollar lending market.

FICO

OCTOBER 4, 2016

The Act requires federal banking agencies (the OCC, FDIC and Federal Reserve – “Agencies”) to conduct periodic reviews of each depository institution’s efforts in this area. CRA regulations provide various methods of evaluating bank performance, corresponding to differences in institutions’ asset sizes, structures and operations.

PYMNTS

FEBRUARY 15, 2019

Those agencies include the aforementioned FinCEN, the Federal Reserve , the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA) and the Office of the Comptroller of the Currency (OCC).

PYMNTS

DECEMBER 18, 2018

Those agencies include the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation (FDIC), the Financial Crimes Enforcement Network (FinCEN) and the National Credit Union Administration.

FICO

JANUARY 6, 2020

We began to see a resurgence in small-dollar lending in 2018 with new regulatory guidance from the OCC and FDIC encouraging banks to compete with payday lenders.”. Payday Lenders Will Face More Robust Competition. “We Read the full post. Chartis: FICO Is a Category Leader in AI for Financial Services.

PYMNTS

DECEMBER 14, 2018

Among those agencies, alphabetically speaking: the Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation (FDIC), the Financial Crimes Enforcement Network (FinCEN) and the National Credit Union Administration.

Fintech Labs Insights

SEPTEMBER 3, 2020

You’d think that Jiko was looking to leverage FDIC insurance to put its customers at ease. Technically not insured, but if T-bills go down, FDIC insurance will probably be insolvent as well. However, they have likely raised more to make the OCC happy as well as pay their 23 person team. But that’s not the current plan.

PYMNTS

NOVEMBER 9, 2017

The proposal by the OCC was made at a banking conference in New York. It (industrial loan charter) does allow us to engage more directly with regulatory bodies, so it’s great to hear that comment coming today from the OCC,” said Sarah Friar, the chief financial officer of Square.

PYMNTS

MAY 24, 2016

Banks and credit unions have been warned off high-risk, non-secured debt of the kind on display with short-term lending by both the FDIC and the Office of the Comptroller, and trying to bring them into the market isn’t straightforward. ” But, Bourke notes, the CFPB rule could do more here if well-formed.

Payments Source

DECEMBER 31, 2019

With fintech firms seemingly stuck in neutral in their efforts to gain banking charters, alternative state licensing options could get another look in 2020.

Payments Source

APRIL 8, 2019

Community banks are open to working with innovative financial startups, but regulators must ensure they face the same oversight standards as traditional banks.

Payments Source

NOVEMBER 16, 2018

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

CB Insights

DECEMBER 4, 2019

The 2017 FDIC National Survey of Unbanked and Underbanked Households shows: Approximately 6.5% News that the firms are connecting with financial regulators suggests that regulations are not an inhibitor, but rather just an obstacle, and meeting with the OCC is one way to get the conversation going to overcome it. adults and 6.4M

PYMNTS

OCTOBER 31, 2017

If the Office of the Comptroller of the Currency (OCC)’s idea is approved, it means the government watchdog can treat Wells Fargo and other big banks with more leniency if they are hit with sanctions down the road. Noreika has been advocating easing the sanctions slapped on Wells Fargo since he took control of the OCC in May, noted Reuters.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content