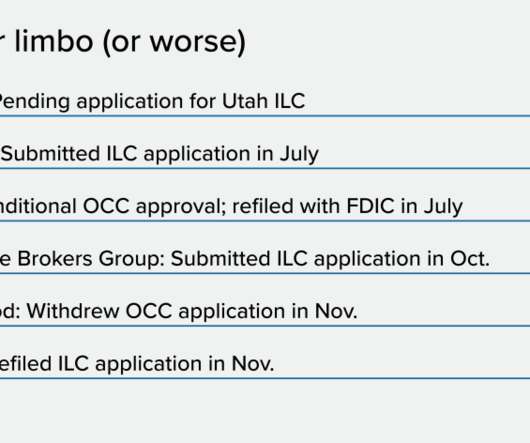

Fed, OCC, FDIC issue joint warning on crypto risks

Payments Dive

JANUARY 4, 2023

The regulators didn't go so far as to create new rules around bank-crypto partnerships, but said they're "continuing to assess" if — and how — such tie-ups can proceed safely.

Let's personalize your content