Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

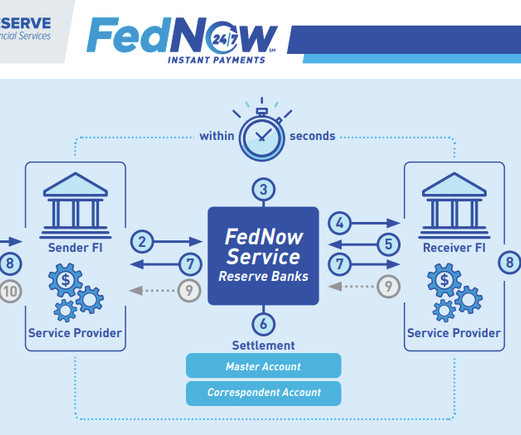

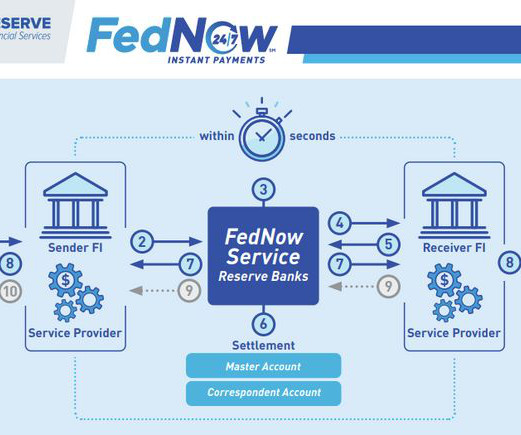

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

JULY 14, 2022

The Federal Reserve plans to unleash a U.S. real-time payments system next year in the form of FedNow, but it’s an open question as to whether, or how, consumers and businesses will adopt instant payments.

Payments Dive

FEBRUARY 23, 2023

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

Payments Dive

JULY 10, 2023

The Federal Reserve in July is launching the FedNow Service, an instant-payment service that will help banks and other financial institutions better serve consumers and businesses.

Payments Dive

JULY 16, 2024

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

Payments Dive

AUGUST 5, 2024

The Federal Reserve instant payments system may cut fees after it attracts more financial institutions, or in the face of competition, a Wolfe Research analyst said, citing a FedNow official.

Payments Source

SEPTEMBER 22, 2020

As the Federal Reserve's FedNow instant payments and settlement system enters into testing and use-case development phases, an emphasis on speed to market, ubiquity and compatibility with other systems remains in the forefront.

Payments Dive

JUNE 28, 2023

The Federal Reserve’s new instant payments system is confronting disinformation as it gears up for a launch, likely late next month.

PYMNTS

AUGUST 5, 2019

The Federal Reserve has officially announced it will create a real-time payments service, to be called FedNow. The move was described by Kansas Federal Reserve President Esther George as the biggest infrastructure upgrade embraced by the Federal Reserve since the ACH system went online in 1972.

Faster Payments Council

SEPTEMBER 6, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? While 'receive-only' instant payments is a significant step forward, the true transformative power lies in actively sending payments. The stakes are certainly high. It's time to lead the charge. Register

Faster Payments Council

AUGUST 23, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? While 'receive-only' instant payments is a significant step forward, the true transformative power lies in actively sending payments. The stakes are certainly high. It's time to lead the charge. Register

PYMNTS

MAY 6, 2020

The Federal Reserve has formed a FedNow Community group for its upcoming instant payment offering, the FedNow Service , and needs volunteers to support it, the Fed announced Wednesday (May 6). Montgomery, Federal Reserve Bank of Boston first vice president, in a statement.

Payments Dive

SEPTEMBER 28, 2022

Jessica Cheney, a vice president at Bottomline Technologies, aims to dispel myths about the meaning and impact of the coming Federal Reserve instant payment system.

Payments Dive

MARCH 3, 2023

real-time services for customers with the mid-year launch of the Federal Reserve instant payments system. The companies are gearing up to add U.S.

Payments Dive

NOVEMBER 8, 2023

Jack Henry & Associates recorded an increase in the number of customers connected to the new Federal Reserve instant payments system, but they’re all in receive-only mode.

Tearsheet

FEBRUARY 16, 2024

Mastercard recently expanded collaboration with The Clearing House (TCH), with the shared goal of propelling the adoption of instant payments. This extended partnership will focus on integrating additional instant payment use cases across a range of payment flows for consumers, businesses, and governments.

Bank Automation

AUGUST 28, 2024

ATLANTA — Instant payments rail FedNow is nearing the addition of its 1,000th financial institution, and the Federal Reserve credits the growing adoption to its network of fintechs that enable the integration.

PYMNTS

AUGUST 6, 2019

The Fed plans to build its own instant clearing and settlement rails. But, as Karen Webster observed in a commentary earlier this year — yesterday’s announcement makes concrete something that the Federal Reserve has been signaling increasingly clearly for the last five years. Why Now For FedNow. It’s now official.

Fintech Finance

MARCH 15, 2024

Federal Reserve Financial Services (FRFS) has introduced the new FedNow User Group to continue promoting collaboration among the 607 participating financial institutions and their service providers on the FedNow Service network.

Payments Dive

AUGUST 20, 2024

The two big banks say they’ll soon connect to the Federal Reserve’s new instant payment system, even as other major banks remain on the sidelines.

PYMNTS

OCTOBER 12, 2020

There is no dearth of faster payments initiatives — and no certainty that there will be one faster payments scheme to rule them all. Along the way, not surprisingly, we’ll transition more fully to digital payments across modernized (and streamlined) rails, flowing domestically and eventually across borders.

Fintech Finance

AUGUST 15, 2024

Modern Treasury , essential infrastructure for the new era of payments, has announced that it has expanded instant payments support for mutual customers of six leading banks — Bank of America, Cross River, JPMorgan Chase, PNC Financial Services, U.S. Instant payments, powered by the first new payment rails in the U.S.

Fintech Finance

JUNE 25, 2024

(“Finzly”), a leader in innovative payment and financial solutions, today announced a partnership with Frost Bank , a subsidiary of Cullen/Frost Bankers, Inc. headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow® and The Clearing House’s RTP®.

Payments Dive

DECEMBER 15, 2023

The Federal Reserve is weighing additional fraud-fighting tools as it takes feedback from users of the new instant payments system.

Payments Dive

AUGUST 16, 2024

The Federal Reserve is still seeking to allay financial institutions' concerns that faster payments allowed by the new instant payments system could lead to faster fraud.

Fintech Finance

AUGUST 22, 2024

As an early adopter of Adyen’s Cash Out feature, InvoiceASAP is able to offer their users instant access to pending funds, bypassing the usual multi-day waiting period. Adyen gives us access to the most advanced payment products and tools, including FedNow for Instant Deposits.” ” said Paul Hoeper, CEO.

PYMNTS

AUGUST 9, 2020

Not everyone favors the Federal Reserve Board’s launch of its settlement service designed to eliminate the three-day check clearing and support instant payments in the U.S. For the most part, the comments said the introduction of the FedNow would lead to less innovation and unfair competition with the private sector.

Faster Payments Council

AUGUST 23, 2024

In response, the Federal Reserve formed a scams definition and classification work group of payments and fraud experts to provide a more consistent foundation for scams reporting to help the payments industry better understand and mitigate the problem. 14 seconds.

Payments Dive

APRIL 25, 2024

The Federal Reserve aimed to “not upset the marketplace as a second mover” when it set fees for the new instant payments system last year, a Fed official said Wednesday.

Bank Automation

JULY 11, 2024

Adoption of the Federal Reserve’s instant payments platform, FedNow, is growing, however, of the more than 800 financial institutions using it, most are doing so in receive-only mode.

PYMNTS

AUGUST 7, 2020

For the Federal Reserve, real-time payments will take time — three or four years’ time, to be specific. Federal Reserve Board members this week shed some light on the timing and mechanics of FedNow — an always-on, fully interoperable interbank-settlement service that will give rise to instant payments in the United States.

Payments Dive

NOVEMBER 7, 2022

Federal Reserve banks introducing the new instant payments system next year will jettison customer transfer and participation fees for the launch.

PYMNTS

AUGUST 14, 2020

A week after details of the Federal Reserve’s instant payment initiative emerged, news came via Bloomberg that the central bank is working with the Massachusetts Institute of Technology (MIT) to explore the possibility of issuing digital currency.

Bank Automation

OCTOBER 4, 2024

As real-time payments become integral to growth strategies, small financial institutions are increasingly signing on with instant payment rail FedNow to boost transaction volume and improve efficiency.

Payments Source

OCTOBER 9, 2019

The Federal Reserve’s FedNow instant payments system will dramatically speed up payment processing, essentially allowing people and businesses to receive money in their accounts within seconds of a transaction, says the Retail Industry Leaders Association's Austen Jensen.

PYMNTS

SEPTEMBER 17, 2019

And for good reason, Ingo Money CEO Drew Edwards noted in a recent conversation with Karen Webster and Ingo Executive Vice President and Chief Product Officer Lisa McFarland — instant payments present a world of interesting possibilities for creating better consumer experiences across a wide range of uses. Edwards said.

NACHA

JULY 20, 2023

Herndon, VA – Today, Nacha President and CEO Jane Larimer released the following statement in response to the Federal Reserve announcing its FedNow Service is now live: “Nacha congratulates the Federal Reserve on the launch of FedNow.

The Fintech Times

JULY 24, 2024

Last year, the US Federal Reserve launched FedNow as a competitive alternative for instant payments in the US. Celebrating its first birthday, we review how the instant payments service has been adopted over the past year. Are instant payment methods becoming more mainstream in the US?

The Paypers

JULY 21, 2023

The Federal Reserve has announced that the FedNow Service, its new system for instant payments, has gone live in the US.

Segpay

JUNE 13, 2024

What is FedNow? Last year, the Federal Reserve launched FedNow, an instant payment service expected to revolutionize the US payment landscape. The Federal Reserve’s goal is to achieve wide adoption of FedNow over time, much like the Fedwire ® Funds Service and FedACH ® Services.

Finovate

OCTOBER 15, 2024

The company launched the new entity, Payfinia , to provide instant payment solutions to both financial institutions and third-party organizations. Payfinia aims to help financial institutions access and establish ownership of their instant payments services.

Finovate

OCTOBER 16, 2024

FedNow, the U.S. Federal Reserve’s instant payment service went live in July of 2023. Now, 15 months later, adoption rates have been unpredictably slow, especially when it comes to banks that are able to send FedNow payments. Of the FedNow participants, 78% are community banks and credit unions.

Fintech Finance

MARCH 28, 2024

Introduced in July 2023, the FedNow service was launched for US banks to provide a new instant payments infrastructure across the country. Our show above includes ‘real-time’ perspectives on this ever-evolving area of payments.

PYMNTS

AUGUST 10, 2020

But it might not be the Federal Reserve ’s doing. You’d be forgiven for thinking that faster payments might be the purview of the U.S. Federal Reserve, where details (a roadmap, really) of FedNow , the proposed instant payment system, were released earlier this month.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content