Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

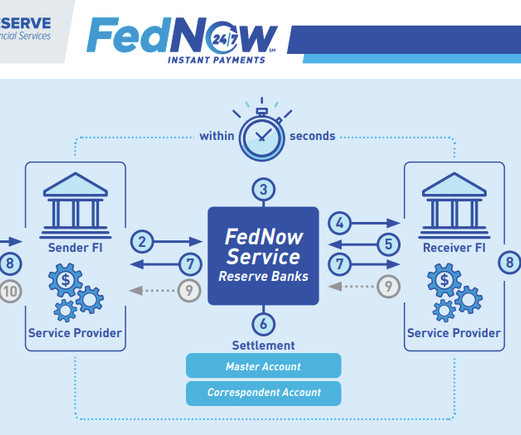

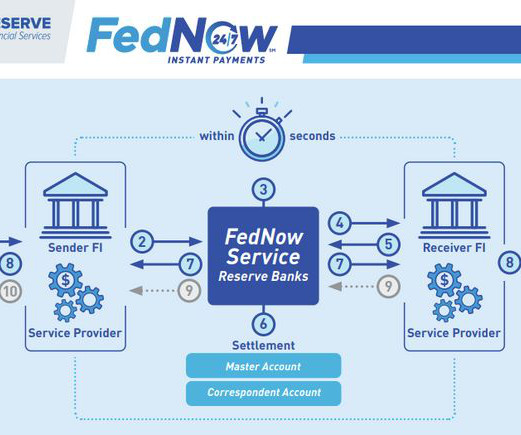

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

AUGUST 5, 2024

The Federal Reserve instant payments system may cut fees after it attracts more financial institutions, or in the face of competition, a Wolfe Research analyst said, citing a FedNow official.

Faster Payments Council

SEPTEMBER 6, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? While 'receive-only' instant payments is a significant step forward, the true transformative power lies in actively sending payments. The stakes are certainly high. It's time to lead the charge. Register

Payments Dive

JULY 10, 2023

The Federal Reserve in July is launching the FedNow Service, an instant-payment service that will help banks and other financial institutions better serve consumers and businesses.

Faster Payments Council

AUGUST 23, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? While 'receive-only' instant payments is a significant step forward, the true transformative power lies in actively sending payments. The stakes are certainly high. It's time to lead the charge. Register

Fintech Finance

MARCH 15, 2024

Federal Reserve Financial Services (FRFS) has introduced the new FedNow User Group to continue promoting collaboration among the 607 participating financial institutions and their service providers on the FedNow Service network.

Payments Dive

FEBRUARY 23, 2023

As the Federal Reserve prepares for a mid-year launch of its instant payments system, FedNow, it’s zeroing in on anti-fraud tools to protect users.

Payments Dive

JULY 16, 2024

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

Payments Dive

JULY 14, 2022

The Federal Reserve plans to unleash a U.S. real-time payments system next year in the form of FedNow, but it’s an open question as to whether, or how, consumers and businesses will adopt instant payments.

Bank Automation

AUGUST 28, 2024

ATLANTA — Instant payments rail FedNow is nearing the addition of its 1,000th financial institution, and the Federal Reserve credits the growing adoption to its network of fintechs that enable the integration.

Bank Automation

OCTOBER 4, 2024

As real-time payments become integral to growth strategies, small financial institutions are increasingly signing on with instant payment rail FedNow to boost transaction volume and improve efficiency.

PYMNTS

AUGUST 5, 2019

The Federal Reserve has officially announced it will create a real-time payments service, to be called FedNow. The move was described by Kansas Federal Reserve President Esther George as the biggest infrastructure upgrade embraced by the Federal Reserve since the ACH system went online in 1972.

Fintech Finance

JUNE 25, 2024

(“Finzly”), a leader in innovative payment and financial solutions, today announced a partnership with Frost Bank , a subsidiary of Cullen/Frost Bankers, Inc. headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow® and The Clearing House’s RTP®.

Payments Dive

JUNE 28, 2023

The Federal Reserve’s new instant payments system is confronting disinformation as it gears up for a launch, likely late next month.

Finovate

OCTOBER 15, 2024

The company launched the new entity, Payfinia , to provide instant payment solutions to both financial institutions and third-party organizations. Payfinia aims to help financial institutions access and establish ownership of their instant payments services.

Fintech Finance

AUGUST 22, 2024

As an early adopter of Adyen’s Cash Out feature, InvoiceASAP is able to offer their users instant access to pending funds, bypassing the usual multi-day waiting period. Adyen gives us access to the most advanced payment products and tools, including FedNow for Instant Deposits.” ” said Paul Hoeper, CEO.

Payments Dive

NOVEMBER 8, 2023

Jack Henry & Associates recorded an increase in the number of customers connected to the new Federal Reserve instant payments system, but they’re all in receive-only mode.

Fintech Finance

AUGUST 15, 2024

Modern Treasury , essential infrastructure for the new era of payments, has announced that it has expanded instant payments support for mutual customers of six leading banks — Bank of America, Cross River, JPMorgan Chase, PNC Financial Services, U.S. Instant payments, powered by the first new payment rails in the U.S.

The Paypers

JULY 21, 2023

The Federal Reserve has announced that the FedNow Service, its new system for instant payments, has gone live in the US.

PYMNTS

MAY 6, 2020

The Federal Reserve has formed a FedNow Community group for its upcoming instant payment offering, the FedNow Service , and needs volunteers to support it, the Fed announced Wednesday (May 6). Montgomery, Federal Reserve Bank of Boston first vice president, in a statement.

Payments Dive

AUGUST 20, 2024

The two big banks say they’ll soon connect to the Federal Reserve’s new instant payment system, even as other major banks remain on the sidelines.

Payments Source

SEPTEMBER 22, 2020

As the Federal Reserve's FedNow instant payments and settlement system enters into testing and use-case development phases, an emphasis on speed to market, ubiquity and compatibility with other systems remains in the forefront.

Finovate

OCTOBER 16, 2024

FedNow, the U.S. Federal Reserve’s instant payment service went live in July of 2023. Now, 15 months later, adoption rates have been unpredictably slow, especially when it comes to banks that are able to send FedNow payments. Of the FedNow participants, 78% are community banks and credit unions.

Payments Dive

AUGUST 16, 2024

The Federal Reserve is still seeking to allay financial institutions' concerns that faster payments allowed by the new instant payments system could lead to faster fraud.

Payments Dive

MARCH 3, 2023

real-time services for customers with the mid-year launch of the Federal Reserve instant payments system. The companies are gearing up to add U.S.

Bank Automation

JULY 11, 2024

Adoption of the Federal Reserve’s instant payments platform, FedNow, is growing, however, of the more than 800 financial institutions using it, most are doing so in receive-only mode.

Payments Dive

SEPTEMBER 28, 2022

Jessica Cheney, a vice president at Bottomline Technologies, aims to dispel myths about the meaning and impact of the coming Federal Reserve instant payment system.

Tearsheet

FEBRUARY 16, 2024

Mastercard recently expanded collaboration with The Clearing House (TCH), with the shared goal of propelling the adoption of instant payments. This extended partnership will focus on integrating additional instant payment use cases across a range of payment flows for consumers, businesses, and governments.

Segpay

JUNE 13, 2024

What is FedNow? Last year, the Federal Reserve launched FedNow, an instant payment service expected to revolutionize the US payment landscape. The Federal Reserve’s goal is to achieve wide adoption of FedNow over time, much like the Fedwire ® Funds Service and FedACH ® Services.

The Fintech Times

JULY 24, 2024

Last year, the US Federal Reserve launched FedNow as a competitive alternative for instant payments in the US. Celebrating its first birthday, we review how the instant payments service has been adopted over the past year. Are instant payment methods becoming more mainstream in the US?

NACHA

JULY 20, 2023

Herndon, VA – Today, Nacha President and CEO Jane Larimer released the following statement in response to the Federal Reserve announcing its FedNow Service is now live: “Nacha congratulates the Federal Reserve on the launch of FedNow.

Payments Dive

APRIL 25, 2024

The Federal Reserve aimed to “not upset the marketplace as a second mover” when it set fees for the new instant payments system last year, a Fed official said Wednesday.

Payments Dive

DECEMBER 15, 2023

The Federal Reserve is weighing additional fraud-fighting tools as it takes feedback from users of the new instant payments system.

Fintech Finance

MARCH 28, 2024

Introduced in July 2023, the FedNow service was launched for US banks to provide a new instant payments infrastructure across the country. Our show above includes ‘real-time’ perspectives on this ever-evolving area of payments.

Fi911

AUGUST 1, 2023

An innovative payment service has just made its debut in the finance sector. The US Federal Reserve has introduced FedNow ; a new instant payment platform that will facilitate transactions at any given time. What is FedNow? FedNow is the Federal Reserve’s innovative real-time payment service.

Payment Savvy

MAY 15, 2023

The Federal Reserve Bank is currently developing a new instant payment service called “FedNow” that will allow financial institutions to make instant payments. The FedNow Service will begin operating in July 2023 and it is the first U.S.

Faster Payments Council

AUGUST 23, 2024

In response, the Federal Reserve formed a scams definition and classification work group of payments and fraud experts to provide a more consistent foundation for scams reporting to help the payments industry better understand and mitigate the problem. 14 seconds.

Finovate

APRIL 2, 2024

Banks in the Treasury Prime network will be able to offer their BaaS clients access to a real-time payment platform via Narmi’s FedNow service. Under the agreement, Narmi will act as the service provider for FedNow. Founded in 2017, Treasury Prime helps banks become partner banks by building an embedded banking platform.

Payments Dive

NOVEMBER 7, 2022

Federal Reserve banks introducing the new instant payments system next year will jettison customer transfer and participation fees for the launch.

PYMNTS

AUGUST 9, 2020

Not everyone favors the Federal Reserve Board’s launch of its settlement service designed to eliminate the three-day check clearing and support instant payments in the U.S. For the most part, the comments said the introduction of the FedNow would lead to less innovation and unfair competition with the private sector.

Fintech Finance

JANUARY 30, 2024

Finzly , the pioneering provider of modern payment infrastructure for financial institutions, today published a report that includes polling results of bank executives’ expectations for profitability from offering instant payments using FedNow. 29% mentioned embedding instant payments into third-party systems.

The Paypers

JULY 26, 2023

Cloud-native account-to-account (A2A) platform Form3 has completed testing and certification for the FedNow Service, the Federal Reserve’s instant payment offering.

The Paypers

JULY 10, 2023

Financial services technology company FIS has completed testing and certification for the FedNow Service, the Federal Reserve’s instant payment service.

The Paypers

JULY 14, 2023

Financial technology platform Adyen has completed testing and certification for the FedNow Service, the Federal Reserve’s instant payment infrastructure launching in July 2023.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content