RTP takes on FedNow

Payments Dive

JULY 31, 2023

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

JULY 31, 2023

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

Bank Automation

NOVEMBER 5, 2024

First International Bank and Trust is expanding its real-time payments options to boost revenue and meet customer demand. The Wadford City, N.D.-based

Bank Automation

MAY 24, 2024

The Clearing House’s Real Time Payments network and The Federal Reserve’s FedNow network are prepared to tackle interoperability eventually — but for now, its value remains minimal.

Fintech Finance

JULY 30, 2024

AppBrilliance , a pioneer in real-time payment solutions with its cutting-edge Money API platform, is leveraging a recent rule change by The Clearing House to expand use-cases for Real Time Payments (RTP) to closed-loop digital wallets in the US.

Bank Automation

MAY 13, 2024

Adoption is ticking up for The Clearing House’ Real Time Payments network and the Federal Reserve’s FedNow payments rail as financial institutions add payment services to their platforms. The RTP network has more than 500 institutions on its network, according to The Clearing House’s website.

Payments Dive

DECEMBER 13, 2023

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

Fintech Finance

OCTOBER 23, 2024

Powered by AWS, the Finzly BankOS platform integrates the FedNow service seamlessly with FIs’ core and digital banking systems. Finzly’s Digital Galaxy enhances this offering by providing a comprehensive digital banking experience, enabling businesses and consumers to send, receive, and request instant payments.

Fintech Finance

JUNE 25, 2024

(“Finzly”), a leader in innovative payment and financial solutions, today announced a partnership with Frost Bank , a subsidiary of Cullen/Frost Bankers, Inc. headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow® and The Clearing House’s RTP®.

Bank Automation

FEBRUARY 13, 2024

The Federal Reserve’s FedNow payments network, launched nearly seven months ago, has signed up almost as many financial institutions as The Clearing House’s Real Time Payments platform has in seven years.

Bank Automation

MAY 6, 2024

The Clearing House’s Real Time Payments’ network is gaining mid-market companies as businesses gravitate toward real-time payments. Businesses prefer The Clearing House’s RTP solution because it is established and is used by nearly 67% of U.S.

Bank Automation

JANUARY 24, 2024

Mastercard extended its collaboration with The Clearing House today to allow customers and businesses to use real-time payments. Mastercard will be the exclusive instant payments software provider for The Clearing House’s (TCH) RTP network, according to a news release from Mastercard.

Bank Automation

APRIL 4, 2024

ACI Worldwide is exploring the use of its cloud platform to onboard bank clients to The Clearing House’s Real-Time Payments network.

The Paypers

AUGUST 23, 2024

US-based Affinity Plus Federal Credit Union has announced the launch of a new real-time payment solution via the FedNow and RTP networks to enable members to access funds instantly.

PYMNTS

NOVEMBER 25, 2020

The tipping point toward real-time payments’ ubiquity might be closer than many observers think, Mark Ranta , payments practice lead at FinTech Alacriti , told PYMNTS in a recent interview. Ranta said RTP is already past the “early adopter” stage and moving into the “fast follower” phase of its evolution.

Payments Dive

NOVEMBER 14, 2023

The new hire is tasked with boosting adoption of The Clearing House’s RTP real-time payments system, as the new rival Federal Reserve FedNow system seeks to attract clients.

Finovate

MARCH 8, 2024

Sila has partnered with Trice to leverage the company’s safeguards for instant payments. Sila combines FedNow and The Clearinghouse’s RTP to allow ACH transactions to be settled in seconds. There has been some movement in the instant payments world this week.

Finovate

MARCH 4, 2024

Though The Bancorp Bank, Galileo will leverage The Clearing House’s Real Time Payments network to offer real-time payments to help its retail and commercial clients transfer money in real time, 24-hours a day. The Clearing House competes directly with the U.S.

Payments Dive

JULY 11, 2024

The real-time payments system has been growing its roster of banks and credit unions, as it newly competes with the Federal Reserve’s FedNow payments system.

PYMNTS

AUGUST 10, 2020

You’d be forgiven for thinking that faster payments might be the purview of the U.S. Federal Reserve, where details (a roadmap, really) of FedNow , the proposed instant payment system, were released earlier this month. But it might not be the Federal Reserve ’s doing. New Trends Emerging. Jack Henry … And Aiming For Ubiquity.

Finovate

OCTOBER 16, 2024

FedNow, the U.S. Federal Reserve’s instant payment service went live in July of 2023. Now, 15 months later, adoption rates have been unpredictably slow, especially when it comes to banks that are able to send FedNow payments. Of the FedNow participants, 78% are community banks and credit unions.

Fintech Finance

NOVEMBER 13, 2024

Using the FedNow service and the Real Time Payment (RTP) network, recipients can conveniently receive cash deposits in minutes, initiated at thousands of locations across the United States, and received into accounts at over 820 banks that are enrolled in FedNow or RTP.

The Fintech Times

JULY 24, 2024

Last year, the US Federal Reserve launched FedNow as a competitive alternative for instant payments in the US. Celebrating its first birthday, we review how the instant payments service has been adopted over the past year. However there is one difference: FedNow is primarily targeted at banks – not at consumers.

Tearsheet

FEBRUARY 16, 2024

“Beyond extending our partnership with Mastercard, we intend to partner on innovating for the banks that use the network by looking for additional use cases that they’ve expressed interest in and that would help drive volume across RTP,” said Lee Alexander, Executive VP and CIO at The Clearing House. This encompasses a variety of aspects.

Fintech Finance

SEPTEMBER 13, 2024

This comprehensive guideline provides essential insights and best practices for financial institutions (FIs) as they navigate the complex landscape of instant payments. With contributions from industry experts, the guideline aims to help FIs enhance their operational readiness for real-time payments, including RTP® and FedNow®.

Segpay

JUNE 13, 2024

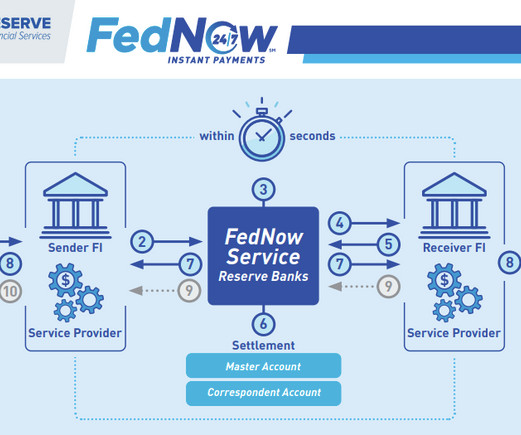

What is FedNow? Last year, the Federal Reserve launched FedNow, an instant payment service expected to revolutionize the US payment landscape. The Federal Reserve’s goal is to achieve wide adoption of FedNow over time, much like the Fedwire ® Funds Service and FedACH ® Services. No ‘pass-through’ fees.

Fintech Finance

APRIL 4, 2024

Trustly , a global leader in Open Banking Payments, and Cross River Bank (“Cross River”), a technology infrastructure provider that offers embedded financial solutions, are proud to expand their collaboration in instant payments with the addition of the FedNow® Service.

Payment Savvy

MAY 15, 2023

The Federal Reserve Bank is currently developing a new instant payment service called “FedNow” that will allow financial institutions to make instant payments. The FedNow Service will begin operating in July 2023 and it is the first U.S. Accessibility FedNow aims to be available to everyone.

PYMNTS

JULY 22, 2020

Yet for many entities, the concept of implementing real-time processing across an entire system can feel overwhelming complex. As real-time payment infrastructure grows more sophisticated, technology presents an opportunity for organizations to mitigate the adoption hurdle. ” Becoming More Adaptive.

PYMNTS

SEPTEMBER 27, 2019

The Federal Reserve’s buildup to faster payments innovation came to a head in August when it announced FedNow , its proposed real-time payments infrastructure under the draft Payments Modernization Act of 2019. payments ecosystem. payments ecosystem.

FICO

AUGUST 26, 2021

As it happens, there’s a lot more happening in the real-time payments arena than just PayPal, Venmo and Zelle. Let’s take a look at the current trends, with a focus on the US, and how banks can better arm themselves to fight fraud in this rapidly growing payments channel. in addressable payment volume.

Bank Automation

JANUARY 2, 2024

Industry experts predict adoption of real-time payments as well as the increased use of FedNow and digital wallets in 2024 as consumer demand for instant payments continues to grow. “We are now seeing a major shift in this direction for real-time payments and can expect to see this continue into 2024,” Zur Yahalom, senior […]

PYMNTS

AUGUST 3, 2020

More recently, Visa issued public support of bitcoin and other digital assets in a July blog post that similarly highlighted opportunities in real-time payments. “That day made an earthquake in digital assets, because to me, it takes the narrative off the table that the government is going to ban bitcoin,” she said.

FICO

FEBRUARY 19, 2020

The Clearing House Association announced in January 2020 that on February 1 st the limit for a single transaction using their RTP scheme will increase from it’s current $25,000 to $100,000. US payment schemes operate in a uniquely competitive environment. How RealTime Payments Impact Financial Crime.

PYMNTS

NOVEMBER 18, 2020

Banks have been playing catch-up with FinTechs in the bid to bring speed to their processes, especially when it comes to B2B payments. The conversation came across a backdrop of more than 50 real-time payment systems currently live around the world, although largely domestic and regional in nature. That said, the U.S.

The Fintech Times

JANUARY 19, 2024

Financial firms in the US are highly interested in faster payment networks, with 78 per cent saying it is a ‘must-have’ for their organisation; according to Volante Technologies , the payments-as-a-service (PaaS) firm.

PYMNTS

AUGUST 6, 2019

Introduced on Monday by Federal Reserve Board Governor Lael Brainard, the Fed’s instant payment scheme FedNow is designed to offer an option for consumers and business to transfer money instantly or nearly instantly in a “ubiquitous, safe and efficient” manner from one bank account to another. “We Why Now For FedNow.

PYMNTS

MARCH 9, 2020

Payment scheme providers must consider how to encourage adoption, especially if operating in countries lacking a government mandate for financial institutions (FIs) to sign on. Banking association and payments company The Clearing House (TCH) has been confronting such concerns as it advances its real-time payment ( RTP ) offering in the U.S.,

The Fintech Times

MAY 7, 2024

Across much of the world, instant payments have quickly become the norm. In fact, less than a third of US banks are signed up to either RTP or FedNow , meaning the vast majority cannot offer instant payments as a service; new research from RedCompass Labs , the payments modernisation company, has revealed.

Finovate

OCTOBER 21, 2024

Mastercard’s launch competes with Visa’s real-time payments solution called Visa Direct , which enables fast and secure money movement to different endpoints across the globe. Photo by Lea L on Unsplash

Faster Payments Council

AUGUST 23, 2024

It's time to confront the harsh reality—innovation alone doesn't drive broad adoption. However, a recent survey by FPC and Finzly reveals a stark reality: two-thirds of financial institutions lack the capability to 'send' instant payments. Strategic shifts are required to unlock the full potential.

Finovate

OCTOBER 15, 2024

Payfinia hinges on Tyfone’s Instant Payment Xchange (IPX), a money movement gateway to FedNow that will serve as Payfinia’s flagship offering. Tyfone launched its IPX platform in July 2023, in conjunction with the Federal Reserve’s FedNow instant payment service.

PYMNTS

OCTOBER 12, 2020

There is no dearth of faster payments initiatives — and no certainty that there will be one faster payments scheme to rule them all. Along the way, not surprisingly, we’ll transition more fully to digital payments across modernized (and streamlined) rails, flowing domestically and eventually across borders. The Timeframe .

Fintech Finance

JULY 24, 2024

In his role at BNY, he is responsible for the Treasury Services commercial platform, delivering Payments, Trade & Cash Management solutions to clients globally. Carl also represents BNY on the Board of Directors for Nacha and The Clearing House Payments Company.

Finovate

SEPTEMBER 20, 2024

Bloomberg unveiled this week that, while the retailer has offered pay-by-bank via Walmart Pay for a few months now, the payments were routed through ACH payment rails and still took days to clear. Leveraging Fiserv to power real time payments is an important move for Walmart as it enters the pay-by-bank game.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content