RTP takes on FedNow

Payments Dive

JULY 31, 2023

the rivalry between RTP and FedNow could get intense, but maybe not. As the only two real-time payments rails in the U.S.,

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

JULY 31, 2023

the rivalry between RTP and FedNow could get intense, but maybe not. As the only two real-time payments rails in the U.S.,

Bank Automation

NOVEMBER 5, 2024

-based bank is adding real-time payments to its BaaS and payments arm, Kotapay, which offers instant payments for payrolls and bills, Trent Sorbe, chief payments officer at First International Bank and Trust (FIBT) and […] The post Why FIBT is joining FedNow and RTP appeared first on Bank Automation News.

Bank Automation

MAY 13, 2024

Adoption is ticking up for The Clearing House’ Real Time Payments network and the Federal Reserve’s FedNow payments rail as financial institutions add payment services to their platforms. The RTP network has more than 500 institutions on its network, according to The Clearing House’s website.

Bank Automation

MAY 24, 2024

The Clearing House’s Real Time Payments network and The Federal Reserve’s FedNow network are prepared to tackle interoperability eventually — but for now, its value remains minimal.

Faster Payments Council

SEPTEMBER 6, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? Join us for an upcoming FPC webinar, sponsored by Finzly, on Wednesday, September 18 from 12:00pm-1:00pmET.

Faster Payments Council

AUGUST 16, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? Join us for an upcoming FPC webinar, sponsored by Finzly, on Wednesday, September 18 from 12:00pm-1:00pmET. Register

Bank Automation

NOVEMBER 30, 2023

Financial institutions may consider which payment rails to integrate — whether RTP or FedNow — but the right answer might be both. “I recommend to financial institutions that if they’re going to just receive, do both rails,” Jeff Bucher, senior product manager for money movement solutions at Alkami Technology, tells Bank Automation News on […] (..)

Faster Payments Council

AUGUST 23, 2024

Is your financial institution fully harnessing the potential of RTP® and FedNow® to drive growth? Join us for an upcoming FPC webinar, sponsored by Finzly, on Wednesday, September 18 from 12:00pm-1:00pmET.

Payments Dive

DECEMBER 13, 2023

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

Fintech Finance

JULY 30, 2024

AppBrilliance , a pioneer in real-time payment solutions with its cutting-edge Money API platform, is leveraging a recent rule change by The Clearing House to expand use-cases for Real Time Payments (RTP) to closed-loop digital wallets in the US.

Finextra

JUNE 25, 2024

headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow and The Clearing House’s RTP®.

Payments Dive

JULY 16, 2024

The Federal Reserve’s nascent instant payments system has collected hundreds of bank participants across the country in its first year of operations, although a few major banks are holdouts.

Fintech Finance

JUNE 25, 2024

headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow® and The Clearing House’s RTP®. As of February 2024, over 470 banks and credit unions are participating in the FedNow network.

Fintech Finance

OCTOBER 23, 2024

Powered by AWS, the Finzly BankOS platform integrates the FedNow service seamlessly with FIs’ core and digital banking systems. A recent US Faster Payments Council survey found that nearly 75% of financial institutions see legacy systems as a barrier to using FedNow.

Bank Automation

FEBRUARY 13, 2024

The Federal Reserve’s FedNow payments network, launched nearly seven months ago, has signed up almost as many financial institutions as The Clearing House’s Real Time Payments platform has in seven years.

The Nilson Report

JULY 12, 2024

The post Frost Bank Taps Finzly to Provide FedNow and RTP Instant Payments to its Business Clients and Consumers appeared first on Nilson Report.

Bank Automation

MAY 6, 2024

Businesses prefer The Clearing House’s RTP solution because it is established and is used by nearly 67% of U.S. financial institutions, compared with the 22% utilizing the Federal Reserve’s FedNow solution for real-time payments, Michael Cummins, executive vice […]

Bank Automation

JANUARY 24, 2024

Mastercard will be the exclusive instant payments software provider for The Clearing House’s (TCH) RTP network, according to a news release from Mastercard. TCH’s RTP network has been gaining traction since the launch of FedNow, with more […]

Finovate

OCTOBER 16, 2024

FedNow, the U.S. Now, 15 months later, adoption rates have been unpredictably slow, especially when it comes to banks that are able to send FedNow payments. Close to 60% of the financial institutions on board with FedNow can receive payments, while only 40% of firms have signed up to send payments.

The Fintech Times

JULY 24, 2024

Last year, the US Federal Reserve launched FedNow as a competitive alternative for instant payments in the US. In July 2023, FedNow was launched to the public and after a year of being out in the wild, over 600 financial institutions have adopted the instant payment method. ” And this is exactly what it did. .”

Payments Dive

JULY 11, 2024

The real-time payments system has been growing its roster of banks and credit unions, as it newly competes with the Federal Reserve’s FedNow payments system.

Payments Dive

NOVEMBER 14, 2023

The new hire is tasked with boosting adoption of The Clearing House’s RTP real-time payments system, as the new rival Federal Reserve FedNow system seeks to attract clients.

NACHA

JULY 20, 2023

Herndon, VA – Today, Nacha President and CEO Jane Larimer released the following statement in response to the Federal Reserve announcing its FedNow Service is now live: “Nacha congratulates the Federal Reserve on the launch of FedNow.

Bank Automation

JULY 11, 2024

Adoption of the Federal Reserve’s instant payments platform, FedNow, is growing, however, of the more than 800 financial institutions using it, most are doing so in receive-only mode.

Fintech Finance

NOVEMBER 13, 2024

Using the FedNow service and the Real Time Payment (RTP) network, recipients can conveniently receive cash deposits in minutes, initiated at thousands of locations across the United States, and received into accounts at over 820 banks that are enrolled in FedNow or RTP.

Fintech Finance

APRIL 4, 2024

Trustly , a global leader in Open Banking Payments, and Cross River Bank (“Cross River”), a technology infrastructure provider that offers embedded financial solutions, are proud to expand their collaboration in instant payments with the addition of the FedNow® Service.

Payments Dive

MAY 7, 2024

When it comes to bridging the FedNow and RTP networks, officials at the Federal Reserve and The Clearing House have slightly different priorities.

Tearsheet

FEBRUARY 16, 2024

“Beyond extending our partnership with Mastercard, we intend to partner on innovating for the banks that use the network by looking for additional use cases that they’ve expressed interest in and that would help drive volume across RTP,” said Lee Alexander, Executive VP and CIO at The Clearing House. Chiro Aikat: It all comes down to choice.

Segpay

JUNE 13, 2024

What is FedNow? Last year, the Federal Reserve launched FedNow, an instant payment service expected to revolutionize the US payment landscape. Since its launch in July last year, about 700 banks and credit unions have joined the FedNow network, and this list is expected to grow as the Fed seeks 8,000 financial institutions.

Payment Savvy

MAY 15, 2023

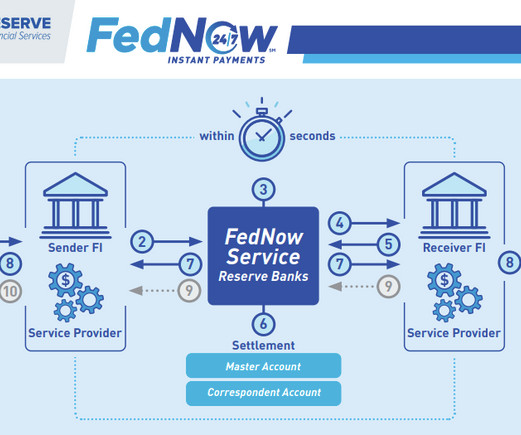

The Federal Reserve Bank is currently developing a new instant payment service called “FedNow” that will allow financial institutions to make instant payments. The FedNow Service will begin operating in July 2023 and it is the first U.S. Interoperability FedNow intends to work seamlessly with other payment networks.

Fintech Finance

NOVEMBER 12, 2024

Banks worldwide are juggling multiple, multi-year, multi-million-dollar modernization projects, such as ISO 20022, SEPA Instant in Europe, and FedNow and RTP in the US. Complex, costly projects like SEPA Instant, ISO 20022, FedNow and RTP are simplified and streamlined. The choice is ours.

Payments Dive

NOVEMBER 20, 2023

The Fed's vice chair for supervision expressed optimism about FedNow’s benefits and said he expects it to co-exist with the privately owned RTP network.

Fintech Finance

AUGUST 15, 2024

Instant payments use the FedNow service, developed and launched by the Federal Reserve in July 2023, and the RTP® network, launched in 2017 by The Clearing House. So far, over 1,000 banks and credit unions have signed on with either the RTP or FedNow networks, or both, and instant payment volume continues to grow.

Fintech Finance

SEPTEMBER 13, 2024

With contributions from industry experts, the guideline aims to help FIs enhance their operational readiness for real-time payments, including RTP® and FedNow®. I truly think this will be a huge asset to banks as they make their journey into the world of RTP and FedNow.”

PYMNTS

AUGUST 6, 2019

Introduced on Monday by Federal Reserve Board Governor Lael Brainard, the Fed’s instant payment scheme FedNow is designed to offer an option for consumers and business to transfer money instantly or nearly instantly in a “ubiquitous, safe and efficient” manner from one bank account to another. “The Why Now For FedNow.

Finovate

MARCH 8, 2024

Sila combines FedNow and The Clearinghouse’s RTP to allow ACH transactions to be settled in seconds. The tool combines The Clearing House’s RTP, the U.S. Federal Government’s FedNow , and Sila’s own instant settlement product that allows all ACH transactions to be settled in seconds.

The Paypers

JUNE 27, 2024

US-based Frost Bank has announced its partnership with Finzly in order to provide FedNow and RTP instant payments to its business clients and customers.

PYMNTS

MARCH 9, 2020

Banking association and payments company The Clearing House (TCH) has been confronting such concerns as it advances its real-time payment ( RTP ) offering in the U.S., The federal government deliberated in 2018 and 2019 over developing its own real-time payment system, FedNow , to compete with RTP.

The Fintech Times

NOVEMBER 14, 2024

Payments modernisation is a high priority for banks, with many incorporating new projects like ISO 20022, SEPA Instant, FedNow and RTP. Complex, costly projects like SEPA Instant, ISO 20022, FedNow and RTP are simplified and streamlined. The choice is ours.

The Paypers

AUGUST 23, 2024

US-based Affinity Plus Federal Credit Union has announced the launch of a new real-time payment solution via the FedNow and RTP networks to enable members to access funds instantly.

PYMNTS

NOVEMBER 25, 2020

Ranta said RTP is already past the “early adopter” stage and moving into the “fast follower” phase of its evolution. After all, The Clearing House’s RTP infrastructure is already up and running. And beyond TCH and RTP, the Federal Reserve’s FedNow real-time payments solution looms. 2021 Could Be The Game-Changer .

The Fintech Times

MAY 7, 2024

In fact, less than a third of US banks are signed up to either RTP or FedNow , meaning the vast majority cannot offer instant payments as a service; new research from RedCompass Labs , the payments modernisation company, has revealed. Across much of the world, instant payments have quickly become the norm.

Fintech Finance

MARCH 11, 2024

The agile, resilient, cloud-based payments solution will help Jefferson Bank to efficiently deliver both RTP TCH and FedNow services 24/7, and accommodate the rapidly growing volume of instant payment transactions.

The Fintech Times

JANUARY 19, 2024

With the FedNow Service launch in July 2023, most institutions have established firm FedNow plans, with a 50 per cent year-over-year uptick in respondents who said they plan to connect within the year or sooner. PaaS and cloud growth PaaS is also on track to displace bank data centres as the preferred method for payment processing.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content