Best Balance sheet reconciliation Software

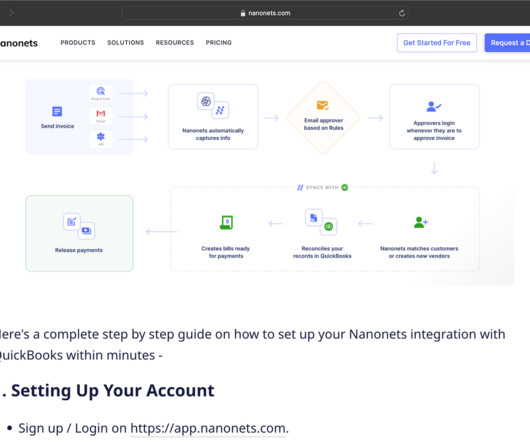

Nanonets

APRIL 29, 2024

Imagine you're a financial manager at a bustling enterprise, entrusted with the responsibility of ensuring the accuracy and integrity of your company's financial records. This is where balance sheet reconciliation software steps in to ensure speed, efficiency and accuracy in financial management.

Let's personalize your content