Overcoming Accounting Problems: Your Friendly Guide

Nanonets

SEPTEMBER 21, 2023

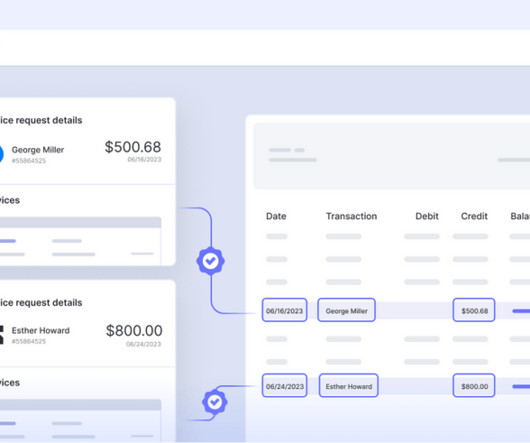

These errors can have a significant impact on financial statements, leading to incorrect financial analysis and decision-making. To overcome this problem, businesses should prioritize data accuracy and implement robust ERP solutions that automate data entry and reconciliation processes.

Let's personalize your content