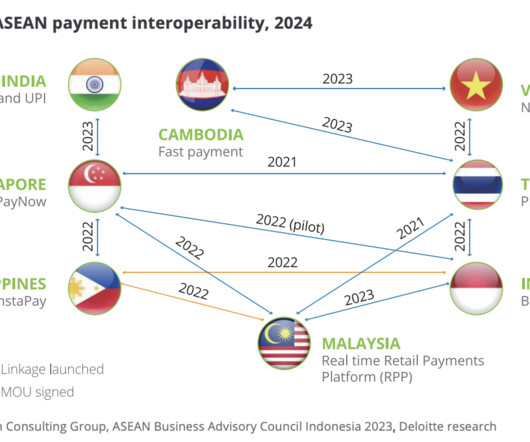

Payments Innovation in Indonesia to Drive Economic Growth and Financial Inclusion

Fintech News

JANUARY 7, 2024

Payments innovation in Indonesia holds significant promise for contributing to the nation’s economy and helping bring about a more inclusive, accessible, and equitable financial system. The total number of QRIS users stood at 43.44 million, BI also reported.

Let's personalize your content