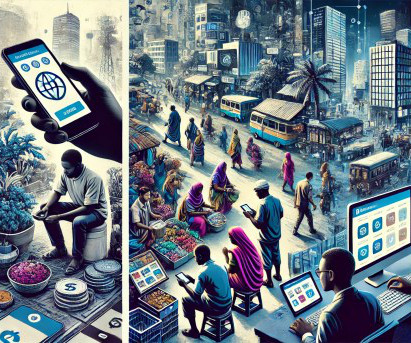

Fintech Solutions for Financial Inclusion in Emerging Markets

Fintech Review

NOVEMBER 6, 2024

Across emerging markets , millions of people lack access to essential banking services. Traditional banks, often limited by infrastructure costs, struggle to reach remote populations. In response, fintech companies are stepping up, using digital innovation to provide banking solutions to the unbanked and underbanked.

Let's personalize your content