Visa launches AI-powered fraud prevention tools

Finextra

MARCH 27, 2024

Visa has added a trio of AI-powered risk and fraud prevention tools to its suite of products for businesses.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Fraud Prevention Related Topics

Fraud Prevention Related Topics

Finextra

MARCH 27, 2024

Visa has added a trio of AI-powered risk and fraud prevention tools to its suite of products for businesses.

Payments Dive

JULY 31, 2024

Generative AI could help spot fraudulent patterns in transaction data and reduce the cost of processing payments, says a McKinsey consultant.

Fintech News

DECEMBER 17, 2024

Visa announced that its fraud prevention system blocked nearly 85% more suspected fraudulent transactions globally this Cyber Monday compared to the same day last year. Featured image credit: Edited from Freepik The post Visa Ramps Up AI-Powered Fraud Prevention During Holiday Shopping Globally appeared first on Fintech Singapore.

Seon

MARCH 20, 2024

However, this expansion brings a corresponding need to evolve fraud prevention strategies to keep pace with advancing threats. Fraud’s Path to Escalation The digital age has ushered in a seismic shift in fraud, marked by increased costs and volume of fraudulent activities. With over 1.4 billion unbanked adults – and 7.1

Fintech News

FEBRUARY 26, 2024

Flagright, an AI-native company specialising in Anti-Money Laundering (AML) compliance and fraud prevention, has announced its partnership with SALT, a financial platform aiming to support Small and Medium Enterprises (SMEs) in India and Asia.

Fintech News

AUGUST 29, 2024

To further combat fraud, Stripe introduced Radar Assistant, an AI-powered tool that allows businesses to set and test new fraud prevention rules using simple language prompts. The post Stripe Unveils AI-Powered Tools for Payments, Pricing, and Fraud Prevention appeared first on Fintech Singapore.

Fintech Finance

OCTOBER 3, 2024

Additionally, 96% of these institutions suffered financial losses due to fraud, with 70% reporting losses exceeding $500k during that period. This underscores the critical need for advanced fraud prevention in the financial sector, a need that Alloy’s platform will directly address within Numerated’s commercial lending solutions.

The Payments Association

NOVEMBER 21, 2024

The latest addition to this network is Forter, a global leader in AI-powered fraud prevention, who joins Paydock in transforming fraud detection and prevention for online businesses. By automating fraud detection, businesses can eliminate manual reviews, accelerating fulfilment and providing a smooth customer experience.

Seon

AUGUST 27, 2024

With fraud losses estimated to cost global businesses billions annually, the need for effective fraud prevention strategies has never been more critical. The webinar discussed the limitations of traditional fraud prevention methods and the necessity of adopting a more proactive, technology-driven approach.

The Payments Association

JUNE 7, 2024

Tony Sales, a former fraudster turned fraud prevention specialist and co-founder of WeFightFraud, shares his perspective on effective strategies and technologies businesses can use to protect against evolving threats. Read more

Fintech Finance

SEPTEMBER 26, 2024

Justt , a leader in AI-powered chargeback mitigation, today announced a strategic partnership with Ravelin , a global provider of AI-native fraud detection and prevention solutions. According to the Ravelin Fraud and Payments Survey 2024 , 52.4% The solution is now live and available to all merchants on Ravelin’s platform.

The Payments Association

JUNE 7, 2024

Adopting ISO 20022 is essential for modernising cross-border payments, enhancing fraud prevention, and ensuring seamless interoperability and efficiency in international financial transactions. Read more

Fintech Finance

DECEMBER 10, 2024

Trustfull , a leader in Identity Intelligence for fraud prevention, is proud to announce a strategic partnership with Scalapay , a premier European buy-now-pay-later (BNPL) provider. This empowers fraud teams to detect synthetic identities and prevent fraud while maintaining a seamless user experience.

The Payments Association

SEPTEMBER 26, 2024

With traditional systems unable to deal with the agile nature of fraud in today's payments space, new approaches such as 'Collaborative Intelligence' and 'Inbound transaction screening' will be seen as key to further improve fraud prevention for financial institutions.

The Fintech Times

APRIL 24, 2024

The post Mastercard Takes On Scammers with AI-Driven Fraud Prevention Tools appeared first on The Fintech Times. “Mastercard’s industry expertise and innovative technology will support our global network’s commitment to stopping scams and protecting consumers.

Fintech News

JUNE 10, 2024

Our combined expertise will provide financial institutions with the tools needed for smooth instant payment processing, reducing errors and fraud, and ensuring compliance with regulatory mandates across the world.” said Alain Raes, Co-founder and CCO of iPiD.

Fintech News

MARCH 27, 2024

Leveraging its extensive experience and a US$10 billion investment in technology and innovation over the past five years, Visa aims to enhance fraud prevention and network security. Featured image credit: Edited from Freepik The post Visa Set to Roll out New AI-Powered Fraud Prevention Solutions appeared first on Fintech Singapore.

Payments Dive

JANUARY 9, 2024

Swipe fee battles, real-time payments, fraud prevention and acquisition plans will be among the hot topics pulsing through the industry this year.

Fi911

DECEMBER 18, 2024

But, did you know it can also be used to help stop card-not-present fraud? Geolocation & Fraud Prevention Geolocation helps prevent fraud by verifying the location of a user or device during transactions, especially in card-not-present scenarios. Can Geolocation Technology Be Spoofed?

The Fintech Times

OCTOBER 28, 2024

Instant payments and fraud prevention have quickly become the areas fintechs need to focus on most, according to the third portion of the ‘2024 Payment State of the Union’ study by Discover Global Network , the global payment network.

Payments Dive

JANUARY 16, 2024

The card issuer is selling the business, which offers online fraud monitoring services to merchants, to the joint venture investment firm Accel-KKR.

Fraud.net

DECEMBER 9, 2024

Discover why traditional fraud prevention strategies are inadequate, and how AI fraud prevention is a proactive approach to modern threats."

Fintech Finance

AUGUST 1, 2024

In partnership we can identify and stop fraud and financial crime and make the world a safer place to transact.” ” The post PAYSTRAX Has Selected Featurespace to Tackle Fraud Across Europe, Demonstrating the Strength of Its Fraud Prevention Technology appeared first on FF News | Fintech Finance.

Fraud.net

DECEMBER 22, 2024

Explore future trends in fraud prevention and how AI helps businesses stay ahead of emerging threats and evolving tactics.

Payments Dive

NOVEMBER 17, 2020

Mobile Payments Today interviewed André Ferraz, the CEO and co-founder of Incognia, a private identity company that provides fraud prevention by using frictionless identity location verification.

The Payments Association

AUGUST 1, 2024

The move to ISO 20022 brings benefits like enriched data and improved fraud prevention, requiring a strategic approach and decisions between building in-house solutions or partnering with vendors. Read more

The Nilson Report

DECEMBER 5, 2024

The post Bectran Partners with GIACT for ACH Fraud Prevention appeared first on Nilson Report.

Fraud.net

DECEMBER 17, 2024

Learn how AI in fraud prevention provides real-time detection, reduces false positives, and boosts operational efficiency.

The Fintech Times

NOVEMBER 16, 2024

European financial service provider Mollie is officially launching in Italy, in a move to enable Italian businesses to access a single platform designed to simplify payment processing, reporting and fraud prevention.

Basis Theory

MAY 16, 2024

Payment security is a key consideration for today’s digital merchants, as acquiring a reputation for not protecting customers’ payment details can be an existential threat.

The Payments Association

APRIL 25, 2024

The recently conducted UK Fraud Awareness Report has revealed that the British public has much to learn about fraud, from the definitions of certain terms to the benefits of using different forms of identity verification technology during onboarding. Read more

The Fintech Times

NOVEMBER 16, 2024

. “Merchants are clearly focused on future-proofing their payments strategy to meet the growing demand for convenience and flexibility and address the major challenges around regulatory compliance and fraud prevention,” explained Ugne Buraciene , group CEO of payabl.

The Fintech Times

JUNE 2, 2024

Fraud prevention decision-makers across Europe are well aware of the growth and danger of AI-driven identity and financial fraud, but are unprepared to combat it, Signicat , the European digital identity and fraud prevention solution provider, has revealed in a new report.

Fintech News

DECEMBER 22, 2024

Featurespaces advanced fraud detection and risk-scoring capabilities will be integrated into Visas existing portfolio of fraud prevention solutions. This integration will enable real-time detection of sophisticated fraud attacks while maintaining a seamless user experience.

The Payments Association

DECEMBER 11, 2024

Digital payments demand advanced fraud prevention, blending AI and human intelligence to counter evolving threats while ensuring seamless user experiences. Multifaceted approaches to fraud prevention Effective fraud prevention now requires a combination of technological and human intelligence, transcending traditional security models.

The Fintech Times

JUNE 1, 2024

Meanwhile, the fraud landscape is rapidly changing. Over a third of fraud attempts (42.5 per cent) targeting financial institutions now use AI, according to a recent study by digital identity and fraud prevention solution Signicat. Overall, around 29 per cent of these AI-driven fraud efforts are successful.

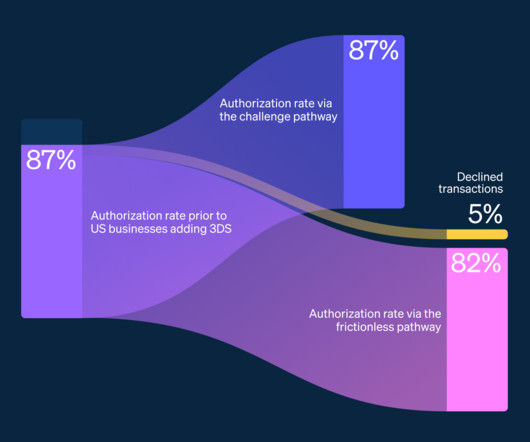

Stripe

AUGUST 4, 2024

Global businesses have told us they’re interested in replicating the fraud-prevention success seen in Europe by requesting 3DS. Last year, we had a front-row seat as several Stripe users chose to do exactly that, but the results in the US were very different from what we have seen in Europe.

The Fintech Times

DECEMBER 18, 2024

This service facilitates Public Administration and corporates in fulfilling their fraud prevention activities vis--vis their customers (e.g. This service covering 98 per cent of the Italian market share, allows providers to operate more efficiently in fraud prevention.

Finextra

APRIL 25, 2024

Moderating her second panel of the day - Fraud prevention and AML: the need for behavioural biometrics in this instant age - Finextra’s senior reporter Niamh Curran spoke to Megan Heald, senior project manager at NICE Actimize, John Sam-Kubam, senior vice president at Crown Agents Bank, Beju Shah, head of Nordic centre at the Bank of International (..)

Finextra

FEBRUARY 13, 2024

Additionally, we explain the key methods for ensuring seamless transactions across borders, leveraging ISO 20022 data and AI for fraud prevention, resilience, and scalability across all 13 markets. We explore the significance of interoperability and the prioritisation of standardisation to enhance cross-border transactions.

Fintech Finance

OCTOBER 21, 2024

Award-winning Swiss FinTech, NetGuardians , known for its enterprise risk platform focused on combating bank fraud, has been chosen by PalawanPay , the e-wallet app from the Palawan Group of Companies, to bolster its fraud prevention measures.

Fintech News

SEPTEMBER 2, 2024

These include AML (anti-money laundering) screening, KYC (Know-Your-Customer) and KYB (Know-Your-Business) processes, as well as ongoing transaction monitoring and fraud prevention. LDP also facilitates compliance across new markets, supporting businesses as they expand globally.

The Payments Association

DECEMBER 19, 2024

Dialect, the payments specialist business outsource provider and Synalogik , the data aggregation and fraud prevention platform, are pleased to announce their new strategic partnership. Together, we’re setting a new standard for excellence and innovation in the fight against fraud.

Payments Dive

DECEMBER 3, 2024

The head of fraud prevention for the processor said the company leverages data to block hackers and fraudsters seeking digital wallet information.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content