Report: FinCEN Files Reveal Billions In Suspicious Money Flows

PYMNTS

SEPTEMBER 21, 2020

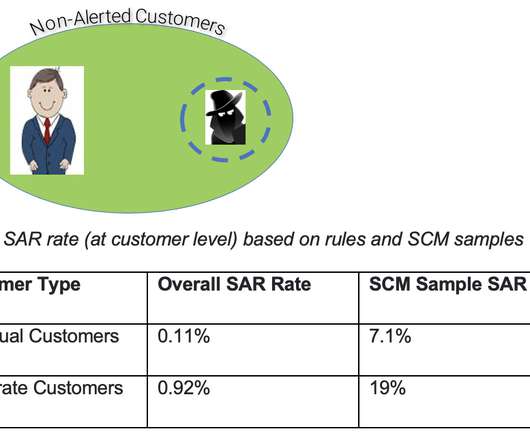

Between 1999 and 2017, FinCEN flagged more than $2 trillion in suspicious transactions. Of those, at least four went on to break the law again and get fined. FinCEN received more than 2 million SARs last year. Paul Pelletier, a former senior Justice Department lawyer, said there’s one way to stop the illegal activity.

Let's personalize your content