AMLYZE: Is the Global Anti-Money Laundering (AML) System Broken?

The Fintech Times

APRIL 29, 2024

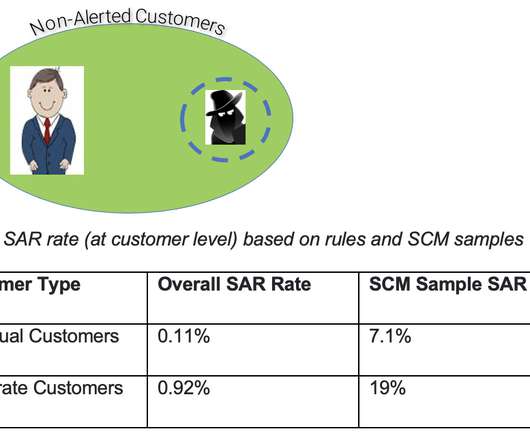

In the last two decades, anti-money laundering (AML) regulatory framework, processes and mechanisms have not changed much. As a result, fraudsters are capitalising on firms’ inadequacies to spot and deal with money laundering. Is the global anti-money laundering (AML) system broken? What’s the problem?

Let's personalize your content