UK's Financial Intelligence Unit publishes latest guide on SAR submissions

The Paypers

AUGUST 23, 2021

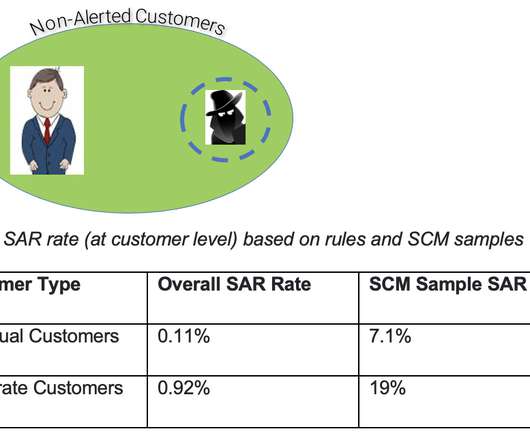

The UK’s Financial Intelligence Unit (UKFIU) has published its guide on how suspicious activity report (SAR) intelligence is being used by law enforcement, aiming to demonstrate SAR filing best practices.

Let's personalize your content