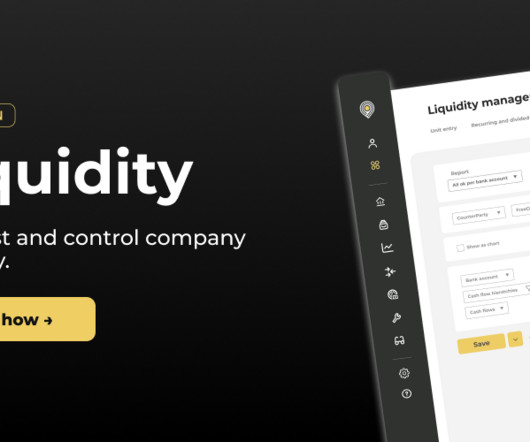

How to assess, manage and mitigate liquidity risk?

Nomentia

MARCH 3, 2025

Recent events, coupled with the interest rate volatility across the world have cause many a treasurer to ask: What is our current liquidity position? What are our primary and secondary sources of liquidity? What counterparty risks could affect our liquidity?

Let's personalize your content