Advanced Data Security: Safeguarding Your Business In The Digital Age

VISTA InfoSec

JUNE 18, 2024

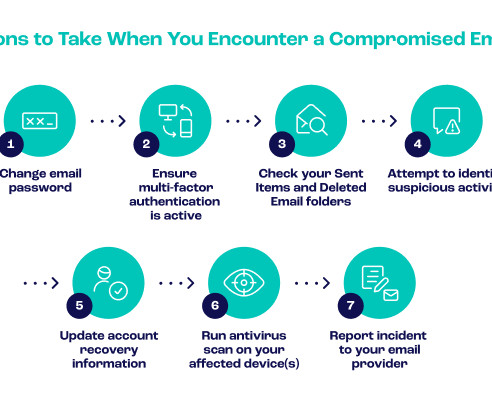

Next, analyze potential risks like malware infections, phishing scams, or disgruntled team members leaking sensitive data. In addition to access control, fortify your defenses with Multi-Factor Authentication (MFA). Kick things off with phishing awareness training. Outdated software?

Let's personalize your content