Charting Course: Building a Cannabis Banking Compliance Program

Innovative Payments Association

AUGUST 29, 2024

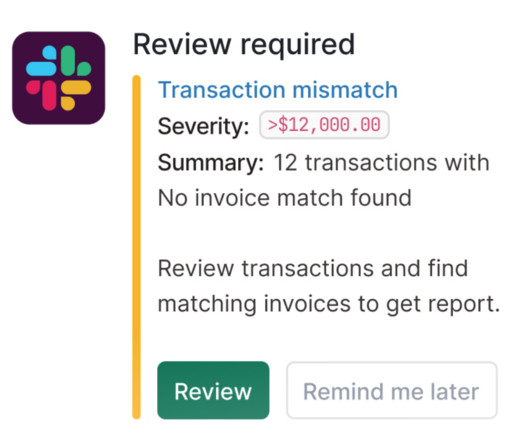

By understanding these risks, businesses can develop appropriate controls to mitigate them. Develop Written Policies and Procedures Clear and comprehensive written policies and procedures are essential for a strong compliance program.

Let's personalize your content