Gates Foundation Supports Expansion Of An Open Mobile Banking Platform in Africa

Tom Groenfeldt

DECEMBER 4, 2018

With some tech support from the Bill & Melinda Gates Foundation an open mobile banking app is launching in Africa.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Mobile Banking Related Topics

Mobile Banking Related Topics

Tom Groenfeldt

DECEMBER 4, 2018

With some tech support from the Bill & Melinda Gates Foundation an open mobile banking app is launching in Africa.

The Fintech Times

MARCH 6, 2025

Liv , the UAE-based digital bank launched by Emirates NBD , has launched a new crypto offering, enabling customers to trade cryptocurrencies within its mobile banking app. The post Emirates NBD’s Liv Unveils New Crypto Offering for UAE Customers in Mobile Banking App appeared first on The Fintech Times.

Finextra

MAY 9, 2024

Global mobile banking trojan attacks on Android users grew by a third in 2023, while cryptocurrency-related phishing also saw a sharp increase, according to a Kaspersky report.

Fintech Finance

AUGUST 22, 2024

In keeping with its constant dedication to providing cutting-edge services to its customers, National Bank of Kuwait (NBK) announced introducing a new service that allows customers to confirm payment transactions online through the NBK Mobile Banking App, making itself as the first provider of this service in Kuwait.

Fintech News

MARCH 25, 2024

Mobile banking is a rapidly growing market that’s projected to hit a value of US$7 billion by 2032. The 2023 study, which analyzed malware targeting banking apps, uncovered that 29 malware families targeted 1,800 banking applications across 61 countries last year.

NFCW

DECEMBER 5, 2023

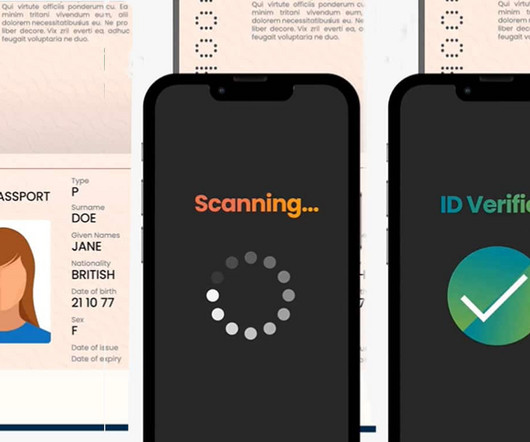

UK cinemas rolled out support for Yoti ID and Post Office EasyID in June 2022 Lloyds Bank adds NFC passport scanning to mobile banking app was written by Sarah Clark and published by NFCW. Lloyds, Yoti and the Post Office “will announce new ways people can use their digital ID apps over the coming months”, Lloyds says.

Finextra

MAY 15, 2024

French mobile payments app Lydia has launched a new challenger bank proposition with plans to invest €100 million in the new venture and hire 400 people over the next three years.

PYMNTS

NOVEMBER 24, 2020

But while some might think the mobile banking innovation trend is a U.S.-dominated Mobile isn’t a U.S. Mobile isn’t a developed market phenomenon. He added that outsourcing technology to someone with an agile platform is one way to equalize the playing field and beat the big guys at their game. phenomenon.

Tom Groenfeldt

MAY 10, 2019

The World Council of Credit Unions helps develop new technology, like mobile banking, that credit unions need but cant afford to develop on their own.

Fintech Finance

DECEMBER 17, 2024

Card Corporation, a leading privately-owned financial services technology company specializing in mobile banking and card payments, is pleased to announce a new collaboration with Visa to introduce Visa Direct Cross-Border payments.

The Fintech Times

JUNE 19, 2024

Together, the two organisations are enabling customers of the bank to see the environmental impact of their spending. Step by step, all private customers can see the CO2 emissions of their expenses in the ING Mobile Banking App, thanks to Footprint Insight functionality from Cogo.

Fintech News

DECEMBER 11, 2024

NAPAS, Vietnam’s national payment switch, and ACLEDA Bank, a Cambodian financial institution that coordinated with other commercial banks through the BAKONG payment system, played crucial roles in coordinating the project.

Finextra

MARCH 26, 2025

In line with its commitment to advancing digital banking, National Bank of Kuwait (NBK) is continuously enhancing its NBK Mobile Banking App by introducing innovative features and refining existing functionalities.

Payments Source

FEBRUARY 11, 2020

The German challenger bank said that its "several hundred thousand" customers in the U.K. have until April 15 to withdraw money or transfer it to another account.

Payments Dive

NOVEMBER 14, 2019

The blockbuster agreement for Citi to integrate its Google Pay wallet with Citi and Stanford Federal Credit Union's mobile checking accounts represents an evolution of Big Tech and traditional banking to offer a mutually beneficial expansion of their digital banking and payments businesses.

Payments Dive

DECEMBER 19, 2019

Donna Embry is the SVP of global payment strategies at Evolve Bank & Trust, and she's involved with next-gen on multiple levels. ATM Marketplace spoke with her to learn more about why IADs, in particular, should be paying attention to the project.

Tom Groenfeldt

JULY 11, 2019

market where other mobile providers already offer similar features? N26 prides itself on its smooth interface and user friendly features like saving by category and tracking expenditures by category. Will that be enough in the U.S.

Fintech Finance

OCTOBER 21, 2024

The post Caixabank Consolidates Its Position in Mobile Banking and Partners With Apple to Enhance Customer Experience appeared first on FF News | Fintech Finance. By speeding up the purchase process and offering the option to divide payments into instalments, shoppers can enjoy a faster user experience.

Finextra

APRIL 24, 2024

2024, Finastra, a global provider of financial software applications and marketplaces, announced the availability of its latest mobile banking software, Next Gen Mobile Banking, a new digital banking experience for community banks and credit unions. Today at Ignite!

The Paypers

APRIL 26, 2024

Global provider of financial software applications and marketplaces Finastra has announced the launch of its Next Gen Mobile Banking solution.

Payments Dive

JULY 24, 2020

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

Fintech News

NOVEMBER 6, 2024

OCBC Bank has launched a new service allowing customers to send money instantly to users of WeChat Pay and Alipay in China. This makes OCBC the first bank in the Asia Pacific region to offer this capability.

Bank Automation

FEBRUARY 26, 2025

based Freedom Bank of Virginia completed integration of Apitures digital banking platform for online and mobile banking, the software firm announced on Feb. Incorporation of the platform took about nine months, an Apiture spokesperson told Bank Automation News. Fairfax, Va.-based

Finovate

APRIL 2, 2024

Indiana-based New Washington State Bank (NWSB) has selected Apiture’s Digital Banking Platform to power its online and mobile banking solutions. The community bank will also deploy Apiture’s Account Opening and Data Intelligence solutions to onboard customers faster and to offer tailored campaigns.

Payments Source

MARCH 31, 2021

(..)

Finextra

MARCH 20, 2025

The trend towards digital and mobile banking has been among the most profound technological shifts o.

Payments Dive

MARCH 20, 2020

Banks across the U.S. are limiting lobby hours and encouraging mobile banking in response to the COVID-19 outbreak. Many banks continue to offer fee waivers and penalty reductions for customers that need to access funds early.

NFCW

MARCH 27, 2025

“Moreover, physical smart cards can easily be read for instance to activate or secure mobile banking.” . “The end user can then use the ring or bracelet in a shop to perform payment transactions like with a payment card without the presence of the iPhone.

Payments Source

DECEMBER 14, 2020

The mobile banking and paperless habits bank customers picked up during the pandemic are here to stay, and financial institutions are working to strengthen their digital offerings, speakers at an American Banker conference said.

PYMNTS

JUNE 12, 2020

As the use of mobile banking apps surges due to the limited access to banks amid the COVID-19 pandemic, the FBI is warning users to beware of cyber attacks.

The Fintech Times

NOVEMBER 4, 2024

In 2019, the central bank then introduced the ‘Payment and Settlement Act’, which provided the legal basis for the development, promotion, expansion, monitoring, and regulation of payments, settlement and clearing systems in the country. Nepal saw significant growth in mobile banking, QR payments and wider cashless solutions.

Payments Dive

OCTOBER 19, 2018

Digital channels are being widely accepted by today's consumers, but with this adoption comes the increase in impersonal transactions through online and mobile banking, drastically impacting the traditional model of building relationships

Payments Source

MARCH 24, 2020

While financial institutions are encouraging customers to use their digital banking services rather than the branch or ATMs during the outbreak, attackers will also be looking to exploit this potential increased adoption of mobile banking and mobile payment apps, says OneSpan's Sam Bakken.

The Fintech Times

APRIL 10, 2025

. “Payits safe and secure platform provides a flexible and seamless way for people to make payments directly from their bank accounts and also for businesses to improve their operational costs.” Adopting Pay by Bank Payit by NatWest boasts instant availability of funds, an essential feature for businesses managing cash flow.

Bank Automation

AUGUST 12, 2024

Banks are modernizing and digitalizing their platforms and offerings as users demand more online and mobile banking experiences. According to Bank Automation News’ proprietary Transactions Dashboard, banks have consistently invested in digital banking solutions since the start of the year.

Finextra

MAY 1, 2024

Mobile banking startup Monese has confirmed the break up of the business into separate consumer-facing and corporate concerns and the arrival of new funding.

Payments Dive

OCTOBER 4, 2019

The successful transition to mobile banking requires a seamless, intuitive user experience built into a mobile app. But the evolution from bricks-and-mortar to digital requires so much more in terms of how you deal with legacy systems, how you listen to customers and how you deal with the challenges of modern day neobanks.

Finextra

JUNE 21, 2024

TBC Bank aims to expand its microlending business and promote financial inclusion in Uzbekistan, Central Asia’s largest country by population.

PYMNTS

DECEMBER 14, 2020

The pandemic has had a significant impact on consumer adoption of online and mobile banking services as more people are digitally engaging with their banks to curb health risks. Mobile banking use is ticking up, especially among younger users, with PYMNTS data showing that 75.9

Fintech Finance

OCTOBER 22, 2024

Entrust , a global leader in delivering identity-centric security solutions, today announced that The Huntington National Bank has selected the Entrust Digital Card Solution to enable digital wallet capabilities, with instant provisioning to third-party digital wallets from its mobile banking app.

Fintech News

SEPTEMBER 1, 2024

Singapore’s OCBC Bank experienced technical difficulties on 1 September (Sunday) that temporarily disrupted its internet and mobile banking services. The bank assured that customer funds were not affected during the service disruption, and no customer data was compromised.

Fintech Finance

FEBRUARY 27, 2025

currently Apple Pay) Leveraging Entrust’s expertise in digital payment enablement Creating a custom wallet in their own banking app, issuers can offer a digital-first payment and banking experience.

Bank Automation

OCTOBER 2, 2024

Tens of thousands of Bank of America clients reported outages of online and mobile banking services today. trillion bank, according to website Downdetector, which publishes the status of outages in real time. ET, more than 20,000 clients had reported issues with the $3.2

Finextra

MAY 22, 2024

Majority, the platform offering mobile banking, international services and more to migrants in the US, today announced $20M in funding after a year of record growth, despite the tumultuous fintech market.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content