Global mobile banking malware surges 32%

Finextra

MAY 9, 2024

Global mobile banking trojan attacks on Android users grew by a third in 2023, while cryptocurrency-related phishing also saw a sharp increase, according to a Kaspersky report.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Mobile Banking Related Topics

Mobile Banking Related Topics

Finextra

MAY 9, 2024

Global mobile banking trojan attacks on Android users grew by a third in 2023, while cryptocurrency-related phishing also saw a sharp increase, according to a Kaspersky report.

Fintech Finance

AUGUST 22, 2024

In keeping with its constant dedication to providing cutting-edge services to its customers, National Bank of Kuwait (NBK) announced introducing a new service that allows customers to confirm payment transactions online through the NBK Mobile Banking App, making itself as the first provider of this service in Kuwait.

Fintech News

MARCH 25, 2024

Mobile banking is a rapidly growing market that’s projected to hit a value of US$7 billion by 2032. The 2023 study, which analyzed malware targeting banking apps, uncovered that 29 malware families targeted 1,800 banking applications across 61 countries last year.

Finextra

APRIL 24, 2024

2024, Finastra, a global provider of financial software applications and marketplaces, announced the availability of its latest mobile banking software, Next Gen Mobile Banking, a new digital banking experience for community banks and credit unions. Today at Ignite!

Finextra

MAY 22, 2024

Global financial technology leader FIS (NYSE: FIS) has launched an enhanced version of its flagship mobile banking application for financial institutions.

The Paypers

APRIL 26, 2024

Global provider of financial software applications and marketplaces Finastra has announced the launch of its Next Gen Mobile Banking solution.

Fintech Finance

OCTOBER 21, 2024

The post Caixabank Consolidates Its Position in Mobile Banking and Partners With Apple to Enhance Customer Experience appeared first on FF News | Fintech Finance. By speeding up the purchase process and offering the option to divide payments into instalments, shoppers can enjoy a faster user experience.

The Paypers

OCTOBER 28, 2024

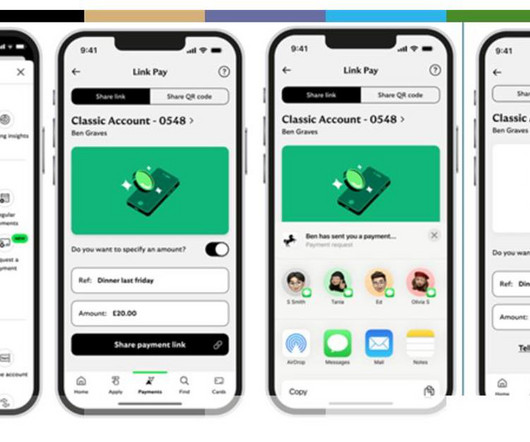

UK-based Lloyds has announced that its customers can now request money from friends and family leveraging the new Link pay capability in the mobile banking app.

The Fintech Times

JUNE 19, 2024

Together, the two organisations are enabling customers of the bank to see the environmental impact of their spending. Step by step, all private customers can see the CO2 emissions of their expenses in the ING Mobile Banking App, thanks to Footprint Insight functionality from Cogo.

Finextra

MAY 15, 2024

French mobile payments app Lydia has launched a new challenger bank proposition with plans to invest €100 million in the new venture and hire 400 people over the next three years.

Finovate

APRIL 2, 2024

Indiana-based New Washington State Bank (NWSB) has selected Apiture’s Digital Banking Platform to power its online and mobile banking solutions. The community bank will also deploy Apiture’s Account Opening and Data Intelligence solutions to onboard customers faster and to offer tailored campaigns.

PYMNTS

NOVEMBER 20, 2020

April was also the month that financial institutions (FIs) and Big Tech firms alike learned that mobile banking had become a much bigger, more important channel, virtually overnight. It took crashing the websites of a string of major banks and credit unions for the sector to grasp what happened. Mobile Experience Can Do More.

NFCW

DECEMBER 5, 2023

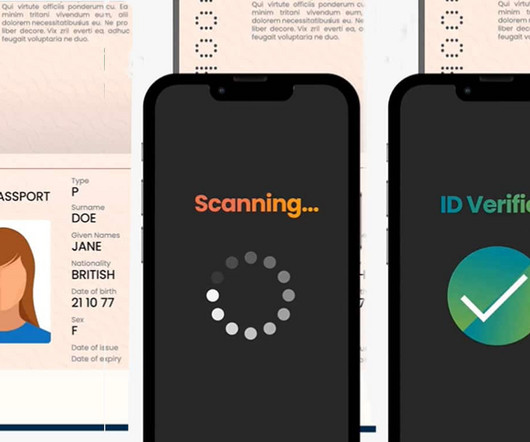

UK cinemas rolled out support for Yoti ID and Post Office EasyID in June 2022 Lloyds Bank adds NFC passport scanning to mobile banking app was written by Sarah Clark and published by NFCW. Lloyds, Yoti and the Post Office “will announce new ways people can use their digital ID apps over the coming months”, Lloyds says.

The Paypers

MARCH 25, 2024

US-based Emporia State Federal Credit Union has launched its updated online and mobile banking app powered by Bankjoy , a digital banking provider.

Fintech Finance

MARCH 27, 2024

Keynova Group , the principal competitive intelligence source for Mobile Banking Payments firms, has announced the results of the Q1 2024 edition of its semi-annual Mobile Banker Scorecard. Bank continued its winning streak, ranking No. mobile bank offerings. Bank, and Wells Fargo.

Finance Magnates

NOVEMBER 24, 2022

Please find out more about our services for Money , Banking , Payments , Licensing , and Cryptocurrency on our website. Mobile Banking App: Welcome Screen was originally published in Faisal Khan LLC Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Finextra

MAY 15, 2024

Emirates NBD, a leading banking group in the MENAT (Middle East, North Africa and Türkiye) region, has announced the launch of fractional bonds on its awards winning mobile banking app ENBD X.

The Paypers

MAY 13, 2024

Cybersecurity company Kaspersky has released a report which uncovered a substantial increase in mobile banking malware and crypto-related phishing in 2023.

PYMNTS

SEPTEMBER 18, 2020

Mobile banking upstart Chime has completed funding that has provided the firm with a $14.5 Chime, which CEO Chris Britt co-founded in 2013, provides clients mobile banking accounts without charges, debit cards and automated teller machine (ATM) access. billion valuation, CNBC reported. The company is geared toward U.S.

Payments Dive

APRIL 26, 2018

adults surveyed, mobile banking app use ranked third (31 percent) behind only social media (55 percent) and weather apps (33 percent), respectively. Of the 2,000 U.S.

The Paypers

FEBRUARY 15, 2024

A recent survey conducted by Chase has revealed that 62% of consumers consider their mobile banking app indispensable, with 78% utilising it on a weekly basis.

PYMNTS

NOVEMBER 17, 2020

Not only are many account holders visiting brick-and-mortar branches less often than they did before the pandemic, but many are also more reliant on digital banking channels — particularly mobile banking apps — than they have ever been. percent more likely to use mobile banking apps now than they were in 2019, and 51.1

PYMNTS

JULY 15, 2020

MoneyLion , the New York-based mobile bank, announced the launch of RoarMoneySM, a demand deposit account powered by MetaBank N.A. It features two-day early paydays, mobile wallet capabilities, funding options, near real-time transaction alerts and advanced cybersecurity, the company said in a Wednesday (July 15) press release.

PYMNTS

JANUARY 14, 2021

There is no shortage of digital-only banks offering a smoother onboarding process, a slick mobile interface and fee waivers in an effort to tempt consumers to leave their traditional bank. 14) that it is jumping into the world of mobile banking with the launch of a debit rewards product somewhat eye-catching. “We

PYMNTS

JULY 23, 2020

France’s Orange Bank is launching completely mobile banking services in Africa, according to a press release. The original intent of the company was to help those without access to the usual banking services, often helping those who lacked employment contracts or identification as they worked in more informal jobs.

PYMNTS

SEPTEMBER 17, 2019

A 5G network could markedly improve mobile banking apps’ speed, security and ease of use. Mobile banking apps have already enjoyed mass adoption, but what are consumers using them for? And, perhaps more importantly, what do they want from digital banking apps that they aren’t currently getting? Most consumers (78.1

PYMNTS

NOVEMBER 24, 2020

But while some might think the mobile banking innovation trend is a U.S.-dominated Mobile isn’t a U.S. Mobile isn’t a developed market phenomenon. He added that outsourcing technology to someone with an agile platform is one way to equalize the playing field and beat the big guys at their game. phenomenon.

PYMNTS

MAY 28, 2020

Only 31 percent borrowed from banks when in need of a loan, which the press release states shows a mistrust in commercial financial institutions. We are challenging the status quo to ensure immigrant communities get fair and secure financial options.”.

Payments Dive

OCTOBER 11, 2019

Tim Tang, director, enterprise solutions at Hughes, sits down with Gil Strickland, vice president, product management at BBVA USA, to talk about customer expectations for online and mobile banking during the Bank Customer Experience Summit in Chicago.

PYMNTS

APRIL 10, 2019

An Inside Look at Chase’s Mobile Banking Approach. In the decade since Apple launched its first-ever iPhone, banks have evolved their approach to mobile banking. For more on Chase’s mobile banking strategy, visit the Tracker’s feature story.

Finextra

MARCH 27, 2024

HID, a worldwide leader in trusted identity solutions, in partnership with Temenos, a global provider of banking software solutions, announces the successful collaboration with Santander International to provide robust and flexible customer authentication for its digital banking platform.

PYMNTS

MAY 23, 2019

Mobile banking Trojans are one of the most rapidly-developing, flexible and dangerous types of malware. They usually steal funds directly from mobile users’ bank accounts, but sometimes their purpose is changed to steal other kinds of credentials,” the company said. In Q4 of 2018, mobile Trojans made up 1.85

PYMNTS

JUNE 26, 2020

Many banks braced themselves for an oncoming surge in the number of consumers accessing their financial accounts online or via mobile banking apps, but safely and seamlessly providing that access remained tricky for many in the space. Developments Around the Cloud Banking World.

PYMNTS

NOVEMBER 18, 2016

New research from comScore MobiLens revealed that mobile banking penetration in France is almost 30 percent. In Q2 2016, more than half (54 percent) of the country’s internet users visited online banking sites on a monthly basis, averaging 10 visits per month lasting more than five minutes each time. percent use banking apps.

The Paypers

SEPTEMBER 29, 2022

UK-based Compass Plus Technologies has introduced a solution named Pocket Bank that aims to reduce time-to-market for launching a mobile banking app.

The Paypers

MAY 10, 2022

Philippines-based Netbank has launched Netizen Mobile Banking app as a ‘One-Stop-Banking Solution’ for Pinoy OFWs around the world.

PYMNTS

SEPTEMBER 8, 2020

Mitek , which provides software and authentication services, said it has upped its game with its release of Mobile Deposit 4.8, a mobile banking app. The company said, in a press release , that the need for such a service is heightened in the COVID-19 era.

The Paypers

JULY 14, 2022

A survey commissioned by Sinch has shown that consumers want more personalised mobile banking experiences that make it easy for them to get 1:1 support anywhere.

PYMNTS

MARCH 3, 2017

Small businesses aren’t impressed by mobile banking, the report , released Thursday (Mar. The Monetizing Digital Banking Products for Small Business Customers survey found that more than a third of SMEs have never used mobile banking, even though their banking provider offers it. 2), concluded.

Payments Dive

SEPTEMBER 7, 2018

Host Will Hernandez, discusses USAA's unique branch-less mobile banking system, which services the U.S. USAA is typically on the cutting edge of mobile banking, and Phil Leininger, the GM of Omnichannel Sales & Service of USAA, talks about their advancements in mobile technology.

Finextra

JUNE 21, 2024

TBC Bank aims to expand its microlending business and promote financial inclusion in Uzbekistan, Central Asia’s largest country by population.

PYMNTS

OCTOBER 31, 2019

Power suggests small businesses have begun to embrace mobile banking and are satisfied with the service. Small Business Banking Satisfaction Survey found an 8 percent year-over-year increase in the percentage of small businesses that use their bank’s mobile banking app (61 percent in 2019, compared to 53 percent in 2018).

Finextra

JUNE 17, 2024

Glia, a leader in customer interaction technology, has successfully integrated its unified interaction capabilities into the mobile version of NCR Voyix's Digital Banking platform.

PYMNTS

APRIL 23, 2019

Chinese technology conglomerate Tencent has invested in Argentinian mobile banking startup Uala, according to a report from Reuters. Point72 Ventures and George Soros have also invested in the mobile payment company. He did not reveal the amount of the investment, but said it would significantly raise the company’s valuation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content