How to Maintain Anti-Money Laundering Compliance as a PayFac

Stax

DECEMBER 4, 2023

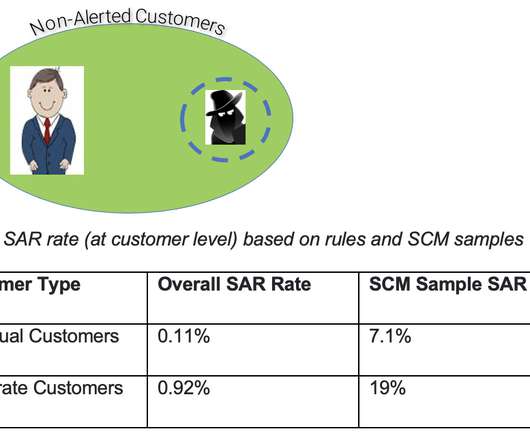

With the global economy moving online, corruption, fraud, trafficking, and other illicit activities continue to rise. According to a UN report, money laundering activities of about $1.6 With AML legislation, financial institutions are required to follow strict protocols for money laundering risk management.

Let's personalize your content