What is the loan origination process?

Nanonets

APRIL 24, 2023

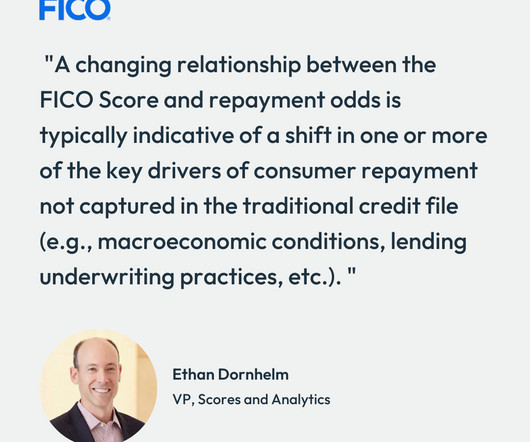

PDF → Excel Convert PDF bank statements to Excel Try for Free Loan origination is the process of applying for and obtaining a loan, including all the steps and activities that are involved in evaluating, approving, and disbursing the loan. It also includes various other steps such as underwriting , documentation, and funding. The

Let's personalize your content