iPiD Publishes Essential Guide for Payment Service Providers: “Verification of Payee: The Race to Compliance”

Fintech Finance

APRIL 4, 2024

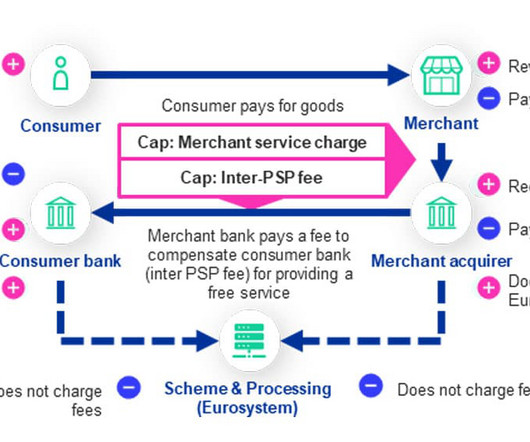

iPiD , a leading payment validation solutions provider, today announced the publication of a pivotal whitepaper, “Verification of Payee: The Race to Compliance,” authored by CEO Damien Dugauquier. The paper is now available on the iPiD website at www.ipid.tech/verification-of-payee-the-race-to-compliance.

Let's personalize your content