Video: No Time to Lose – AI-Driven Fraud in Real Time Payments (RTP)

Fraud.net

SEPTEMBER 27, 2024

How to De-Risk Real-Time Payments (RTP) The post Video: No Time to Lose – AI-Driven Fraud in Real Time Payments (RTP) appeared first on Fraud.net.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Fraud.net

SEPTEMBER 27, 2024

How to De-Risk Real-Time Payments (RTP) The post Video: No Time to Lose – AI-Driven Fraud in Real Time Payments (RTP) appeared first on Fraud.net.

Finextra

SEPTEMBER 15, 2024

Real-time payments (RTP) are emerging as a key innovation with the potential to revolutionize how mo.

Fintech Finance

NOVEMBER 12, 2024

The RTP® network, the largest instant payments system in the United States operated by The Clearing House , now averages over 1 million payments per day. The RTP network also set single day records of 1.46 In October, the RTP network experienced a record 31.7 In October, the RTP network experienced a record 31.7

Tearsheet

MAY 1, 2024

The RTP payments network reached a milestone by processing over 1 million payments in a single day on September 1, 2023. EWA and gig worker payments emerged as the network’s primary drivers , surpassing account-to-account (A2A) transfers.

Fintech Finance

JULY 30, 2024

AppBrilliance , a pioneer in real-time payment solutions with its cutting-edge Money API platform, is leveraging a recent rule change by The Clearing House to expand use-cases for Real Time Payments (RTP) to closed-loop digital wallets in the US. Outside the U.S.,

Payments Dive

JULY 31, 2023

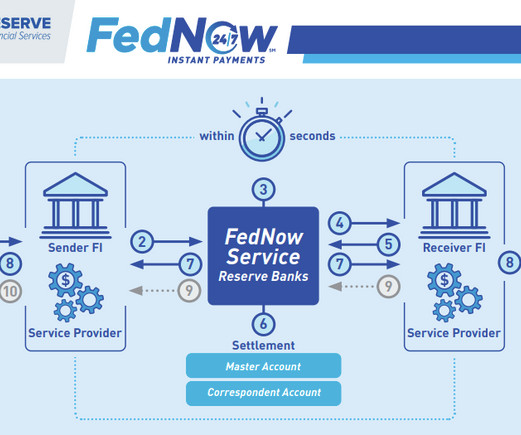

As the only two real-time payments rails in the U.S., the rivalry between RTP and FedNow could get intense, but maybe not.

Bank Automation

NOVEMBER 5, 2024

First International Bank and Trust is expanding its real-time payments options to boost revenue and meet customer demand. The Wadford City, N.D.-based

Fintech Finance

JANUARY 24, 2024

Mastercard and The Clearing House (TCH) have announced an extended multi-year partnership, bringing the companies together to collaborate on innovative capabilities for consumers, businesses and governments to evolve and embrace the digital economy through real-time payments (RTP) adoption on the RTP® network.

Finovate

MARCH 4, 2024

Though The Bancorp Bank, Galileo will leverage The Clearing House’s Real Time Payments network to offer real-time payments to help its retail and commercial clients transfer money in real time, 24-hours a day. The Clearing House competes directly with the U.S.

Finextra

NOVEMBER 12, 2024

The RTP network, the largest instant payments system in the United States operated by The Clearing House, now averages over 1 million payments per day.

Finextra

JULY 30, 2024

AppBrilliance, a pioneer in real-time payment solutions with its cutting-edge Money API platform, is leveraging a recent rule change by The Clearing House to expand use-cases for Real Time Payments (RTP) to closed-loop digital wallets in the US.

Payments Source

AUGUST 18, 2020

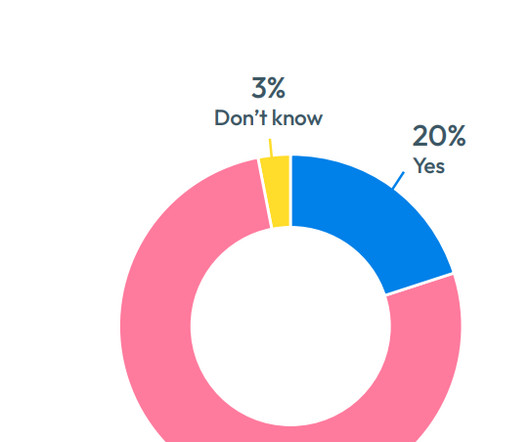

For real-time payments to become a standard in U.S. billing and payment processing, businesses have to want what providers are developing. And that acceptance, or the interest in having an RTP option, is on the rise.

Bank Automation

MAY 24, 2024

The Clearing House’s Real Time Payments network and The Federal Reserve’s FedNow network are prepared to tackle interoperability eventually — but for now, its value remains minimal.

Bank Automation

APRIL 4, 2024

ACI Worldwide is exploring the use of its cloud platform to onboard bank clients to The Clearing House’s Real-Time Payments network.

The Paypers

AUGUST 23, 2024

US-based Affinity Plus Federal Credit Union has announced the launch of a new real-time payment solution via the FedNow and RTP networks to enable members to access funds instantly.

PYMNTS

NOVEMBER 25, 2020

The tipping point toward real-time payments’ ubiquity might be closer than many observers think, Mark Ranta , payments practice lead at FinTech Alacriti , told PYMNTS in a recent interview. Ranta said RTP is already past the “early adopter” stage and moving into the “fast follower” phase of its evolution.

PYMNTS

NOVEMBER 3, 2020

The payments ecosystem now prizes quickness above all things in a time of cash flow shortages, where each paper check takes an eternity — assuming it arrives at all. It’s time to embrace it, especially for financial institutions (FIs) and adjacent players that intend to stay relevant in this market. We’ve evolved.

Bank Automation

MAY 6, 2024

The Clearing House’s Real Time Payments’ network is gaining mid-market companies as businesses gravitate toward real-time payments. Businesses prefer The Clearing House’s RTP solution because it is established and is used by nearly 67% of U.S.

PYMNTS

AUGUST 10, 2020

Real time is getting ever closer to prime time. You’d be forgiven for thinking that faster payments might be the purview of the U.S. Federal Reserve, where details (a roadmap, really) of FedNow , the proposed instant payment system, were released earlier this month. But it might not be the Federal Reserve ’s doing.

Fintech Finance

MARCH 4, 2024

NASDAQ: SOFI), announced today an expansion of its relationship with The Bancorp Bank, NA , that enables real-time payments services. Real-time payments are available any time of day, year-round, ensuring the instant availability of funds even when traditional methods such as ACH and wires are unavailable.

Bank Automation

MAY 13, 2024

Adoption is ticking up for The Clearing House’ Real Time Payments network and the Federal Reserve’s FedNow payments rail as financial institutions add payment services to their platforms. The RTP network has more than 500 institutions on its network, according to The Clearing House’s website.

Finovate

MARCH 8, 2024

Sila has partnered with Trice to leverage the company’s safeguards for instant payments. Sila combines FedNow and The Clearinghouse’s RTP to allow ACH transactions to be settled in seconds. There has been some movement in the instant payments world this week. The tool combines The Clearing House’s RTP, the U.S.

Bank Automation

JANUARY 24, 2024

Mastercard extended its collaboration with The Clearing House today to allow customers and businesses to use real-time payments. Mastercard will be the exclusive instant payments software provider for The Clearing House’s (TCH) RTP network, according to a news release from Mastercard.

Bank Automation

DECEMBER 20, 2023

Financial institutions are looking to The Clearing House’s real-time payments network to grow deposits and offer instant gratification in their payments offerings. “It’s definitely been an interesting and accelerating year for the growth of the real-time payments (RTP) network,” Elena Whisler, chief client officer at The Clearing House, told Bank (..)

Payment Savvy

FEBRUARY 24, 2023

Real-time payments have revolutionized how we make financial transactions, providing unparalleled speed, convenience, and security. With real-time payments, money can be transferred almost instantly from one person to another, anywhere in the world.

FICO

APRIL 20, 2023

According to FICO’s latest survey of consumers from 14 countries around the globe, 90% of all consumers have sent a real-time payment, and at least 95% of consumers have used real-time payments in India , Indonesia , the Philippines , and Brazil.

Finextra

JANUARY 25, 2024

Mastercard and The Clearing House (TCH) have announced an extended multi-year partnership, bringing the companies together to collaborate on innovative capabilities for consumers, businesses and governments to evolve and embrace the digital economy through real-time payments (RTP) adoption on the RTP network.

PYMNTS

JANUARY 26, 2021

Nearly a year of trial-by-fire, pandemic-era learning within the payments business has not only provided some great lessons but has also set the stage for some major advances in 2021 that have been in the cards for years. Consumer initiation, tokenization and RfP combine to deliver safer, faster and smarter payments,” added Waterhouse.

Finextra

JANUARY 24, 2024

Mastercard and The Clearing House (TCH) have announced an extended multi-year partnership, bringing the companies together to collaborate on innovative capabilities for consumers, businesses and governments to evolve and embrace the digital economy through real-time payments (RTP) adoption on the RTP® network.

PYMNTS

OCTOBER 16, 2020

It’s been three years since The Clearing House rolled out its Real-Time Payments (RTP) network, but Mark Ranta, payments practice lead at Alacriti, tells PYMNTS that 2021 will be the year FIs migrate to the technology in record numbers. Making Real-Time Payments A Reality. Here’s why. .

Payments Dive

MAY 4, 2018

Real-time payments infrastructure officially arrived in the U.S. with the launch of The Clearing House RTP system in November. Will the technology ultimately prove to be, as predicted, "one of the most important payment transformation efforts in our industry"?

PYMNTS

NOVEMBER 27, 2020

Consumers and businesses alike have long been familiar with digital payments, but both now expect smoother payment experiences as the COVID-19 pandemic’s financial impacts continue. The hunt for faster payment experiences among all users is generating a spike in interest in real-time payments.

Fintech Finance

JUNE 25, 2024

(“Finzly”), a leader in innovative payment and financial solutions, today announced a partnership with Frost Bank , a subsidiary of Cullen/Frost Bankers, Inc. headquartered in Texas, to deliver instant payments capabilities to the banks global business and consumer customers through the Federal Reserve’s FedNow® and The Clearing House’s RTP®.

Fintech Finance

SEPTEMBER 13, 2024

Faster Payments Council (FPC), a membership organization devoted to advancing safe, easy-to-use faster payments in the United States, today announced the release of its latest publication, Operational Considerations for Receiving Instant Payments.

PYMNTS

JANUARY 17, 2020

When The Clearing House launched its Real-Time Payments (RTP) network in 2017, the service was bound to rewrite some rules, and it has. The initial blush of RTP has been around improving cash flow, and that remains its core appeal. There’s More to RTP Than Fast Money. Banks, FinTechs Race to RTP Glory.

Payments Dive

DECEMBER 13, 2023

The number of banks participating in The Clearing House’s real-time payments network surged this year after the launch of the rival FedNow system.

PYMNTS

JANUARY 23, 2020

MUFG Union Bank is now offering business customers real-time payments on The Clearing House (TCH) RTP network, MUFG announced on Thursday (Jan. The RTP network provides instantaneous payments that allow customers the convenience of using funds right away. in over 40 years, the release noted.

PYMNTS

DECEMBER 17, 2020

ESL Federal Credit Union , through a team effort with other organizations, has gone live with real-time payments on the RTP network. ESL joined the RTP network by connecting through BNY Mellon , which helps companies convert to digital payments. This is a new payment system," he noted.

Faster Payments Council

MAY 17, 2021

Introduction on RTP and its adoption around the world. While real-time payments (RTP) was previously considered an infrastructure luxury, it has now become a common method of payment in many parts of the world. This adoption has changed the payments landscape. Why RTP is used?

Fintech Finance

DECEMBER 13, 2023

Trustly , a global leader in Open Banking Payments, is proud to announce that it is seeing tremendous adoption of its Real-Time Payments (RTP®) service and has become one of the largest originators on the RTP® network.

Payments Dive

JULY 11, 2024

The real-time payments system has been growing its roster of banks and credit unions, as it newly competes with the Federal Reserve’s FedNow payments system.

PYMNTS

JULY 22, 2020

Yet for many entities, the concept of implementing real-time processing across an entire system can feel overwhelming complex. As real-time payment infrastructure grows more sophisticated, technology presents an opportunity for organizations to mitigate the adoption hurdle. ” Becoming More Adaptive.

Tearsheet

FEBRUARY 16, 2024

Mastercard recently expanded collaboration with The Clearing House (TCH), with the shared goal of propelling the adoption of instant payments. This extended partnership will focus on integrating additional instant payment use cases across a range of payment flows for consumers, businesses, and governments.

Payments Dive

MAY 18, 2018

Real-time payments (RTP) have been proliferating globally since 1973, increasingly driven by the need for payments clearing to keep pace with today’s on-demand digital world.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content