What Is Tiered Pricing in Credit Card Processing?

Stax

OCTOBER 21, 2024

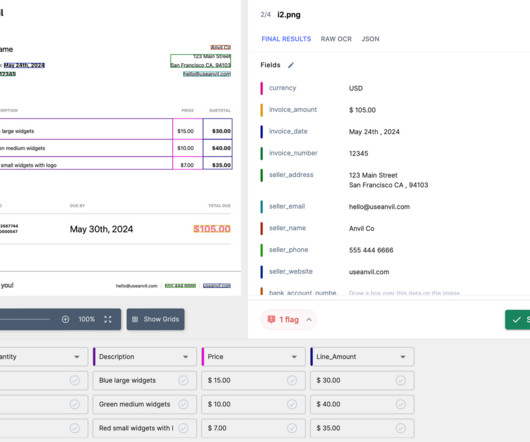

As beneficial as credit card processing is for small businesses, you’ll have to work with a payment service provider and their fees can be tricky to navigate. In payment processing, tiered pricing splits transactions into three types—non-qualified, mid-qualified, and qualified—and charges a different fee for each.

Let's personalize your content